Mutual Fund or ULIP- Where to Invest?

People quite often search for opportunities to elevate their financial worth. Investing your money wisely has a strong potential that will help you to build your wealth. When it comes to investment, Unit Linked Insurance Plan (ULIP) and the Mutual Fund (MF) is one of the top products that you may ponder to invest your money.

Before investing, it is a crucial move to make comparisons between these two investment products and then choose the best one for investing your hard earned money as per your requirement. Both Mutual funds and ULIPs are exposed to market risks, these products, however, differ in several critical parameters such as returns potential, benefits, liquidity, expenses involved, etc.

In this blog, we will be discussing key aspects which will help you to understand these two investment products in a better manner to take the right decision.

Table Content

Unit Linked Insurance Plan (ULIP)

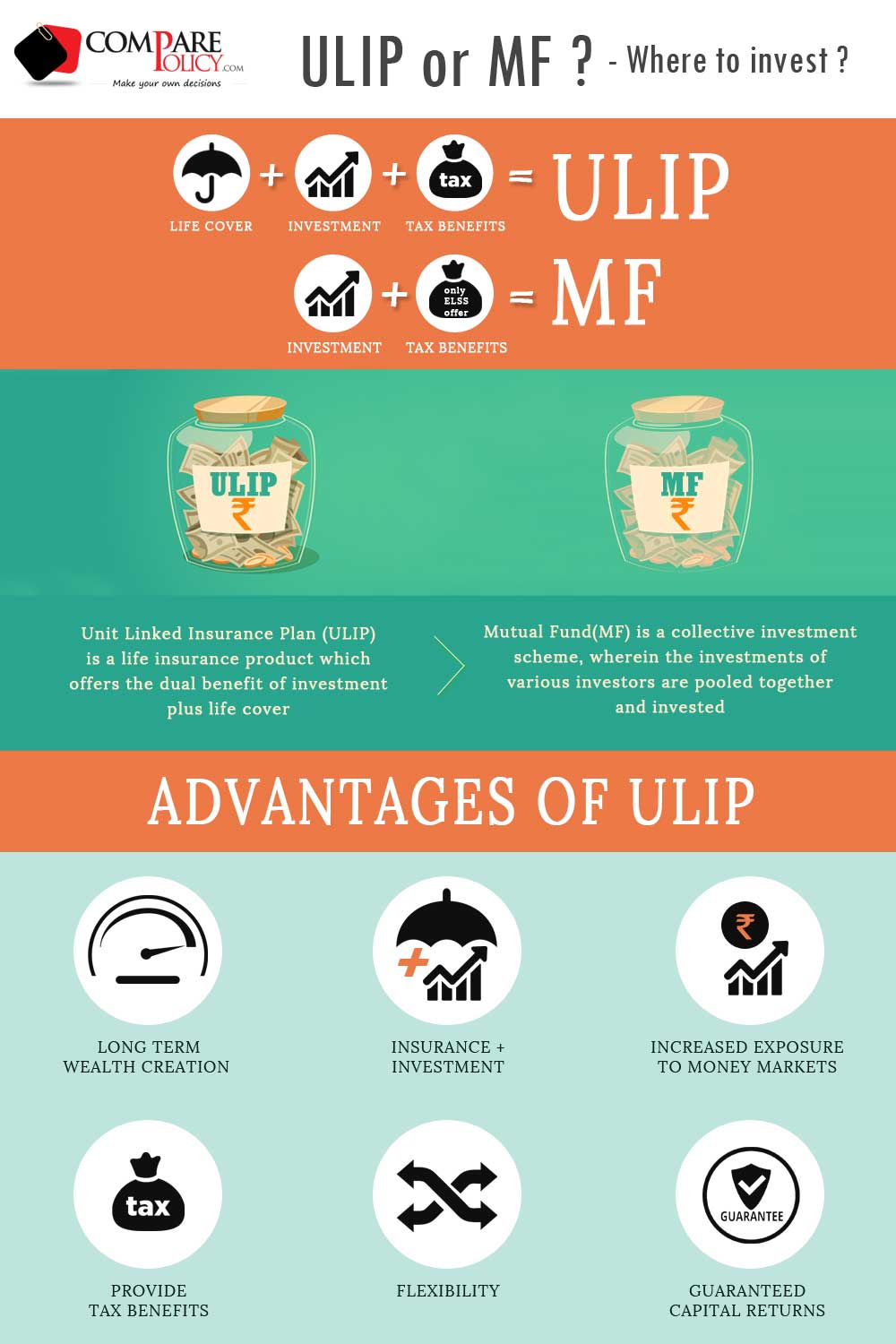

Unit Linked Insurance Plan (ULIP) is a life insurance product which offers the dual benefit of investment plus life cover. With a ULIP investment, you get the flexibility to invest your money with various fund options available which will help you grow your wealth. Along with investment, a ULIP plan also offers a life cover which ensures financial protection for your family, in the event of your untimely demise.

A small portion of the premium is kept for providing the insurance cover and the rest of the amount is invested in stocks and/or bonds to assure wealth appreciation as per your risk apetite. A risk averse investor has the option to invest his money in bonds, while another investor having a greater appetite for risk could go for investing in equities.One can also choose the combination of both by investing in a balanced fund.

Mutual Fund

Mutual Fund is a collective investment scheme, wherein the investments of various investors are pooled together and then the collective fund is invested in various asset classes such as bonds, shares, money market instruments, etc. The profits and the losses involved are distributed proportionately amongst the investors. NAV (net asset value) is computed on a daily basis that helps an investor to understand the fund’s price movement and market value.

Let’s Assess the Key Differences:

A major benefit of investing in a ULIP plan is the investment plus insurance cover under a single plan, which is not available in mutual funds investment. Mutual funds are pure investment products and don’t offer any insurance cover.

Not only this, there are several other differences that set them apart. Let’s evaluate these two investment avenues on different parameters:

Return Potential:

ULIP: ULIP is comparatively a low risk investment product as compared to a mutual fund investment as part of the policyholder’s money is allocated towards various funds as opted by the policyholder. ULIP offers relatively higher returns if invested for a longer tenure of 10 or more years.ULIPs invest in relatively low risk products as have to promise sum assured irrespective of whether the plan makes money. ULIP’s assure a fixed sum assured amount which is payable on the demise of the policyholder and this benefit is in addition to the investment returns received.

MF: Mutual funds investment is a pure investment product and it offers market linked insurance returns as per the investment portfolio chosen by the investor. With equity oriented mutual funds, you will enjoy higher returns with higher risks as compared to the hybrid mutual funds which provide average returns than debt funds.

Risk Component

ULIP: When it comes to risk exposure, ULIP is a less risky product in comparison to mutual fund investment. As ULIPs involve investment in equities, debts or balanced fund.One can invest as per the risk apetite. Also with the benefits of switching and premium redirection, the policyholder can manage his investments based on the market fluctuations and swap to relatively safer fund or vice versa.

MF: As far as mutual funds is concerned, debt oriented mutual fund is less risky than hybrid mutual funds. Equity oriented mutual funds are the riskiest one among all categories of mutual funds.

Life Insurance Cover

ULIP: Life Insurance Cover assures your family or loved ones with a financial protection, in the event of your demise. A ULIP plan offers a life insurance coverage along with the investment component, which is not available with a mutual fund investment. It is the core advantage available under ULIP investment.

MF: Mutual fund is a pure investment instrument and no life insurance cover is available under this investment tool.

Charges Involved

ULIP: ULIPs and mutual fund investments attract different charges. When it comes to ULIP investment, there are various charges involved, including premium allocation charges, policy administration charge, mortality charges, fund management charges, switching charge, etc. IRDAI puts a cap on charges levied and in the long run, these charges are not going to make an adverse effect on returns aspect.

MF: A mutual fund investment only levies charges for managing your money and SEBI put a cap for expenses chargeable to investors. Under a mutual fund, expenses are levied for activities such as fund management, sales and marketing, administrative expenses, etc. If the charges for a mutual fund investment exceeds the prescribed limit, the expenses will have to be borne by the fund house.

Liquidity

ULIP: Liquidity defines an extent to which a market allows assets to convert it into cash. ULIP has a lock-in period of 5 years and it can only be surrendered upon completion of this period.

MF: Typically, mutual funds don’t have a lock-in period, however Equity Linked Savings Scheme (ELSS) funds can be redeemed after a period of 3 years. Mutual funds are relatively liquid and are easily convertible into cash at a short notice.

Fund Switching

ULIP: Under ULIP, you have the flexibility to switch your money to different fund/s as per your investment objective and market volatility. This facility is available either free or at a nominal cost.

MF: Mutual funds investment does not offer such flexibility to the investors.

Tax Benefits

ULIP: ULIP investments offer a tax deduction on the premium amount under section section 80C of the Income Tax Act. You will also receive tax-free ULIP proceeds under Section 10(10D).

MF: Equity Linked Savings Scheme (ELSS) funds are eligible for tax benefit under section 80C but the proceeds are taxable through securities transaction tax. Other categories of mutual funds have varying tax implications on redemption.

Key Differences at Glance

| Parameters | Unit Linked Insurance Plan (ULIP) | Mutual Fund (MF) |

| Return Potential | ULIP offers attractive returns over a long term period with disciplined investing | MF is a pure investment product and thus offers market linked returns |

| Risk Element | ULIP is a less risky product as entire money is not diverted for investment | MF is a high risk product as entire amount is invested for market linked returns |

| Life Cover | ULIP assures financial protection for family with a life insurance cover | MF doesn’t offer any life cover |

| Charges | ULIP levies various charges such as premium allocation charges, policy administration charge, fund management charges, etc. | MF charges only for managing your money |

| Liquidity | ULIP has a lock-in period of minimum 5 years | MF can be liquidated at any time possible, unless otherwise specified |

| Switching | ULIP offers flexibility to switch your money within funds | MF does not offer the facility to switch funds |

| Tax Benefits | ULIP offers tax benefits under section 80C & 10 (10D) | Some MF’s like equity linked saving scheme (ELSS) are qualified for tax benefit under section 80C |

Both ULIPs and mutual funds has a risk component that arises from investing and it may vary depending on the asset class you choose for investing your money. Both these investment avenues look similar in terms of their structure and function. Like mutual funds, a ULIP also allots units to their investors and NAV is also declared on a daily basis. A ULIP investment also has a flexibility invest across assets.

Which Investment Option is the Better One?

When you should choose a ULIP investment or when a mutual fund investment, depends entirely on your needs. Following are some aspects that you need to assess that will facilitate you in choosing a financial product, you can invest in.

- What is your risk appetite such as risky or risk-averse investor?

- What are your financial goals such as saving for retirement, child’s marriage expenses, etc.?

- Whether you require life cover to assure financial protection for your family?

- Do you like to invest for short term or long term?

Conclusion

ULIP’s and mutual funds are two different types of investment products. ULIP investment is the best for those who are seeking to achieve wealth creation along with insurance cover. You need to invest with ULIPs for long term to get the adequate returns to meet the financial goals. Mutual funds also help you to achieve your financial goals, if invested wisely, but it does not offer any life insurance benefit and relatively lesser or no tax benefits. When comparing to mutual funds, investing in a ULIP is the better option. It provides you triple benefits of investment returns, life cover and tax savings along with the assurance of minimal risk.

Thanks for the list. I have gone through each blog sites and they are very helpful. Again many Thanks and Keep posting!!!