MONEY LESSONS Inspired by The Festival of Diwali

Diwali is a festival of lights, and it is a festival celebrated every year with a lot of splendor and enthusiasm all over the country and the world over. This auspicious festival is dedicated to honoring the return of Lord Rama to his homeland after his victorious battle against the demon king Ravana.

The occasion of Diwali is also marked by the worship of goddess Lakshmi-the goddess of wealth and prosperity. The festival teaches us various moral lessons. But ever wondered that the festival is also a great source to learn various financial lessons too.

Do illuminate the light of financial freedom on this Diwali; this is our first demand and it will be the first choice too, but not everyone puts so much effort into being free financially. It’s like a have to drink tea too, but there is a fear of not burning the lips. Financial freedom lifts you towards a stress-free life, where you can take any decision without any hesitation, which is a gift of being free financially. In simple words, if you have no tension about the financial proposition, then you start exploring different things in a different ways.

Important money lessons to be learned from the festival of Diwali to strategize our financial planning to attain various financial objectives.

Table Content

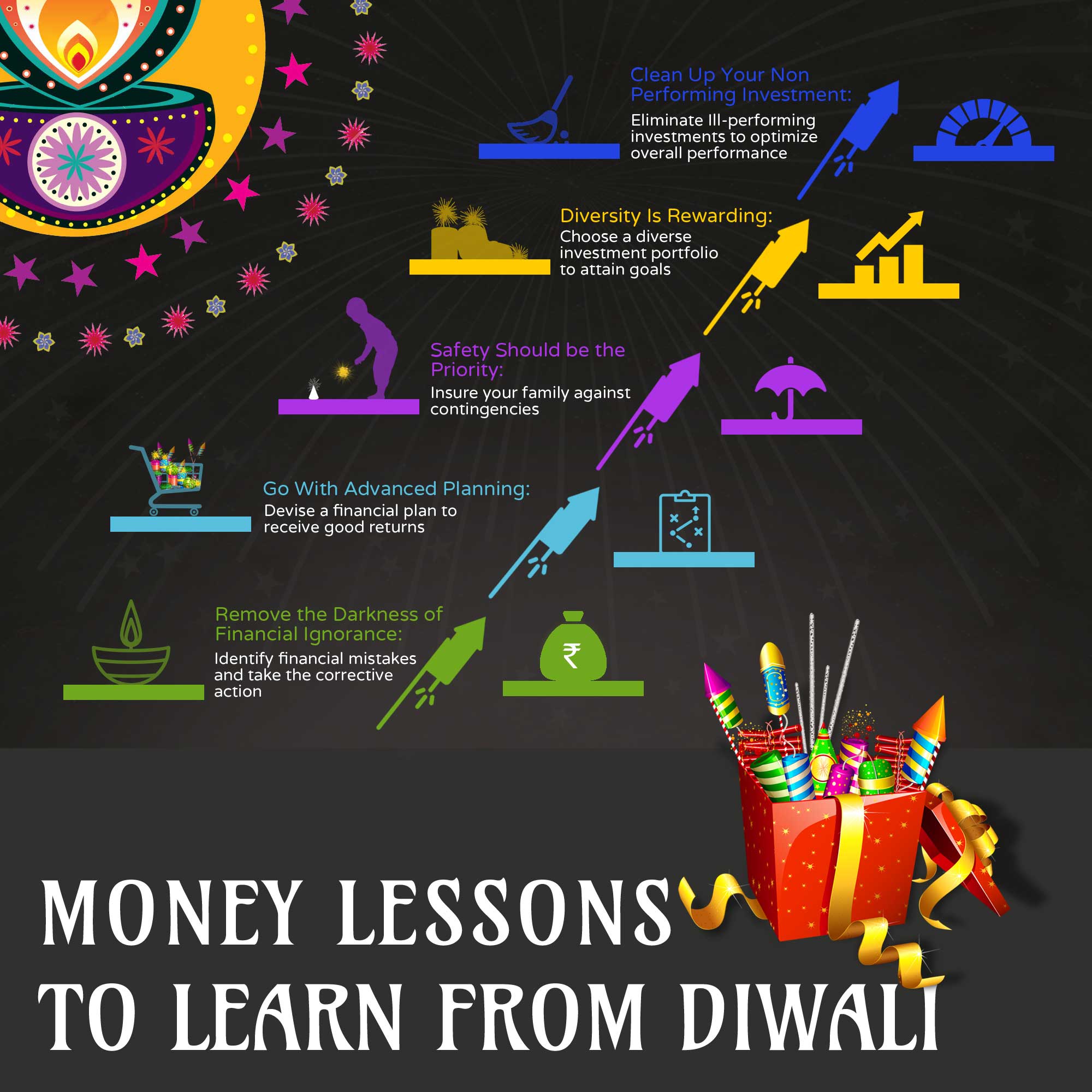

Financial Lesson 1: Remove The Darkness of Financial Ignorance

Diwali is celebrated with the lightening of lamps, which remove the darkness surrounding us. A lamp signifies knowledge through which darkness is dispelled. Similarly, you can allay darkness or ignorance related to finance and investments.

It is advised to identify the financial mistakes you did in the past, such as choosing a wrong financial product, opting for a wrong financial scheme or fund which is providing you consistently lower returns than estimated, which will not help you towards achieving your financial goal. Identifying the economic mistakes is not the end.

You also need to take corrective action so that the same financial mistakes will not occur next time in the future. Some investment schemes offer lucrative returns, but actually, they are just disastrous. You need to do thorough research, set your short-term & long-term goals, take help from a certified financial planner and choose investment vehicles that help you be more financially empowered later in your life.

Financial Lesson 2: Go with Advance Planning

Diwali is a grand festival, and people always plan for it well in advance. Everyone makes all efforts to make this festival a joyful and memorable one for their family. Everything goes in tune when you plan things, and the same aspect of planning can wisely be implemented in managing finances.

A proper financial plan helps you to reap better returns. You are advised to make investments as early as possible, which will help you benefit from compounding and good returns in the long run.

Prior to making the investments, it is essential to devise a well-detailed financial plan that ensures a financial backup for you & your family in your presence and supports your family even in your absence too. It must cover costs, such as your children’s education & marriage, health-related expenses, cost of living expenses, etc. The right financial plan includes your dreams, goals, and responsibilities for the entire family.

Financial Lesson 3: Safety Should be The Priority

Kids and adults enjoy fireworks alike, and it requires taking the needed measures to keep families safe. It is crucial to ensure precautionary ways to avoid any mishap leading to a significant loss.

Similarly, it is essential to get your life and your assets protected through a financial arrangement that will offer a safety net to your family in case of any unforeseen exigency.

Purchasing a life insurance policy provides life cover, ensuring that your family’s financial needs are met even in your absence. Having a health policy offers coverage for medical expenses incurred in the event of you or your family member’s hospitalization. You can also get cover for your home & its contents with a home insurance policy and cover your vehicle with a motor insurance policy. It is vital to attain adequate financial coverage and ensure the complete protection of your entire family.

Financial Lesson 4: Diversity is Rewarding

You tend to purchase a variety of sweets, fruits, gifts to have a joyous and fun time with your entire family with a variety of options. Similarly, you can diversify your investments and reap the benefits with a well-balanced portfolio. When opting for investments, it would be the right move to choose a combination of schemes having varying risk & return profiles so that you can achieve financial balance and stability.

Financial Lesson 5: Clean up Your Non-Performing Investments

Before Diwali, we clean our homes, reassemble things in a better manner and dispose of the stuff which is not required as per the current need. You can apply the same concept when it comes to your investments. You should review your investment portfolio from time to time, identify the investment schemes that are non-performing regarding timely and anticipated returns, and discard them appropriately. Ill-performing assets will only adversely affect the performance of your investment portfolio, and you need to eliminate them to optimize the performance of the portfolio.

Conclusion

Diwali is a celebration of light, and this festival is celebrated by different cultures around the world. This festival teaches various money management lessons, which we can implement in real life to lead the way towards robust financial planning.

The cost of not taking the right decisions is huge, and it will impact the future in the long run. It is thus advisable to choose investment options that are in sync with your financial objectives. It’s time to plan your investments and celebrate a safe, sparkling, and financially planned Diwali!