How to make Your Health Insurance Cover Affordable?

With uprising medical costs, getting treatment in a good hospital has become extremely expensive. To combat the soaring costs, it is important to have an alternative arrangement that can take care of the expenses for the overall treatment without affecting your savings and funds which are accumulated for other major financial objectives. “Health Insurance Policy” constitutes one such important form of financial arrangement to take care of the hefty medical bills and to combat medical inflation. let’s know How to make Your “Health Insurance Cover Affordable”?

Table Content

- Need to keep it in mind while Health Insurance covers Affordable

- Opt for Top-up and Super Top-up Health Insurance Plans

- Let us Understand it With an Example

- Now to secure an additional Rs 10 Lakhs of Health insurance at his age, there are 2 options:

- Option 1: BUY AN INDIVIDUAL HEALTH INSURANCE PLAN

- Option 2: BUY A TOP UP/ SUPER TOP UP HEALTH INSURANCE PLAN

- TOP-UP HEALTH INSURANCE PLAN

- Let us understand Top-up Health Plans with different claim scenarios

- SUPER TOP-UP HEALTH INSURANCE PLAN

- TOP-UP & SUPER TOP UP PLANS

- PREMIUM COMPARISON

- Concluding Words of Top-up & Super Top-up plan

- Opting a “Longer Policy Term” Health Insurance Cover Affordable

- BENEFITS OF OPTING FOR A“LONGER POLICY TERM”

- DISCOUNTS OFFERED BY VARIOUS INSURANCE COMPANIES

- Accumulate your NO CLAIM BONUS

- Let Us Understand it with an Example

- Let’s have a look at the NCB offered by various Heath Insurance Plans

- Look for Varied Discounts Under Your Health Insurance Plan

- 1. Family Discount, “Health Insurance” Cover Affordable

- 2. Discounts at Hospitals, Diagnostic Centers & Pharmacy Centers

- 3. Free Health Checkup is also a way of “Health Insurance” Cover Affordable

- 4. Opting for a Voluntary Co-payment

- 5. Gender-Related Discount

- 6. TPA Service Discount

- FINAL WORD

- Related posts:

Need to keep it in mind while Health Insurance covers Affordable

- Top-up/ Super top-up

- Long policy term

- No Claim Bonus

- Varied discount under health insurance.

Opt for Top-up and Super Top-up Health Insurance Plans

But, many people underestimate the importance of having a health insurance policy, assuming that nothing can happen to them. It is good to take care of your health and stay fit, but health hazards come uninvited causing a drain in your financial kitty to pay for the treatment and allied expenses.

As per the government statistics, only 18% of the urban people are covered under any kind of government scheme or any other health scheme. The significant reason for a low percentage is the lack of awareness about the benefits of buying a Health Insurance policy. The cost of health insurance can also be accounted for as another significant reason, which makes people defer the decision of buying a health insurance plan.

Even the people who possess the health policy are either underinsured or primarily buy the policy to save tax under section 80 D of the Income Tax Act, 1961. Even though medical costs are mounting high, still the average ticket size of a health insurance policy range between Rs.2 Lakhs to Rs 3 Lakhs. Such an amount may be sufficient to endow small hospitalization costs, but may not suffice in the event of a serious case of a heart attack or to treat cancer. Buying the health plan merely to claim a tax deduction without assessing the need-based buying is another blunder.

Many of us have an employer-provided health plan which makes us feel relaxed. Employer-based health plans come with their own benefits and limitations which may not prove to be an adequate health cover. Now, the point comes how much additional or extra health insurance coverage, one should have over and above the basic health insurance cover?

Let us Understand it With an Example

Sanjeev is a 35-year-old IT professional, his company has provided him a 4 Lakhs health cover. He needs an additional Rs 10 Lakhs health insurance cover as per his health need analysis based on his medical condition, age, family history of critical illness, medical inflation, etc.

Now to secure an additional Rs 10 Lakhs of Health insurance at his age, there are 2 options:

Option 1: BUY AN INDIVIDUAL HEALTH INSURANCE PLANSanjeev can either buy a regular Health Insurance policy of Rs 10 Lakhs. A regular indemnity-based health plan will cost him Rs 9,000 to Rs 10,000 or more annually. |

Option 2: BUY A TOP UP/ SUPER TOP UP HEALTH INSURANCE PLANTop-up/Super Top-up health insurance policy is an ideal way to stay adequately insured with the right coverage amount at an affordable premium price. Top-up/Super top-up health insurance policy comes into action when your basic health cover amount falls insufficient to fund your medical bills. Top-up/Super Top-up health plan offers additional cover, typically over and above the current available limit, at lower premium amounts. It can be considered as a safety net that helps you in case you exceed certain limits/threshold limits or deductibles. |

Let us understand the concept and the difference between Top-up and Super Top-up Plans with the help of illustrative examples below:

TOP-UP HEALTH INSURANCE PLAN

To enhance the health insurance cover affordable at a reasonable cost, Sanjeev can opt to buy a Top-up Health Plan of Rs 10 Lakhs which will cost him between Rs 6,000 to Rs 6,300 annually with a deductible limit of 4 Lakhs in place of choosing option 1.

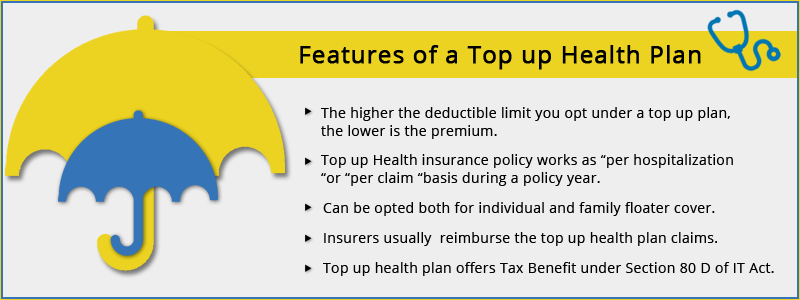

Like in Sanjeev’s case, if his hospitalization bill is within the range of Rs 4 Lakhs, it will be taken care of by his regular health plan. If the bill exceeds Rs 4 lakh say, for example, the bill is Rs 7 Lakhs, the remaining amount of Rs 3 Lakhs can be funded via his top-up health insurance plan (where the deductible limit chosen by Sanjeev is Rs 4 Lakhs). Top-up Health plans will supplement your basic health insurance plan in case of claims of higher amounts. The higher the deductible limit you opt for under a top-up plan, the lower the premium.

Like in Sanjeev’s case, if his hospitalization bill is within the range of Rs 4 Lakhs, it will be taken care of by his regular health plan. If the bill exceeds Rs 4 lakh say, for example, the bill is Rs 7 Lakhs, the remaining amount of Rs 3 Lakhs can be funded via his top-up health insurance plan (where the deductible limit chosen by Sanjeev is Rs 4 Lakhs). Top-up Health plans will supplement your basic health insurance plan in case of claims of higher amounts. The higher the deductible limit you opt for under a top-up plan, the lower the premium.

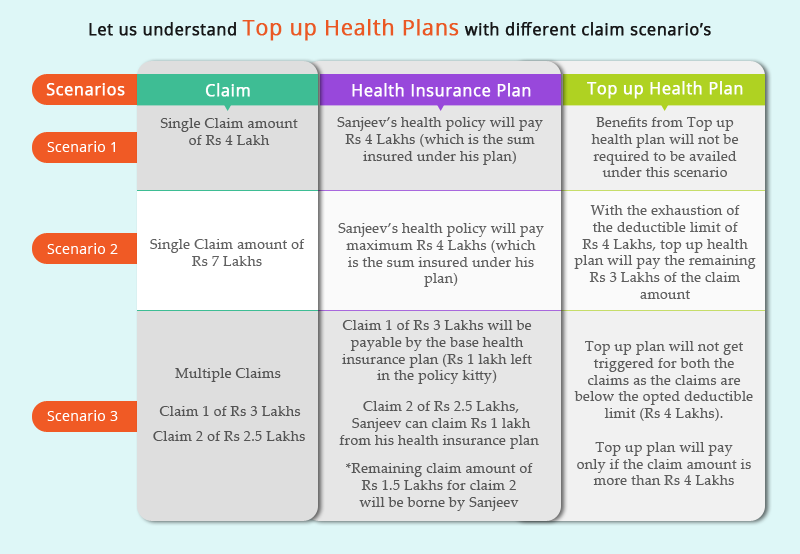

Let us understand Top-up Health Plans with different claim scenarios

Health Plans owned by Sanjeev:

- Regular Health insurance plan with SI- Rs 4 Lakhs

- Top-up Health insurance plan of Rs 10 Lakhs with a deductible limit-Rs 4 Lakhs

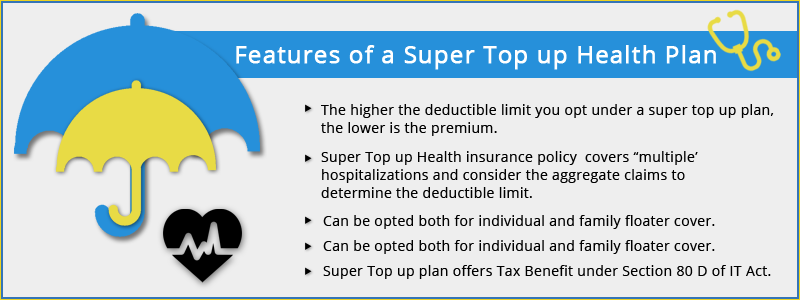

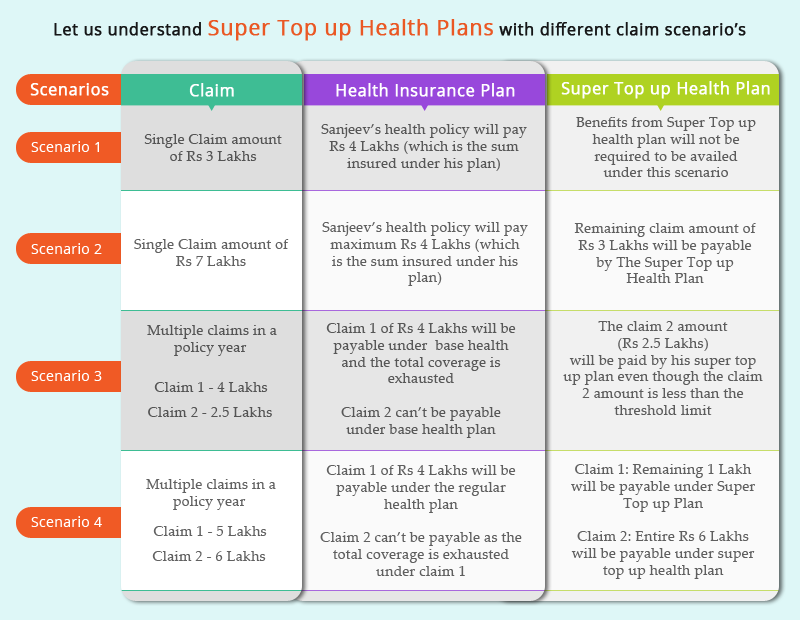

SUPER TOP-UP HEALTH INSURANCE PLAN

Super Top-up health plan is another way of getting an enhanced health cover with a reasonable premium amount. Super top-up health plans work under ‘multiple’ hospitalizations and consider the aggregate claim in a policy year to calculate the deductible or threshold limit. This is not the case for a Top-up health plan as a top-up health plan, pay per claim, or per hospitalization basis.

Sanjeev has opted for Rs 4 Lakh as SI under a basic health insurance policy and Rs 10 Lakhs SI under a Super top-up health policy with a deductible limit of Rs 4 Lakhs. Let us understand super top-up benefits under different claim scenarios.

Sanjeev has opted for Rs 4 Lakh as SI under a basic health insurance policy and Rs 10 Lakhs SI under a Super top-up health policy with a deductible limit of Rs 4 Lakhs. Let us understand super top-up benefits under different claim scenarios.

The above scenarios explain that the Super Top-up Health plans to take into account ‘the total of all the bills’ in a given year. Super Top-up Health plans cover ‘multiple’ hospitalizations and consider the aggregate claim. Super Top-up health plans consider several cases of hospitalization to calculate the deductible/threshold limit which makes it different from the Top-up Health Insurance Plan.

TOP-UP & SUPER TOP UP PLANS

- Enhance-Super Top-up Insurance by Care Health Insurance Co.

- Optima Cash & Optima Plus Plan by HDFC ERGO Health Insurance Limited

- HDFC ERGO Health Optima Super Top Up by HDFC ERGO Health Insurance Limited

- Heartbeat High Deductible Plan Niva Bupa

- ProHealth Plus Plan (Under ‘Protect’ & ‘Plus’ Plans) by Cigna TTK

- Health Suraksha Top Up Plus by HDFC Ergo General Insurance Company, etc.

- Extra Care by Bajaj Allianz Health Insurance Company,

- United India Super Top-up plan by United India General Insurance Co.

PREMIUM COMPARISON

Let us take an example of a regular health plan and a Super top-up health plan from Care to understand the premium difference.

| Health Plan | Super Top up Plan | |

|---|---|---|

| Plans | Care (a regular health insurance plan) | Care Enhance – Super Top-up Plan |

| Premium | Rs 8,139 (inclusive of 18% GST) (For an individual between the age range of 25 to 35 years, opting for a Sum Insured of Rs 10 Lakhs) | Rs 3,320 (inclusive of 18% GST) (For an individual between the age range of 25 to 35 years, opting for a Sum Insured of Rs 12 Lakhs with the deductible of Rs 4 Lakhs) |

Concluding Words of Top-up & Super Top-up plan

- The probability of getting higher claim amounts of Rs 10 Lakhs is much lower than getting a claim amount of Rs 1 Lakh to 3 Lakhs. With top-up/super top-up plans coming with a threshold/deductible limit (which is either to be borne by the policyholder or claimed under another health insurance policy), the insurance company assumes that your claim amount will not exceed the deductible limit under a single claim or multiple claims in a policy year. That is why the higher the risk of claim borne by you, (the higher the deductible limit you choose), the lower will be the cost of buying the top-up/super top-up health plan (the lower will be the premium).In nutshell, Deductible amount and Premium amount are inversely proportional to one another.

- It is prudent to choose the deductible limit equal to the sum insured under your regular or employee-based health insurance plan. So that over and above your basic health cover, you can avail the benefits of top-up/super top-up plans at a lower premium.

- It is prudent and beneficial to split your total health coverage amount into a base policy and a top-up / super top-up policy to attain an optimum health insurance cover at an affordable price. This does not imply that you opt for a health cover of Rs 1 Lakh and take the top-up plan of Rs 10 Lakhs to reduce your premium cost. There has to be an ideal mix between the basic health plan and top-up/super top-up health plan.

- Buying a Top-up/Super top-up Health plan is one prudent way to reduce your health insurance cost. Do not buy the Top-up/Super Top-up plans merely because of the low premiums only, understand the fine print and compare the plans before making a final purchase.

- Most of the companies don’t offer cashless under the top-up/super top-up claims, so initially, the cost has to be borne by the policyholder. Consider this aspect as well before buying the product.

- If we compare the costing of the top-up plans and super top-up plans, it is clear from the above illustrations that super top-up plans offer wider coverage than top-up plans. Therefore, a super top-up plan comes at a higher premium as compared to top-up plans.

Keep watching the space for more insights on “How to make your Health Insurance Cover more affordable”!

Opting a “Longer Policy Term” Health Insurance Cover Affordable

The cost of health insurance coverage depends upon your age, medical condition, city, and budget. The premium for the health insurance policy might refrain you from opting for an adequate sum insured or deferring your decision to buy. We will learn about “Health Insurance Cover Affordable”.

The usual health insurance policy is basically an annual insurance policy that needs to be renewed yearly to avail its benefits and coverage on a continuous basis. But there are insurance companies which offer a health insurance plan for a policy term of 2 years and 3 years respectively.

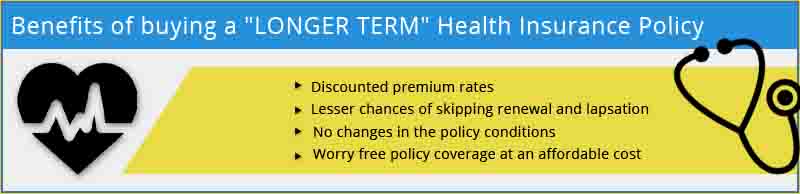

BENEFITS OF OPTING FOR A“LONGER POLICY TERM”

Buying a policy for a longer policy term will allow you to avail good discounts on the premium and wider policy coverage. An insurance policy with a longer policy term will enable insurance companies to save on administrative costs of issuance and renewal. Also, the company assumes you to be a loyal customer and offers you a premium discount for staying with the same insurer for more than just a year.

A longer policy term wipes out the probability of your health insurance policy getting lapsed due to the non-renewal of the policy contract after a period of one year. Failure to renew may result in deprivation of benefits like “No claim bonus”. Discontinuation of health insurance policy due to failure of active yearly renewals also results in discontinuation of the waiting period term of pre-existing diseases which hampers the inclusiveness of pre-existing diseases under your health insurance policy.

A longer policy term wipes out the probability of your health insurance policy getting lapsed due to the non-renewal of the policy contract after a period of one year. Failure to renew may result in deprivation of benefits like “No claim bonus”. Discontinuation of health insurance policy due to failure of active yearly renewals also results in discontinuation of the waiting period term of pre-existing diseases which hampers the inclusiveness of pre-existing diseases under your health insurance policy.

The discount on opting for a policy term for more than a year may range between 7% to 13% on the base premium.

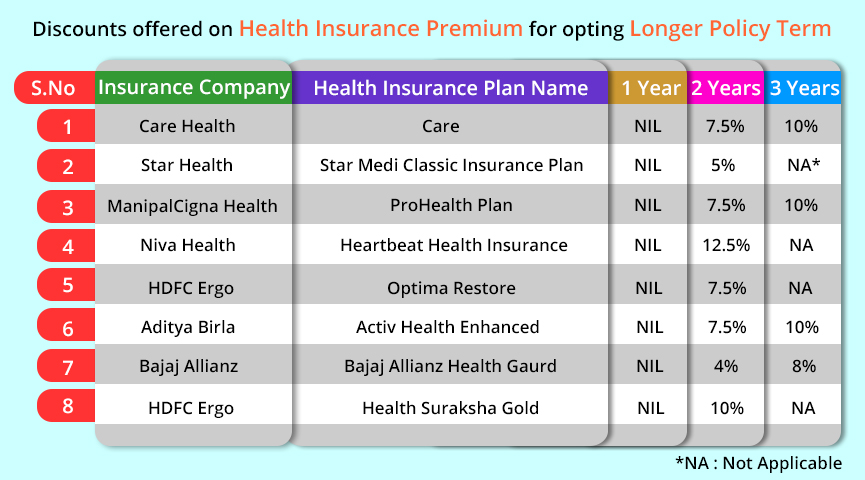

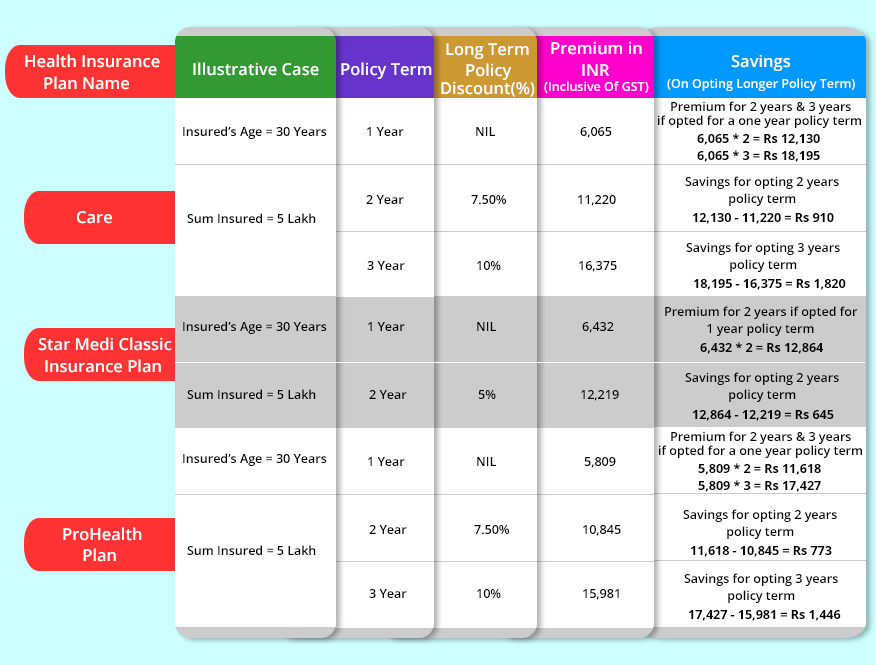

DISCOUNTS OFFERED BY VARIOUS INSURANCE COMPANIES

Care Health Insurance Company offers a 7.5% discount on premium for buying a Health plan for a 2-year policy term and a 10% discount for a 3-year policy term.

Example: Rahul who is 30 years of age, opting for a sum insured of Rs 5 Lakh under Care Health Plan will have to pay Rs 6,065 annually. Next year to renew his health insurance plan he has to pay Rs 6,065 (assuming no change in the premium amount by the insurer). So the total premium cost for 2 years is Rs 12,130. On the other hand, if Rahul opts for a 2 years policy term at the inception, he has to pay Rs 11,220 after a 7.5% discount on the premium. He saves Rs 910 annually (Rs 12,130 – Rs 11,220) Further if a person opts for a 3-year policy term, he has to pay a total of Rs 16,375 after getting a 10% discount on the premium.

Health insurance covers affordable. means you are opting health policy with a good amount of coverage that’ll help you in needy time, every cover has its own motive and every health cover.

Refer below for more such illustrative cases:

Keep watching the space for more insights on saving your Health Premium!

Accumulate your NO CLAIM BONUS

We all like attaining some extra benefits in the form of a Bonus. The health insurance policy also felicitates you with a bonus known as “ NO CLAIM BONUS (NCB)” or Cumulative Bonus. I am sure most of you must have heard this term about your car/two-wheeler insurance. Let me articulate the No Claim Bonus under “Health Insurance Policy”.

NCB is a value-adding benefit or advantage under your health insurance plan. In the event of no claims filed under your health insurance plan during the policy term, your insurance company will offer you a “No Claim Bonus” as an accolade for keeping yourself fit and healthy.

Accumulated No Claim Bonus helps you to enhance your sum insured under the health insurance policy without paying any extra money as a premium. It is a reward by the insurer to acknowledge you to maintain good health which is evident by no claims under the policy.

NCB is a win-win situation for both the insured and the insurer in monetary terms.

- For an insurer, there are no payouts or claim disbursements under the policy.

- For an insured, with no claim bonus, he/she is getting enhanced coverage over and above the base sum insured opted under the health insurance policy with the same base premium amount.

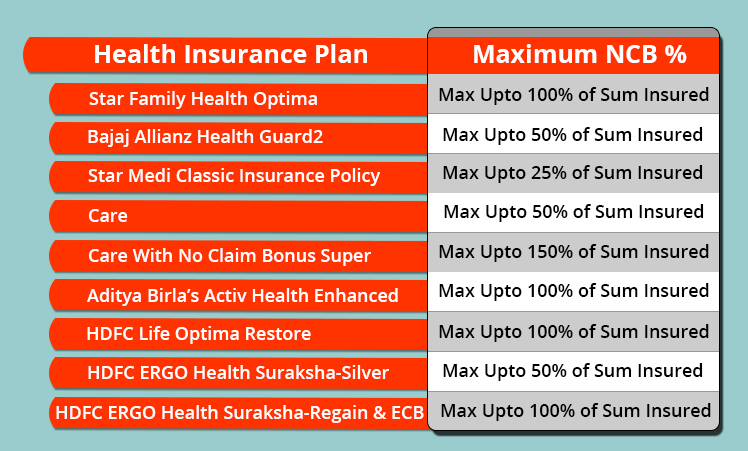

NCB is usually expressed as a percentage enhancement of the Sum Insured which ranges from 5% of Sum Insured to 30% per annum up to a maximum of 50 %– 100%of the Sum Insured. The No Claim Bonus varies from plan to plan and from insurer to insurer.

It is prudent to preserve and accumulate your No Claim Bonus; now it does not mean that you should not file a claim under your health insurance policy to save your money on Health insurance premiums. After all, a health insurance policy is taken so that in the event of a claim, all your financial worries are taken care of by your Health Policy. However, it is important that you don’t file a claim which is petty and affordable at your end or can be accommodated in your budget. Claim filed for the small amount waive off or nullify your accumulated No Claim Bonus. The bottom line is that – It is important to assess what you will get (as a claim amount) over what you will lose (in the form of a no claim bonus).

Let Us Understand it with an Example

| Mr.Narang purchased a Health insurance policy of Rs 5 lakh as the sum insured. The plan offers a 10% increment in the sum insured yearly as a no claim bonus subject to a maximum of 50% of the sum insured. In the first year, Mr. Narang did not file a claim under his health policy resulting in Rs 50,000 increase in the sum insured elevating the total sum insured to Rs 5,50,000. In the second policy year, Mr. Narang suffered from a severe viral fever which resulted in hospitalization for 2 days with a total bill amount of Rs 10,000. Now, if Mr. Narang claims the hospital bill of Rs 10,000 under his health policy, he would lose out on a No Claim Bonus of Rs 50,000. In the event of Mr. Narang paying the hospital bill of Rs 10,000 out of his own pocket, the sum insured under his Health Insurance policy will elevate to Rs 6,00,000 (Rs 5,50,000 – for 1st year and another addition of Rs 50,000 as NCB (10% of the base sum insured) in the 2nd policy year) This, way ideally Mr. Narang is paying a premium for the Rs 5,00,000 sum insured, but by preserving his cumulative bonus/no claim bonus, he is getting a sum insured of Rs 6,00,000 within a span of 2 no claim policy years. It is important to do a cost-benefit analysis with respect to your No Claim Bonus and the actual admissible claim, amounts to attain maximum gains. |

Let’s have a look at the NCB offered by various Heath Insurance Plans

It is imperative to understand your cumulative bonus clause under your health insurance policy and avoid unnecessary, small amounts of claims which you can bear out of your pockets without any financial strain. This way you will build upon your base sum insured to a maximum of 50% or 100% (as offered under your health plan) of the sum insured with the same base premium making your Health Insurance plan more affordable by paying a lesser premium and getting enhanced coverage.

We all love to have freebies, and it is all the more important when it is related to our health. The word discount makes every Indian consumer happy and content. Obviously, getting some discount is always comforting. Similarly, you may look up to various kinds of discounts under your Health Insurance policy. It will enable you to save your health insurance premium cost. You can reduce your health insurance premium cost by availing of various discounts offered by the insurance companies which could be helpful in providing your pocket a cushion against the actual premium cost. let’s know How to make Your “Health Insurance” Cover Affordable

Look for Varied Discounts Under Your Health Insurance Plan

Let us have a quick look at such discounts:

1. Family Discount, “Health Insurance” Cover Affordable

A family discount is available in case more than one person in your family is covered in the same policy under Individual Sum Insured option. There are many insurance companies that offer a family discount ranging from 10% to 20% on the premium amount for insuring your family members under the same health plan.

- ManipalCigna offers a 10% discount on the premium amount of its PROHealth range of health insurance products for enrolling more than 2 family members under a single individual policy.

- Tata AIG also offers a 10% family discount on the premium amount on its Mediraksha Health insurance plan.

- Future Generali’s health total plan offers a Family discount of 10% in case more than one person is covered in the same policy in the case of the Individual Sum Insured option.

- HDFC Ergo offers a family discount of 10% if more than one person is covered under its Health Suraksha policy.

2. Discounts at Hospitals, Diagnostic Centers & Pharmacy Centers

Many Insurance companies offer discounts at empaneled Hospitals, Diagnostic Centers, and Pharmacy centers for their policyholders. The discounts can be availed in the form of OPD discounts at selected facilities, discounts on Wellness tests at selected outlets, and other health-related offers at selected outlets under the different categories. The same can be availed by showing your Health Insurance Card or by showcasing your policy number/document.

- Bajaj Allianz General Insurance offers discounts on pathology labs at select outlets, Radiology at select outlets, Wellness tests at select outlets, and also on Pharmacy.

- Universal Sompo offers vouchers that can be utilized at empaneled service provider(s). The details of these discounts and offerings on health and wellness products and services are available on its website.

- ManipalCigna also offers reward points equal to 1% of the premium paid each year. Redeem the cumulative reward points as a discount in premium from the next renewal or as a reimbursement of out-patient and other small medical expenses.

3. Free Health Checkup is also a way of “Health Insurance” Cover Affordable

Many insurers offer free health checks or pay partial amounts for the health checkups in the event of specified claim-free years or otherwise. Opt for plans offering such facilities and features. A regular health check will cost you about Rs 1500 to 3000 which you will save if you opt for a health plan offering a free health check-up feature, or health check-up at a discounted cost. Health checkups cover medical tests like blood sugar, blood count, urine test, cholesterol check, PPBS (postprandial/lunch blood sugar), ECG, complete blood count, etc. Also, some insurers offer a bundle of value-added services such as second opinion, online advice from a doctor, consultations and follow-up sessions, and meeting with diet and nutrition consultants.

- Care Health Insurance Company offers Annual Health Check-Up for all insureds regardless of claims history.

- Star Health Insurance company offers Health check-ups at the block every 3 claim-free years.

- Bajaj Allianz General Insurance Company offers Free Health check-ups after every continuous 4 claim-free years at empaneled diagnostic centers.

- HDFC ERGO Health check-up is covered after 4 continuous claim-free policy years.

- ManipalCigna offers Health check-ups for all major insured persons once every 3 years.

4. Opting for a Voluntary Co-payment

Co-payment suggests that a portion of the admissible claim amount has to be borne by the insured in the event of a claim. There is a compulsory and voluntary co-payment clause under various health insurance policies. On opting for a voluntary co-payment percentage, the insurer offers you a lot of discounts on the premium. The higher the co-payment share, the higher will be the discount offered on premium. The companies offer such discounts because the probability of getting an unnecessary claim reduces which allows the insurance company to offer you premium discounts on choosing a specified co-payment share.

- Oriental Insurance Co. offers premium discounts of 10% and 20% for voluntary co-payment of 10% and 20% respectively.

- Niva Bupa Heartbeat Plan offers voluntary co-payment options of 10% and 20% to make your premiums affordable.

- A co-payment option is also available under HDFC Health Suraksha under optional benefits.

- The energy health plan of HDFC ERGO Health also offers a 20% co-payment on an optional basis.

- Aditya Birla’s Health Plan “Activ Health Essential” offers an option to select a deductible of Rs 25 K,50 K,1 Lac, or 2 Lac which offers a substantial premium discount.

5. Gender-Related Discount

Some insurance companies offer a discount on health premiums for including a woman or a girl child in the plan like

- 5% discount to single women and girl child is offered by Reliance general insurance company’s Health gain policy.

- New India, Asha Kiran Policy offers premium rebates for including a daughter in the policy.

6. TPA Service Discount

A few insurance companies offer a TPA discount for not opting for Third-party administrator (TPA) services and dealing directly with the insurance company in the event of a claim. TPA charges the insurance companies for providing their services during the event of a claim by acting as a link between the insurer and the insured. By not opting for TPA services, the company saves on the TPA cost and transfers the benefit to the customer in terms of discounts on health insurance premiums.

- Oriental Insurance Co. offers a discount of 5.5% on premiums if TPA services haven’t been opted for.

All the discounts mentioned above may not be available under one Health insurance policy but the bottom line is that do look for such value-added benefits in your Health Insurance policy which will certainly reduce the burden of the health insurance premium. It is, therefore, necessary to take out time and study the plan benefits and additional cost-effective features associated with the health plan rather than blindly following your agent.

(Disclaimer: Views are not biased towards any insurer rather examples of insurers are given to express the concept only)

FINAL WORD

Apart from getting a discount on premium for a longer policy term, the policy will insure you for a wider span and will shield you from any revisions in your policy conditions at renewal. Many people tend to forget the annual renewal of their health plan which may lead to losing benefits like No Claim Bonus and waiting period timelines. Thus, act smart and buy smart by knowing insightful hacks to save on your “Health Insurance” premium.