How to Link Aadhaar to Your Insurance Policy?

After linking your bank account, mobile number, and PAN Card with the Aadhaar number, it’s time for insurance policies to get linked to it. Insurance Regulatory and Development Authority of India (IRDAI) have mandated the insurance companies to get every insurance policy linked to the Aadhaar number and PAN of individual policyholders. How to “Link Aadhaar with Insurance Policy”?

Table Content

IRDAI Mandate on Linking Aadhaar

In a circular issued by IRDAI, linkage of 12-digit Aadhaar numbers and PAN to insurance policies is a mandatory requirement. The government had notified the Prevention of Money Laundering (Maintenance of Records) Second Amendment Rules, 2017, making Aaadhar and PAN/Form 60 mandatory for availing financial services including insurance. It needs to link all existing and new insurance policies with the Aadhaar number and PAN.

The insurance regulator specifies that the rule is statutory in nature and life and general insurance companies (including standalone health insurance companies) are required to link Aadhaar with every insurance policy. Insurance companies are now informing their policyholders to link their respective Aadhaar numbers issued by the Unique Identification Authority of India.

When it comes to linking Aadhaar with an insurance policy, most people don’t know the process? In this blog, we shall discuss the process related to linking Aadhaar with the insurance policy.

Documents Required

You need to provide Aadhaar number and, PAN (Permanent Account Number)/Form 60 or 61. Form 60/61 is required to be submitted for those who don’t have a PAN for making premium payments above Rs 50,000.

The procedure of Linking Aadhaar with Insurance Policy

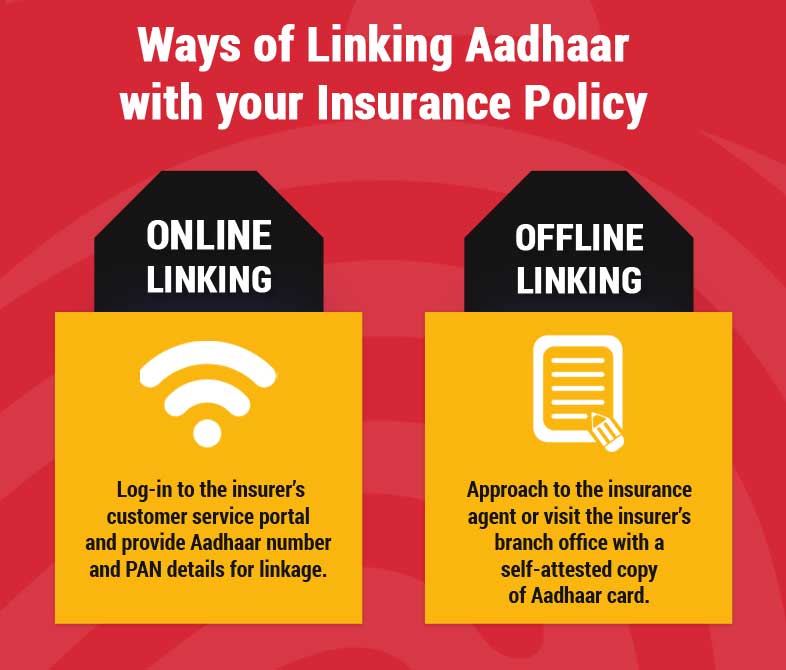

Let’s check how you can link your Aadhaar number with the insurance policy. Online linking and offline linking are the two ways of linking the Aadhaar number.

1. Online Mode

This is the most convenient way of updating Aadhaar details with the insurer.

For a Registered User: The policyholder needs to log in to the customer service portal of the insurance company and furnish the Adhaar number.

For a Non-Registered User: If the policyholder is not registered online, he/she needs to visit the insurance company’s website and register it online by providing details such as policy number, date of birth, email id, mobile number, Aadhaar number, and PAN.

After furnishing the Aadhaar number through online mode, an OTP is sent to the registered mobile number. After entering the OTP, the Adhaar number is linked successfully with your insurance policy.

2. Offline Mode

You also have the option to link the Aadhaar number with the insurance policy via offline mode. A policyholder needs to visit the nearest branch office of the insurance company or approach to the insurance agent with a self-attested copy of the Aadhaar card to complete the process of linking it with the policy. For new policies, there is no need to follow this process, as the Aadhaar number is required to be submitted at the proposal stage itself.

Benefits of Linking Aadhaar with Insurance Policies

- Linking Aadhaar with insurance policies helps prevent frauds, money laundering, black marketing activities, etc.

- As Aadhaar is already linked to bank accounts and PAN, linking it with insurance will ensure a unified platform for financial services. It also helps you to obtain financial services quickly.

- It helps to streamline the insurance administration processes, in respect of insurance policies.

- It will ensure a faster claims process and a better customer experience.

- Insurance claim amounts will directly be transferred to your account without any hassles.

Short Term Challenges

Experts have a belief that linking Aadhaar with insurance may have some short-term challenges, but it would prove beneficial in the long run. From a customer’s perspective, it is another Aadhaar linkage, and it is not too difficult to link Aadhaar with the insurance policy. Many people have already linked their Aadhaar to their bank accounts, mobile numbers, and PAN. The linkage of Aadhaar to insurance is not any different, and you can do it by visiting the insurance company’s website, or furnishing Aadhaar to a nearby branch office.

There are 24 life insurance companies and 33 general insurance companies, which carry out insurance business in India. Policies are issued every year, and the task of linking insurance policies requires serious efforts. LIC alone has around 29 crore policyholders. It is evident that the insurance industry has to face short-term operational challenges in linking previously issued policies. However, upon completion of the linkage process, it would be quite beneficial for the entire insurance industry and customers as well.

What happens if you do not link your Aadhar card?

Ever since the era of KYC started, the Aadhaar card is being linked with everything, from a bank account to ration cards, and according to the government, KYC is an important step and everyone should contribute to it. In such a situation, the government has also ordered to link the Aadhar card with the insurance and it has also been named as KYC. Your insurance policy will continue only if you complete the KYC process at the time of renewal.

This is even more important in the case of health insurance because your claim is very important and you can understand this thing in such a way that your claim cannot be accepted by any insurance company unless your KYC is complete. Doesn’t happen hence, it is suggested that you link your Aadhar card with your insurance policy at the earliest.

See, despite being a policyholder, if your claim is rejected only because of KYC, then it will look like a waste of money, and nowadays, Aadhaar has been given importance as the identity of a person and in such a situation without any thought. – Get the KYC done on time.

Conclusion

A move towards linking Aadhaar with insurance policies is a positive development. With a unique 12-digit Aadhaar number, it will be easy to authenticate the customers and help avoid frauds in the insurance industry. IRDAI however, has not given any deadline to comply with the norms, the policyholders need to make efforts to link their Aadhaar number with existing policies. While buying a new policy, they will be asked to furnish the Aadhaar details. Link Aadhaar with your insurance policy and contribute your part towards implementing the norms, as specified by IRDAI.

Great information thanks dear!

Really love your site