How Life Insurance Policy and Tax Benefits Go Hand in Hand

Buying a life insurance policy provides a financial cover, in the event of a contingency such as death and disability arising from natural or accidental means. On the demise of the insured, resulting in loss of income to the household, a life insurance policy provides a lump sum amount equal to the sum assured opted

The payment of premium under a life insurance policy offers a life cover to the policyholder. The premiums paid also qualify for ‘tax benefits’ under section 80C of the Income Tax Act, 1961. Section 80C provides a tax deduction for the life insurance premium paid during a financial year. A policyholder can also avail of tax exemption under Section 10 (10D) towards the policy proceeds, as applicable under the policy.

The tax benefits under a life insurance policy ensure that people will go ahead to invest a part of their savings towards buying a policy that further provides financial protection for their family. The life insurance policy serves as an effective tax planning instrument, and thus it is extremely essential to understand all aspects of availing the tax benefits as per the Income Tax Act.

Let us understand all about the TAX BENEFITS; you can avail of a Life Insurance Policy

Table Content

Tax Benefits under Section 80C

The premium paid for the life insurance policy is eligible for tax deduction from the gross total income under section 80C of the Income Tax Act, 1961.

The tax deduction under section 80C can be availed when you are paying a premium for your own life insurance policy. Although you can also pay life insurance premiums for any other person, you are eligible to avail of a tax deduction upon payment of premiums for insuring the lives of the following.

- Individual: Section 80C provides the tax deduction for payment of premium for insuring the life of self, spouse, and children. When it comes to a tax deduction for premium payment for insuring a child, he/she may be dependent or independent, minor or major, male or female, married or unmarried. A policy bought in the name of any other person is not eligible to avail of tax deduction under section 80C of the IT Act.

- HUF (Hindu Undivided Family): Tax deduction under section 80C can be availed, in case of payment of life insurance premium for any member of HUF.

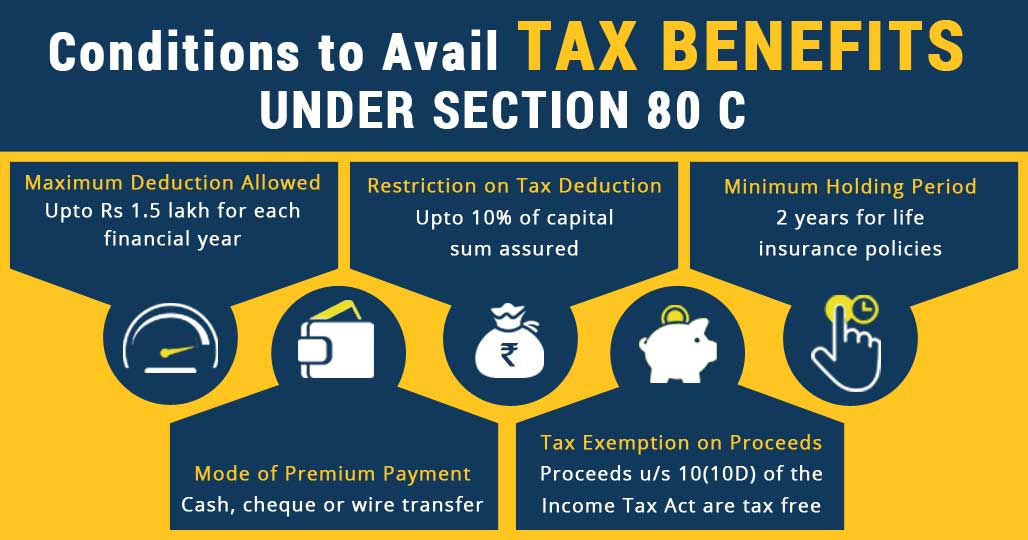

Condition to Avail Deduction under Section 80C of the Income Tax Act

The tax deduction for life insurance premium is applicable only in the year in which the premium is paid. For example, the life insurance premium is paid for the next 3 years or postponed to the next year; the tax benefit can be availed only in the actual year of receipt.

Maximum Deduction Allowed

Section 80C offers a tax deduction to individuals or HUF for paying the life insurance premium. The maximum total amount that can be claimed as a deduction is Rs 1.5 lakh for each financial year.

The key point to note here is that the deduction of Rs 1.5 lakh is the total deduction allowed for all investments as specified under sections 80CCC and 80CCD, which is considered in computing the maximum tax deduction limit under section 80C.

Restriction on Amount of Tax Deduction

The tax deduction is restricted to 20% of the capital sum assured, in case of policies are issued on or before 31st March 2012 and it is 10% for policies issued on or after 1st April 2012. If the policy is issued on or after 1st April 2013 for a person suffering from a disability as specified under section 80U or suffering from the disease as mentioned in section 80DDB, the deduction will be limited to 15% of the capital sum assured.

For Example, Mohit paid a life insurance premium of Rs 9,500 for the policy issued in the month of March 2011 having a sum assured of Rs 50,000, in such a scenario he can claim a tax deduction of Rs 10,000 (20% of the capital sum assured) towards premium payment of life insurance policy. So, he can get the deduction for his entire premium paid for the policy.

Minimum Holding Period

There requires a minimum holding period for investments to claim tax deduction under section 80C. You need to hold your life insurance policy for a minimum period of 2 years. For ULIP policies, senior citizens saving scheme, and post office time deposit, the minimum holding period is 5 years.

If the life policy or other specified investments is terminated before the minimum holding period, the deduction allowed in earlier years would then be considered as income in the year during which you had claimed the deduction. Moreover, no deduction will be allowed for such policy in the year it gets terminated.

Mode of Premium Payment

The premium can be paid via cash, cheque, or wire transfer to claim deduction under section 80C. You only need to pay the required premium amount on or before the due date, so your policy remains in force without a break.

Tax Exemption on Life Insurance Policy Proceeds

It is a general thinking that the proceeds of a life insurance policy are entirely tax-free. You can avail of tax exemption on the policy proceeds under section 10 (10D) of the Income Tax Act, 1961. However, there are certain conditions and exceptions that you need to be aware of when the policy proceeds are tax-free and when taxable.

Let us understand the tax treatment of life insurance policy proceeds in detail. Under section 10(10D), the sum assured amount plus bonus received on death, maturity, or surrender of the policy is entirely tax-free for the policyholder, subject to conditions applicable.

- In case a life insurance policy is issued after 1st April 2003 but on or before 31st March 2012 and the premium payable during a financial year is more than 20% of the chosen sum assured, the policy proceeds would be considered taxable for the insured.

- For life policies issued on or after 1st April 2012, the amount of annual premium payment should not exceed 10% of the opted sum assured to avail exemption on the policy proceeds.

- In case the policy is issued on or after 1st April 2013, and the insured is suffering from disability or disease, then the limit of premium payment during a year is up to 15% of the sum assured amount.

If the annual premium payable exceeds the specified percentage of the actual sum assured, then the whole amount of policy payouts would be considered as income and become taxable in the year of receipt. In case of a death claim, the policy proceeds will be tax-free irrespective of the premium limit specified.

TDS at the rate of 1% (2% if payment is made before 1st June 2016) is applicable if the amount received as policy proceeds is not exempted under section 10 (10D) of the Income Tax Act. Moreover, TDS would be applicable on all tax payments equal to or exceeding Rs 1 lakh. If a PAN is not available or invalid, 20% TDS will be applicable.

Final Word

Buying a life insurance policy ensures a dual advantage of tax saving and life cover. Life insurance provides you a helping hand to reduce taxes and allows you to plan for long-term financial goals. You need to pick the right sum assured that not only helps you to take advantage of tax benefits plus facilitates you to cover all the future financial needs of your family, even in your absence.

You are advised to explore various life insurance policies available with different insurers and choose the one that maximizes the tax-saving and life cover benefit.

(Note: The tax benefits applicable are subject to prevailing tax laws that may amend from time to time)