LIC’s Best Child Insurance Plans to Invest in 2017

Being a parent, brings the joy for you & your family, however the parenthood brings responsibilities as well. It involves raising the child in his/her early age, providing quality education and need to address each and every issue that can ensure a secure future for your child.

Having a good education paves the way for a successful future of the child. It is thus essential for you to have a significant corpus of funds that can help meet the future expenses of higher education for your child. However, the skyrocketing cost of education is something that the most parents cannot easily afford without having a secure financial pool.

As per rough estimates, there is an education inflation of about 10 to 12 percent on an annual basis. At present, a four-year engineering course that costs you around Rs 8 Lacs and it would cost you around Rs 30 Lacs when going to enroll for the same engineering course after a decade.

Not only the education, other expenditures such as better clothing, food, health care, entertainment, etc. also cost you a lot. According to an estimate,it will cost you around Rs 55 Lacs for raising a child.

All these expenses for your child can easily be met by investing in a child plan.

Table Content

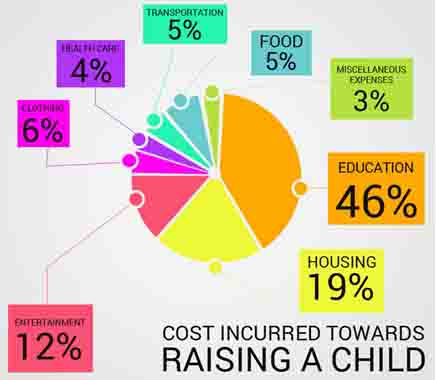

Cost Incurred towards Raising a Child

Having a child is one of the happiest moments for you & your partner, but raising a child brings a cost as well. With the rising cost of education, health care, food, clothing, etc., it is costlier than ever in India.

A recent study conducted by ET Wealth says, it will cost you around Rs 54.75 lacs to raise a child in India. When it comes to break down the cost involved in raising a child, a family spends 46% on education, 19% for housing, 12% for entertainment, 6% is spent for clothing and accessories,5% on food,5% on transportation, 4% on health care, and 3% on miscellaneous expenses.

What is a Child Plan?

As a caring parent, you would always want to ensure that you fulfill all dreams and aspirations of the child. A child insurance plan ensures a secure future for your child, as it provides financial protection to the child when you are not around. Investing in a child insurance plan helps you in financial planning to meet your child’s future needs.

These plans offer death & maturity benefit plus provide payouts at crucial junctures such as higher education and marriage.

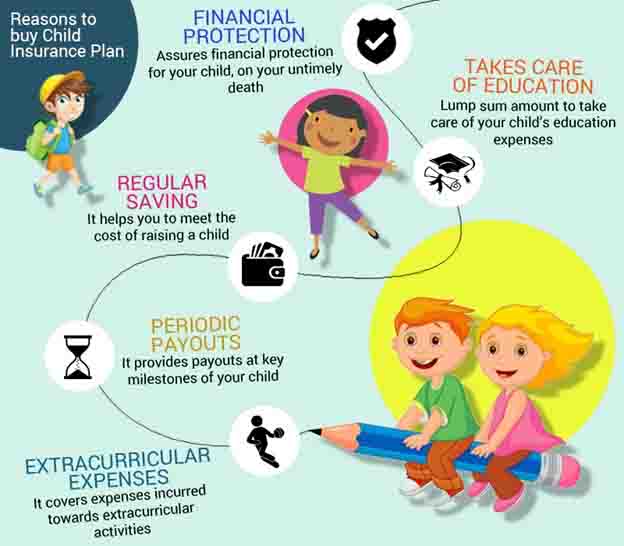

Reasons to buy a Child Insurance Plan:

- Financial Protection

In the event of your unfortunate demise, a child plan ensures a complete financial protection for your child.It makes sure that your child’s future is not compromised, even in your absence. Several child insurance plans come with inbuilt waiver of premium benefit under which, on your demise the insurance company will pay all the future premiums and the policy continues, so all the due benefits can be availed.

- Takes Care of Education

Life is uncertain and unfortunate event may occur to you at any time. In the event of your untimely death, your child’s desires and aspirations may be put at risk.Providing a quality education to your child is never easy, considering the escalating cost of education. On your demise, no one will be there to care of your child’s education. In order to tackle this scenario, it becomes imperative to buy a child plan which ensures you to pay a lump sum to your child, when you are not around.

- Regular Savings

Buying a child plan requires you to pay regular premiums towards ensuring a lump sum amount for your child. Investing in a child plan helps you meet the cost of raising a child such as education, healthcare, entertainment, marriage expenses, etc. You just need to compute the cost involved in raising a child and then buy a child plan accordingly.

- Periodic Payouts

You need finances to meet expenses at milestone stages of your child such as going for higher education. As a parent, you always want to do the best in facilitating your child in achieving his/her dreams and aspirations. A child plan provides payouts at key milestones, so you can meet your child’s education & other expenses.

- Extracurricular Expenses

Getting an education for your child is not just enough, there are several extracurricular activities such as theatre, painting, music, etc. that ensures all-round development of the child. Extra curricular activities require additional finances that can be met by investing in a child insurance plan.

LIC’s Child Insurance Plans

LIC offers two child plans, namely, LIC’s New Children’s Money Back Plan and LIC’s Jeevan Tarun.

| LIC’s New Children’s Money Back Plan | LIC’s Jeevan Tarun | |

| Entry Age | Min: 0 years, Max: 12 years | Min: 90 days, Max: 12 years |

| Maturity Age | Max: 25 years | Max: 25 years |

| Policy Term | (25 minus age at entry) years | (25 minus age at entry) years |

| Premium Paying Term | Equal to Policy Tenure | (20 minus age at entry) years |

| Sum Assured | Min: 1 Lac, Max: No Limit (subject to underwriting) | Min: Rs 75,000, Max: No Limit ( subject to underwriting) |

LIC’s New Children’s Money Back Plan

LIC’s New Children’s Money Back Plan is a non-linked & a participating money back plan which is designed to meet the educational, marriage and other needs of the children. This plan provides life cover for the child during the term of the policy. It also offers survival benefits at specified durations within the policy term.

This plan also offers the maturity benefit on survival till end of the policy term. You can also avail participation in profits in the form of bonuses. You can choose a rider to enjoy the premium waiver benefit. This plan also offers premium rebate for choosing sum assured of Rs 2 Lacs & above and on opting annual/semi annual premium payment mode.

Benefits under this Plan

- In case of unfortunate demise of the life insured prior the date of maturity, but before the date of commencement of risk, return of premium is payable. In the event of death after the date of commencement of risk, but prior the date of maturity, the nominee will receive a Sum Assured on Death plus Vested Simple Reversionary Bonuses & Final Additional Bonus.

- In case of survival of the life insured till the end of the policy term, the maturity benefit equal to 40% of the basic sum assured plus Vested Simple Reversionary Bonuses & Final Additional Bonus is payable.

- 20% of the basic sum assured as survival benefit is payable on coinciding or completion of 18, 20 & 22 years of age.

- Simple Reversionary Bonuses & Final Additional Bonus is payable as participation in profits.

- Loan facility is available after payment of premiums for at least 3 full policy years.

- Surrender Value is also payable after paying premiums for at least 3 policy years.

- LIC’s Premium Waiver Benefit Rider can be attached in this plan.

- Tax benefits are available under section 80C & 10 (10D) of the Income Tax Act.

LIC’s Jeevan Tarun Plan

LIC’s Jeevan Tarun is a non-linked, participating limited premium plan which offers savings plus protection feature for children. This plan caters the educational and other needs of your children with the help of survival benefits at specified years and maturity benefit at the completion of the policy term. This policy provides you the flexibility to choose the proportion of survival and maturity benefit payable, depending on the option chosen.

You can get the premium rebate on choosing annual/semi annual payment mode or opting for sum assured of Rs 2 Lacs & above. You can choose rider to waive off all the future premiums. This policy also offers participation in profits through bonuses. This plan offers tax benefits under section 80C & 10 (10D) of the IT Act, 1961.

Benefits under this Plan

- In the event of death of the life insured before the date of maturity, but prior the date of commencement of risk, total premiums paid shall be payable as Death Benefit. In case of death after the date of commencement of risk, but before the date of maturity, the nominee will receive the Sum Assured on Death plus Vested Simple Reversionary Bonuses & Final Additional Bonus.

- On survival of the life insured till maturity, Sum Assured on Maturity plus Vested Simple Reversionary Bonuses & Final Additional Bonus is payable.

- Survival benefit as 5%/10%/15% of the sum assured every year for 5 years, on survival, of the life insured on coinciding or completion of 20 years of age and subsequently on each of the next 4 policy anniversaries.

- Simple Reversionary Bonuses & Final Additional Bonus is payable, as participation in profits.

- Loan benefit is available, provided the surrender value has been acquired under the policy.

- Surrender Value can be acquired on payment of all premiums for at least 2/3 policy years, when the premium payment term is less than 10 years/equal to 10 years or above.

- You can opt for LIC’s Premium Waiver Benefit Rider, under this plan.

Conclusion

Being a parent, it’s your responsibility to ensure that your child’s future is not compromised at all. You seek to give him/her the best education, so your child can achieve fulfillment in the career. Having a child plan provides complete financial protection for your child. By investing in a child plan, your child’s future is secured against unfortunate event of your death plus it offers payouts at key milestones of your child.