IRDAI Incurred Claims Ratio 2015-16 of General Insurance Companies in India

Incurred Claim Ratio is the ratio of claims incurred by the insurance company to the actual premium collected in that period. You can consider it as the net claim settlement cost incurred to the net premium collected for a particular accounting period. It is one of the most important parameters to analyze the performance of an insurance company. IRDAI issues an annual report of the performance of general insurance companies which also contains the Incurred Claims Ratio of all the general insurance companies.

Table Content

- Why it is important to check the ICR of non-life insurance companies?

- How is ICR calculated?

- Incurred Claims Ratio = Net Claims Incurred/ Net Premiums Collected

- Incurred Claims Ratio of Non-Life Insurance Companies for the year 2015-2016

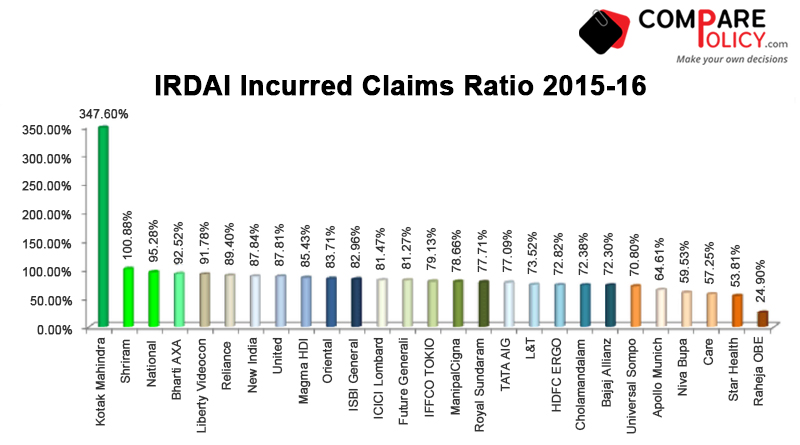

- Performance of Insurance Companies in Chart

- Key aspects about Incurred Claims Ratio

- Related posts:

Why it is important to check the ICR of non-life insurance companies?

The Incurred Claim Ratio indicates the reliability of the insurance company in terms of the claim settlement. A higher Incurred Claim Ratio is always good for the policyholder and it indicates that the insurance company is successfully meeting its claim. In simple words, ICR indicates the company’s ability to pay the claim. But a Very high Incurred Claim Ratio also indicates that the insurance company is going into losses. If the Incurred Claim Ratio of an insurance company is more than 100%, then it means that the amount of money which the company is giving in the form of claims is more than the amount of money collected in the form of premium which indicates the ill financial health of the company.

How is ICR calculated?

Incurred Claim Ratio is calculated by dividing the total value of claims paid by the company with the total value of premiums collected by the company during a financial year.

Incurred Claims Ratio = Net Claims Incurred/ Net Premiums Collected

Let us understand this with an example:

| XYZ Company earned a premium of Rs.10 lacs and spent Rs.9 lacs on claims during the particular financial year 2015-16. So now, according to the formula of Incurred Claim Ratio Net premium earned = Rs.10 lacs Net claim incurred = Rs.9 lacs Therefore, Incurred Claims Ratio =9/10 (in lacs) Thus, the ICR of the XYZ insurance company for the year 2015 will be 90%. This also means out of every Rs.100 received, the insurance company has spent Rs.90 out of it for payment of claims. |

Incurred Claims Ratio of Non-Life Insurance Companies for the year 2015-2016

| S.No | Private General Insurance Companies | Net Earned Premium (in lakh) | Claims Incurred (in lakh) | Total Incurred Claims Ratio (%) |

| 1 | Kotak Mahindra | 6 | 21 | 347.60% |

| 2 | Shriram General Insurance | 148106 | 149415 | 100.88% |

| 3 | Bharti AXA | 115822 | 107161 | 92.52% |

| 4 | Liberty Videocon | 29630 | 27194 | 91.78% |

| 5 | Reliance General Insurance | 199940 | 178751 | 89.40% |

| 6 | Magma HDI | 37322 | 31883 | 85.43% |

| 7 | SBI General | 120689 | 100127 | 82.96% |

| 8 | ICICI Lombard | 482162 | 392821 | 81.47% |

| 9 | Future Generali | 108144 | 87890 | 81.27% |

| 10 | IFFCO-TOKIO | 280495 | 221967 | 79.13% |

| 11 | Royal Sundaram | 139002 | 108018 | 77.71% |

| 12 | TATA AIG | 206274 | 159026 | 77.09% |

| 13 | L&T | 29783 | 21896 | 73.52% |

| 14 | HDFC ERGO | 170854 | 124416 | 72.82% |

| 15 | Cholamandalam | 169080 | 122377 | 72.38% |

| 16 | Bajaj Allianz | 422365 | 305386 | 72.30% |

| 17 | Universal Sompo | 53056 | 37561 | 70.80% |

| 18 | Raheja OBE | 2149 | 535 | 24.90% |

| S.No | Public General Insurance Companies | Net Earned Premium (in lakh) | Claims Incurred (in lakh) | Total Incurred Claims Ratio (%) |

| 1 | National | 1079138 | 1028240 | 95.28% |

| 2 | New India | 1495983 | 1314119 | 87.84% |

| 3 | Oriental | 702390 | 587959 | 83.71% |

| 4 | United | 1002287 | 880109 | 87.81% |

| S.No | Stand Alone Health Insurers | Net Earned Premium (in lakh) | Claims Incurred (in lakh) | ICR (%) |

| 1 | HDFC ERGO Health | 77490 | 50065 | 64.61% |

| 2 | Cigna TTK | 7096 | 5582 | 78.66% |

| 3 | Niva Bupa | 39311 | 23402 | 59.53% |

| 4 | Religare | 28773 | 16472 | 57.25% |

| 5 | Star Health | 151387 | 81445 | 53.81% |

Source: IRDAI Annual Report 2015-16

IRDA Incurred Claims Ratio for the Year 2018-19

Top 10 Health Insurance Companies in India 2020

Performance of Insurance Companies in Chart

Key aspects about Incurred Claims Ratio

- ICR indicates the ratio of claims settled against the collected premiums, but it doesn’t indicate the time taken to settle the claim. A company may be having a very high ICR yet the claim settlement process may be lengthy.

- ICR is different for different lines of general insurance business like Motor, Health, Fire, Marine, and others. Collectively combining all gives us the total ICR of a company.

- An Incurred Claim ratio of more than 100% can also be because of a startup insurer that doesn’t have substantial premium earning in the initial years of operation and has faced a high rate of claims.

- A high ICR indicates that the insurance company is successfully meeting its claims.

- Even if ICR is one of the most important yardsticks to measure the performance of a company, but it shouldn’t be the only parameter to analyze the company.

hello sir….

1. my mother (she 51 years old ) from past 2 to 3 month ……i plane to do surgery next renewal after july 2018

my previous policy was bajaj just portability with star (star told me we cover after continuous 24 month only in when portability case )

please make sure is it right???

note – because no any preexist diseases mention on bajaj policy…

2. i confuse between cigna ttk & universal sompo mediclaim (this policy take for me age is 31 years old)

Thank you sir

I am thinking of taking 10 year term householder policy from Liberty Videocon. How is their policy & claim admission & settlement vis-a-vis others ? Plz consider urgent as policy expires today.

I want to take term insurance of5000000 for up to age of 84.which is the best company? My age 34.