IRDA Claim Settlement Ratio for 2019-20

Every year IRDA publishes a report of the Claim Settlement Ratio of different Insurance companies, to give a broader view for customers to make the right choice in terms of insurance plan and plan service.

In FY 2019-20 IRDA publish their CSR report on 30 August, some of the best Insurance companies are on the top of the list and serving people with their all. Although last year was tough for common people and also for insurance companies everyone’s got their claim settlement and it’s still going on.

Table Content

First, we know, Claim Settlement Ratio

Claim Settlement Ratio is the percentage of the total number of claims filed is divided by the total number of claims settled. For example, suppose a Life insurance company has 1000 death claims, and out of them that company has settled 924 claims, then that company will have a claim settlement ratio of 92.40% and claim rejection rate of 7.60%.

We all know about the insurance company and the Claim Settlement report is like the second identity of companies. Claim Settlement Ratio gives the proper way to their customer to figure out one of the best insurance companies and the best plan to settle.

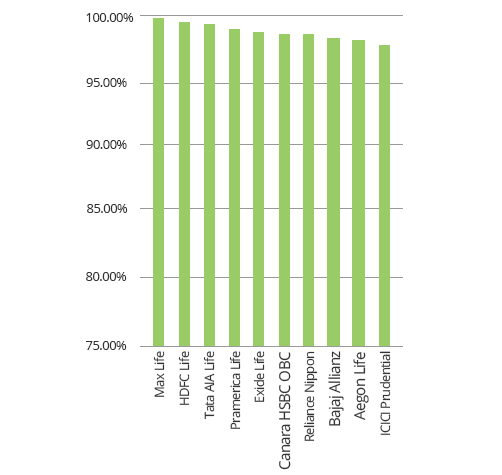

Claim Settlement Ratio of Life Insurance Companies

Here is the list of the latest Claim Settlement Ratio of all Life insurance companies for FY 2019-20, as released by IRDAI.

| Insurer Name | Claim Settlement Ratio |

| Max Life Insurance | 99.22% |

| HDFC Life Insurance | 99.07% |

| Tata AIA Life Insurance | 99.06% |

| Pramerica Life Insurance | 98.42% |

| Exide Life Insurance | 98.15% |

| Canara HSBC OBC | 98.12% |

| Reliance Nippon Life Insurance | 98.12% |

| Bajaj Allianz Life Insurance | 98.02% |

| Aegon Life Insurance | 98.01% |

| ICICI Prudential Life Insurance | 97.84% |

CSR Trend of Life Insurance Companies

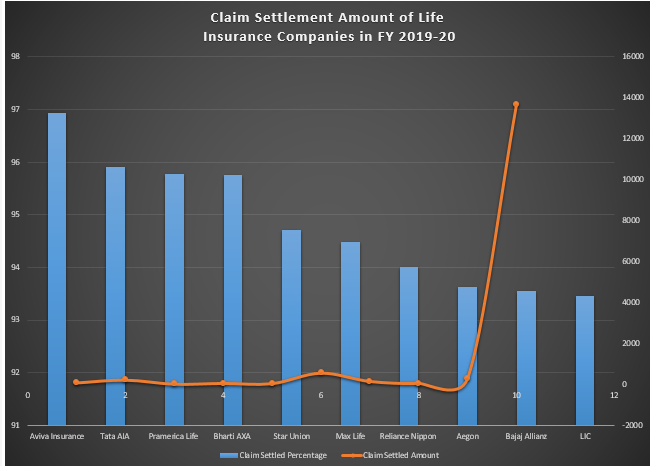

Claim Settlement Amount of Life Insurance Companies in FY 2019-20

Well, all insurance companies try to give their best and serve with a good ratio and last year was like a test for everyone. In terms of claim settlement companies have a certain policy and they always provide claim settlement with immediate effect.

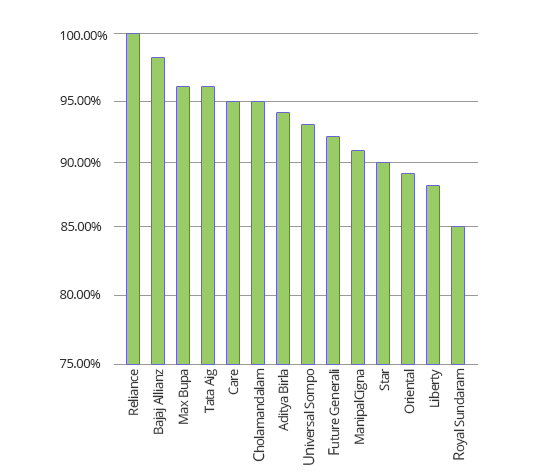

Claim Settlement Ratio of Health Insurance Companies

Here is the list of the latest Claim Settlement Ratio of all Health insurance companies for FY 2019-20, as released by IRDAI.

Remarkable Points:

- Reliance Health Insurance makes the place on top of insurance companies with 100% of Claim Settlement Ratio and Reliance Health Insurance serving with his all.

- There are five Health insurers having a claim settlement ratio equal to or higher than 95%. It includes Bajaj Allianz (98%), Tata AIG (96%), Niva Bupa (96%), Care Health Insurance (95%), Cholamandalam Health Insurance (95%).

CSR Trend of Health Insurance Companies

Let’s have a thorough insight into the trend of claim settlement ratio of Health insurance companies in FY 2019-20 from the previous year.

Reliance company is on top of the list with serving 100% Claim Settlement and CSR making it a valuable insurance company. Once, a wise man said “A policy of Health insurance is the cheapest and safest mode of making a certain provision for one’s family” so choose wisely and make your health and decision precious too.