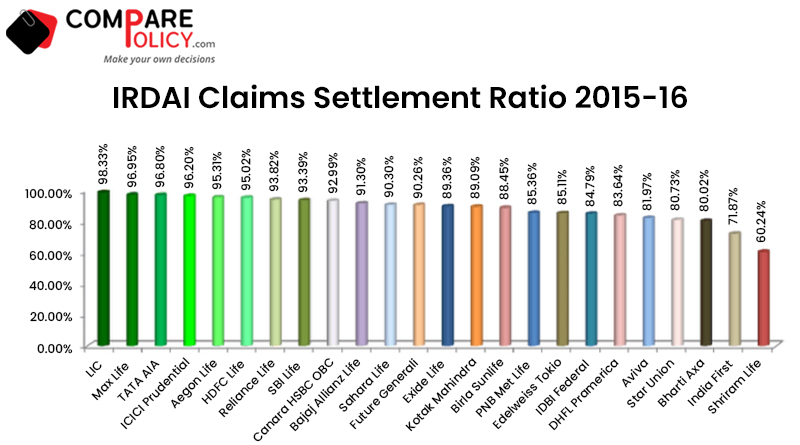

IRDAI Claims Settlement Ratio 2015-16

Claim Settlement Ratio is the number of insurance claims settled by a life insurance company as a percentage of a number of claims received over a particular period of time. It is measured for all the products of the life insurance company in a given financial year. IRDAI issues the claim settlement ratio of all the life insurance companies in its annual report, which can be easily found on the internet. in this article, we will know about Claims Settlement Ratio 2015-16 of Life insurance companies.

CSR reports are a way to know about the performance of insurance companies, look we all know that every insurance provider says “they are the best insurance service provider” but before trusting anyone blindly. You should find the claim settlement ratio report of every insurance company which is released by IRDAI every financial year. It will make things clear and easy for you in terms of buying an insurance policy, CSR report shows you the alternative way to judge the best insurance company and it also helps you take some best decisions.

Table Content

Why it is Important to Check CSR of a Life Insurance Company?

Settlement of Claim is one of the most important services which is provided by an insurance company. That’s why knowing the reliability of a company regarding its claim settlement is very much necessary. A Claim Settlement Ratio acts as one of the most important yardsticks to determine the claim settlement capacity of the life insurance company. Higher the claim settlement ratio, the more favorable it would be for the policyholder. That’s why one should always look for a higher Claim Settlement Ratio aspect before buying a life insurance policy. However, this is one major aspect to ponder before buying a policy and other aspects must be looked upon as well along with the “Claim settlement ratio” of the life insurance company.

How is Claim Settlement Ratio Calculated?

Claim Settlement Ratio is calculated by dividing the number of claims approved by the insurance company by the total number of claims received.

Claim Settlement Ratio = Numer of claims approved/Total number of claims received

Let us understand this with an example:

| The XYZ Life insurance company received 1000 claims in the year 2015, out of which 900 claims were settled. So now, according to the formula of Claim Settlement Ratio Number of claims received= 1000 Number of claims settled= 900 Therefore, Claim, Settlement Ratio= 900/1000 So, the CSR for XYZ company will be 90% for the year 2015 |

Check the latest Claim Settlement Ratio for the FY 2016-17

Claim Settlement Ratio of Life Insurance Companies for FY 2015-2016

| S.No | Life Insurance Companies | Total no. of claims | Claims paid | CSR (2015-16) |

|---|---|---|---|---|

| 1 | LIC | 761983 | 749249 | 98.33% |

| 2 | Max Life | 9175 | 8895 | 96.95% |

| 3 | TATA AIA | 3311 | 3205 | 96.80% |

| 4 | ICICI Prudential | 11034 | 10615 | 96.20% |

| 5 | Aegon Life | 533 | 508 | 95.31% |

| 6 | HDFC Standard Life | 12430 | 11811 | 95.02% |

| 7 | Reliance Life | 14618 | 13714 | 93.82% |

| 8 | SBI Life | 16102 | 15037 | 93.39% |

| 9 | Canara HSBC OBC | 571 | 531 | 92.99% |

| 10 | Bajaj Allianz Life | 17967 | 16404 | 91.30% |

| 11 | Sahara Life | 794 | 717 | 90.30% |

| 12 | Future Generali | 1530 | 1381 | 90.26% |

| 13 | Exide Life | 3233 | 2889 | 89.36% |

| 14 | Kotak Mahindra Old Mutual | 2767 | 2465 | 89.09% |

| 15 | Birla Sunlife | 7204 | 6372 | 88.45% |

| 16 | PNB Met Life | 3094 | 2641 | 85.36% |

| 17 | Edelweiss Tokio | 141 | 120 | 85.11% |

| 18 | IDBI Federal | 1085 | 920 | 84.79% |

| 19 | Pramerica Life | 550 | 460 | 83.64% |

| 20 | Aviva | 1531 | 1255 | 81.97% |

| 21 | Star Union | 1365 | 1102 | 80.73% |

| 22 | Bharti Axa | 1261 | 1009 | 80.02% |

| 23 | India First | 1891 | 1359 | 71.87% |

| 24 | Shriram Life | 2510 | 1512 | 60.24% |

Source: IRDAI Annual Report 2015-16

Check out this Article: IRDAI Claim Settlement Ratio FY 2019-20 of Life & Health insurance companies

Key aspects about Claim Settlement Ratio

- Claim settlement Ratio issued by IRDAI does deal with the type of life insurance policy, i.e. whether the claim received is a money-back policy, endowment plan, or term plan. CSR is just an average of all types of life insurance policies.

- The higher the claim settlement ratio, the better are the chances of smooth claim settlement for the policyholder.

- While Claim Settlement is one of the most important parameters for analyzing a company, it shouldn’t be the only yardstick before buying a policy.

- Every year, IRDAI issues an annual report on the insurance industry, which contains the details of the performance of insurance companies. This annual data contains the CSR of all the life insurance companies in India.

- One should also check the consistency of the Claim Settlement Ratio because the ratio is not static but changes every year.

- The insurance company is not always responsible for the rejection of claims as there are many cases of impersonation, misrepresentation, and fraud claims.

Check out this Article: IRDAI Incurred Claims Ratio 2015-16 of General Insurance Companies in India

Hello!

Please provide Amount-wise claim settlement Ratios of all the Cos for the Year 2015-16

And also the following Ratios:—-

1) Persistency Ratio

2) Solvency Ratio

3) Combined Ratio

4) Incurred Claims Ratio

5) Commission Expense Ratio

Please refer the article in the ET Wealth Mumbai edition dt. 26th June, 2017

Thank you Mr. Prakash for reading our Blog. The ET Wealth article which you are quoting is done by us in collaboration with Economic Times. You may find the data source as ComparePolicy. We will certainly share the ratio details on our blog section soon.