Investments under Section 80C of Income Tax Act to Avail Tax Deduction

Government levies taxes on the taxable income of individuals, Hindu undivided families (HUFs), companies, firms, trusts, etc. The taxes levied in India are governed by the Income Tax Act, 1961. Taxes account for a significant component of the income earned by the government, which is then utilised towards welfare measures and improving the infrastructure of the nation.

Taxes can have financial implication for a taxpayer; thus Government offers specific provisions under the Income Tax Act,1961 which helps one to save tax. Tax deductions help one to reduce the tax liability. The government provides tax deductions for investments made under various sections of income tax to exempt the tax liability up to the permissible limit.

One such section is 80 C of IT Act, 1961 which enables you to save tax for the investments made using various tax saving instruments.

Table Content

- Section 80 C

- Investment Options to Avail Tax Deduction under Section 80 C

- Life Insurance

- Employees’ Provident Fund (EPF)

- Public Provident Fund (PPF)

- National Pension Scheme (NPS)

- National Savings Certificates (NSC)

- Sukanya Samriddhi Account

- Home Loan

- Equity Linked Savings Scheme (ELSS)

- Bank Fixed Deposit

- Post Office Time Deposit

- Post Office Senior Citizen Savings Scheme

- Tuition Fees of Children

- Tax Saving Investments Under Section 80C at a Glance

- Subsections under Section 80C

- Final Word

- Related posts:

Section 80 C

Section 80C is one of the most critical sections of the Income Tax Act which offers a taxpayer to avail income tax deduction for the investments made. Individuals and Hindu Undivided Families (HUFs) are eligible for a tax deduction under section 80C, and they can avail the deduction up to a maximum limit of Rs 1.5 lakhs during a financial year. Section 80C reduces your tax liability, and for some income groups, they don’t have to pay any tax due to the tax deductions applicable.

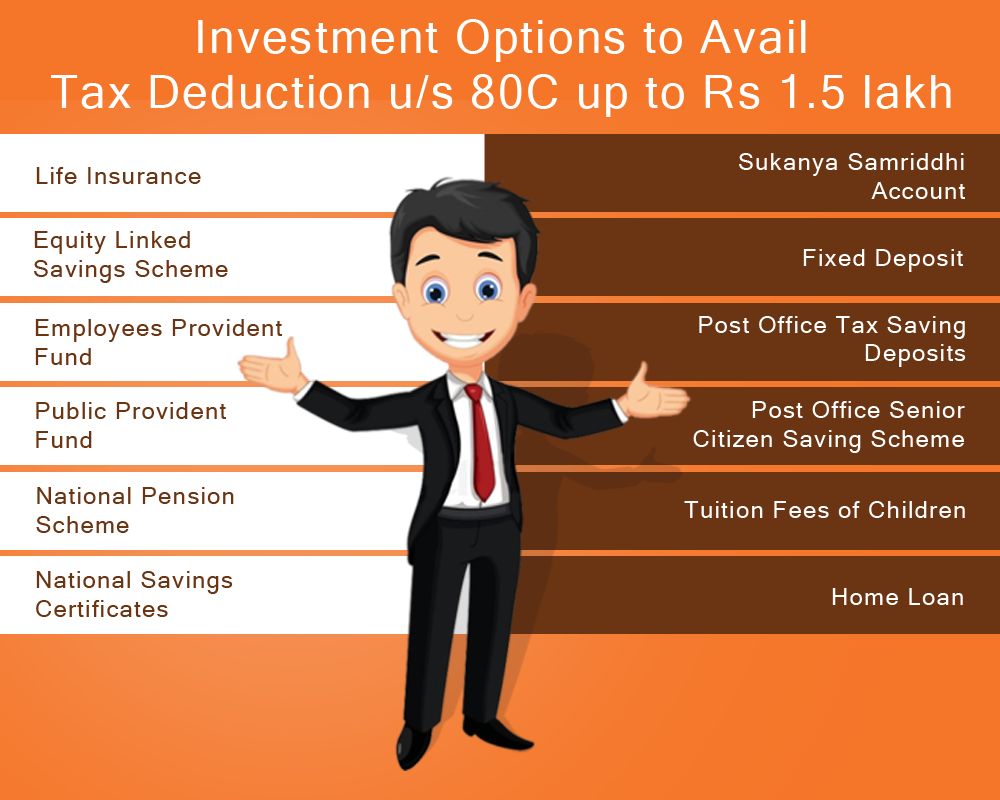

Investment Options to Avail Tax Deduction under Section 80 C

Section 80 C comprise of various investment options which enable you to avail income tax deductions.The maximum tax deduction allowed under section 80 C is Rs 1.5 Lakhs. So, you may invest in one or multiple investment options; the maximum deduction is fixed at Rs 1.5 Lakhs as per the current income tax norms. Each investment specified under this section is varied and need based. It is thus essential to assess and invest in the most suitable ones that can facilitate you to achieve your financial goals along with tax savings

Life Insurance

Buying a life insurance policy provides a life coverage, which ensures a financial protection for your family & loved ones. There are various types of life insurance plans you can invest in as per your financial goals. Some life insurance policies provide only life cover while others offer investment returns along with life coverage.

- Term Insurance: Term plan is a pure protection plan which offers a comprehensive protection for your family at a nominal cost. A term insurance policy lets you enjoy the dual benefits of tax saving and pure insurance. Any amount paid towards term insurance policy for yourself, spouse or children are eligible for tax deduction under section 80C up to the maximum deduction limit of Rs 1.5 lakhs. The deduction is valid only if the premium is less than 10% of the sum assured. Every working individual should have an adequate term insurance cover.

- Unit Linked Insurance Plan (ULIP): Investing in a ULIP plan helps you create wealth along with life coverage and tax saving. A small portion of your investment goes for providing life cover, and the remaining part is invested in debt, equity or balanced fund, which help you to gain market linked returns. ULIP investments are also eligible for deduction under Section 80C. Buying a ULIP plan is best for those who are seeking to build wealth along with life cover advantage.

- Child Plan: Buying a child plan helps you to save enough for your child that can assure you a secured future for the child, even if you are not around. It pays money at specified milestones to cater to your child’s financial needs plus offers life insurance coverage, which ensures a lump sum payment on the untimely demise of the policyholder. Apart from securing your child’s future, investing in a child plan also offers you tax benefits under section 80 C of IT Act, 1961.

- Pension Plan: You can invest in a pension plan as it helps you to save for your post-retirement life so you can sustain your current lifestyle even after the retirement. Out of the accumulated corpus, you have the option to withdraw up to 1/3rd of the amount as a lump sum, and you may invest the remaining amount with an annuity plan to start receiving a regular pension. The annual investment made under a pension insurance plan is eligible for tax deduction under section 80CCC ( a subsection of 80C) of the Income Tax Act up to a maximum limit of Rs 1.5 lakh. The lump sum amount received (1/3rd of the entire corpus) is also eligible for tax exemption under section 10(10A) of IT Act.

Employees’ Provident Fund (EPF)

Employees’ Provident Fund is a retirement benefit scheme available to salaried employees of every organization or establishment having 20 or more persons employed. Both employee and employer need to make an equal contribution of 12% of employee’s basic salary plus dearness allowance. At the age of retirement, the total accumulated amount along with interest is payable to the employee as a lump sum amount.

The employer’s contribution is exempt from tax and employee’s contribution is eligible for availing tax deduction under section 80C, up to the permissible limit of Rs 1.5 lakhs. You also have the option to contribute additional amount through voluntary contributions. These additional contributions are also eligible for deduction under Section 80C.

Public Provident Fund (PPF)

Public Provident Fund (PPF) scheme is a long term investment option being offered by the government of India, which ensures attractive returns and the interest earned are fully exempted from tax. A maximum of Rs 1.5 lakh can be claimed in one financial year. PPF has a term of 15 years post which the withdrawals are tax free. With PPF investment, you can avail loan facility, against corpus in the PPF account. You can avail tax deduction under Section 80C for the annual contribution made under PPF scheme. Contributions to PPF accounts of the spouse and children also qualify for tax deduction under section 80C up to 1.5 Lakhs.

National Pension Scheme (NPS)

Investing with the government run ‘National Pension scheme’ allows you to accumulate the retirement corpus, which helps to get a regular monthly pension for your entire life. Apart from pension savings, you can also avail a tax deduction of up to Rs 1.5 lakh under Sec 80 C. This investment also provides an additional deduction of Rs 50,000 under section 80CCD (1B). Maturity proceeds are taxable under NPS.

National Savings Certificates (NSC)

National Savings Certificates (NSC) is the government savings bond which is issued by the India Postal Service and you can purchase it from any post office. It is issued for 5 years and 10 year maturity period. NSC investment is eligible for tax deduction under Section 80C. The interest accumulated is taxable and if re-invested, it is eligible for deduction under section 80C.

Sukanya Samriddhi Account

Sukanya Samriddhi Account is a government backed savings scheme for girl children. Deposits of up to Rs 1.5 lakh can be added to a Sukanya Samriddhi Yojana account for tax saving under Section 80C. It helps parents to build a fund to fulfill the education and marriage expenses for their daughter. Parents or legal guardians can open the account anytime before a girl child attains 10 years of age. Parents or legal guardian of a girl child is allowed to open the account for two girl children only. The account is allowed to close after completion of 21 years of the girl child. Premature closure is also allowed post completion of 18 years, if the girl is married. Deposits made under Sukanya Samriddhi account are eligible for tax deduction under Section 80C. The interest and maturity proceeds are tax free under this scheme.

Home Loan

You can take a home loan for building a house or buying a flat. You need to repay the home loan through monthly EMI’s. Under home loan EMI, both the principal and interest part is payable. The principal part qualifies for tax deduction under section 80C. Not only the principal part, charges levied for stamp duty and registration of the property can also be claimed u/s 80C for tax deduction. You can also avail tax deduction for the interest part payable up to a maximum of Rs 2 lakh under section 24 of the Income Tax Act.

Equity Linked Savings Scheme (ELSS)

ELSS is an open-ended equity mutual fund investment having the potential to generate high returns. The investments made for ELSS are eligible for tax deduction under Section 80C of the Income Tax Act. The capital gains from ELSS funds are also exempted from tax.

Bank Fixed Deposit

Bank fixed deposits provide you guaranteed returns with no risk involved. When investing your money in a fixed deposit with a 5-year tenure, you can enjoy tax benefits while multiplying your investments. A five-year bank fixed deposit qualifies for tax deduction under section 80C up to a limit of Rs 1.5 lakhs.

Post Office Time Deposit

Post Office Time Deposit can be opened by an individual. An account can also be opened in the name of a minor aged above 10 years and who can operate the account. As of now, investing in a 5-year time deposit account provides an interest rate of 7.6% and it attracts tax benefits as well. A 5-year time deposit account provides a tax deduction under section 80C of the Income Tax Act.

Post Office Senior Citizen Savings Scheme

An individual with age 60 years or above can open the account under the senior citizen savings scheme. An individual with age of 55 years & above but less than 60 years who has retired under VRS or superannuation, can also open an account within one month of receiving the retirement benefits. You may operate more than one account individually or jointly with your spouse. The maturity period of investment under this scheme is 5 years as of now and interest is payable at a rate of 8.4 % per annum.Investments made under the senior citizen savings scheme are eligible to avail tax deduction under section 80C.

Tuition Fees of Children

You can also avail tax benefits, when imparting education to your children. Tuition fee paid to any college/university/educational institution in India towards full-time education of two dependent children is eligible for tax deduction under section 80C up to Rs 1.50 lakhs.

Tax Saving Investments Under Section 80C at a Glance

| Investments | Existing Return on Investment | Lock-in Period |

|---|---|---|

| Traditional Life Insurance Plan | Depends on the plan chosen | Up to 3 years |

| Unit Linked Insurance Plan | Return varies, as it is a market-linked product | Up to 5 years |

| Employees’ Provident Fund | 8.65% per annum | Till retirement |

| Public Provident Fund | 8.1% per annum | 15 years and can be further extended |

| Equity Linked Savings Scheme (ELSS) | Return varies, as it is a market-linked product | 3 years and can be further extended |

| National Pension Scheme (NPS) | 8-10% per annum | Till retirement |

| National Savings Certificates | 7.8% per annum | 5 years |

| Sukanya Samriddhi Account | 8.6% per annum | Till girl child attains 21 years |

| Bank Fixed Deposit | 7% to 9% per annum, depending on the bank | 5 years |

| Post Office Time Deposit | 7.6% per annum | 5 years |

| Post Office Senior Citizen Savings Scheme | 8.4% per annum | 5 years |

Subsections under Section 80C

Subsections under section 80C include Section 80CCC, 80CCD, 80CCF and 80CCG which provide provisions to get the tax deduction. Here, we are also specifying the investments applicable to avail deductions against each subsection.

Section 80CCC: Section 80 CCC of the Income Tax Act provides provisions to avail tax deductions on investments made in a pension plan offered by an insurance company. The individual taxpayers can only claim a tax deduction under this section and it can be availed up to a maximum of Rs 1.5 lakh.

Section 80CCD: This section provides tax deductions for making contributions to the pension schemes offered by central government, including National Pension Scheme (NPS) and Atal Pension Yojana (APY).

There are two sub-sections under section 80CCD.

Section 80CCD(1): This section provides tax deduction to individual taxpayers, not exceeding Rs 1.5 lakh for investments made under NPS and APY schemes. 80CCD (1B) provides an additional tax deduction of Rs 50,000 to all subscribers for contributions made under NPS and APY scheme.

Section 80CCD(2): Under this section, tax deduction is available for corporate subscribers, in case the employer makes contribution to the employee’s account in NPS scheme.

Section 80CCF: Section 80CCF contains provisions for tax deductions against investments in infrastructure and other tax saving bonds. An individual can claim up to a maximum of Rs 20,000 in a financial year and this tax deduction is available over and above to the deduction available under Section 80C.

Section 80CCG: Tax deduction under this section has been discontinued from 1st April, 2017. The deduction was available for Rajiv Gandhi Equity Savings Scheme (RGESS) up to 50% of the amount invested, subject to a maximum deduction of Rs 50,000 per year.

Final Word

Section 80C of the Income Tax act specifies provisions to take the benefit of tax deductions available against eligible investments.It is important to keep in mind that the tax deduction limit is maximum up to Rs 1.5 Lakh for the above investment options mentioned as per the current income tax norms. Now, you are aware of various tax saving instruments available, you only need to choose the investment options that are in sync with your financial goals along with tax saving.

When it comes to investments, don’t wait for the last moment and make the hurried decision for investing. You are however, advised to do a thorough research, invest your money wisely and avail tax benefits in the most prudent way.