Incurred Claims Ratio ICR for Health Insurance Companies in India

Just like any industry, the insurance industry also consists of companies that can be categorized as good, better, and best in their respective domains. To help customers make the right decisions and deal with only the best companies, the Insurance Regulatory and Development Authority of India (IRDAI) suggests various parameters to be looked upon by the customers to decide on the best health insurance company. Both Life and general insurance companies are authorized to sell health insurance along with standalone health providers like Niva Bupa, Star Health, etc. The parameters are based on the Incurred Claims Ratio (ICR) which acts as a guiding force for the potential buyers.

Table Content

What is Incurred Claims Ratio (ICR)?

In layman’s language, ICR can be only defined as the total value of all the claims paid by an insurance company in a given year divided by the total premium collected in the same year. For example, an insurance company paid Rs. 750 as claims against the total premium collection of Rs. 1000/-. This would mean the ICR for that company is 75%. This ratio depicts the insurers’ ability to pay the claims and remain sufficiently profitable.

What is The Ideal Ratio?

The misconception doing the rounds is that the higher the ratio, the better the company is. However, the truth is far from it. An insurance provider can’t be giving almost all its earnings as claims as that would have an adverse impact on the profitability and the long-term business sustainability of the organization. However, if it pays too little, it would mean either it’s earning too many profits on account of higher premiums compared to other health insurance companies, or it’s mainly catering to youth, who are considered to be less risky as customers. Based on this analysis, the ideal ICR for insurance companies should be in the range of 60-90%; preferably around 60% that ensuring sufficient claim payout along with sustainable profitability.

Is ICR the Same As Claim Settlement Ratio (CSR)?

CSR is basically the ratio of claims approved to the total claims made. In the case of CSR, it is a prerequisite to have a higher ratio for an insurance company to be declared a well-performing company. It means that the company is paying out the claims as its commitment to the insured as a part of the contract.

However, the claims team of the insurance companies has its own parameters for assessing the claims intimated. So every claim intimated to the insurance company may not be paid or repudiated.

When it comes to health insurance in India, IRDAI takes into account ICR to define the best companies.

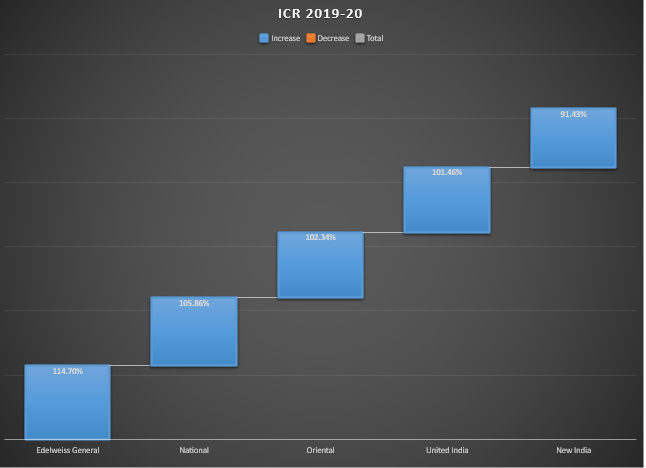

IRDAI declared the list of companies with their respective ICR in FY 2019-20:

| Insurer Name | Incurred Claim Ratio in % FY 2019-20 |

| Edelweiss General | 114.70% |

| National Health Insurance | 105.86% |

| Oriental Health Insurance | 102.34% |

| United India Health Insurance | 101.46% |

| New India Health Insurance | 91.43% |

Note: Latest IRDA Incurred Claims Ratio for the Year 2018-19 for Health Insurance Companies in India

also, read Latest IRDA Claim Settlement Ratio 2018-19 for Life Insurance Companies in India

There are more companies in the sector, providing different solutions for different needs, and one of the important factors to be considered is CSR. However, it is mentioned on the individual insurer’s website for your reference. The health insurance companies in India are the ones that have maintained a balance between high CSR and Optimum ICR. All you have to do is do your diligent research in finding out the details of different insurers and plans offered by them.

Health insurance in India has come a long way when it comes to reliability and offering policies that prove beneficial to the customers. IRDAI has also played its role efficiently in ensuring that companies function within the guidelines. With the insurance ecosystem in place and thriving, the onus is now on you to take the maximum advantage of it and get your health policy today, keeping in mind the regulator’s parameters as well.

Also, you can know about the Top 10 Health Insurance Companies in India 2020

madam,

please tell me about a good family health care plan for 5 members, senior menber age is 40 years