How to Choose the Best Health Insurance Policy

A good percentage of millennials are aware of the benefits of good health and adequate medical cover, but a large percentage still looks at health insurance as a tax-saving instrument. A recent ICICI Lombard survey of 1,400 young people in the age group of 25-35 years had 75% of the respondents saying that they had a health insurance policy.

But 46% of the buyers said that the tax deduction on health insurance premiums was what made them buy the health cover. The quest for tax benefits was more pronounced among female respondents, with 64% citing it as the reason for buying the cover. The survey findings show that most people buy insurance only to save tax and not for the benefits it offers.

Take the case of Noida-based Mohit Kumar. He has been advised to buy a family floater plan worth Rs 10 lakh, which will cost Rs 15,000 annually. However, his busy work schedule has kept him from buying the policy. Kumar should know that he can purchase a health policy online. All it will take is 30-40 minutes and some amount of effort to key in his details.

Table Content

Health insurance is a necessity

Well, The good news is that awareness about the need for health insurance is on the rise. Most of the respondents to the ICICI Lombard survey said they knew about the need for health insurance. But insurers say some myths need to be shattered first.

For instance, half of the respondents of another survey by Niva Bupa thought that health insurance is for the old and 48% thought they don’t need it since they are healthy. Many were also bullish about their ability to foot post-retirement health bills as they believed they have enough savings to sail through.

Many are still unsure about the benefits of health insurance. Hence, only 50% of respondents to the Niva Bupa survey claimed to have renewed their policies. Many still see it as a waste of money because it does not offer any return.

Chennai-based Veerendra Kumar is stuck at the quotation stage of a Rs 10 lakh family floater plan. “After I was advised to buy additional health insurance, I have looked up some policies online and offline. I have called for some quotations. I should be able to finalize a policy soon,” he says.

How much cover do you need?

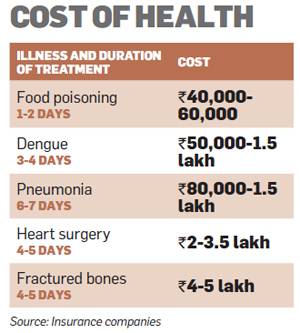

A health insurance floater policy of Rs 5 lakh is quite sufficient in most parts of the country. However, it may not be adequate if you live in a metro, where the cost of medical treatment is significantly higher. A 2-3 day hospitalization for common diseases can land you a bill of Rs 60,000-70,000 in private hospitals of metro cities. The bill for bigger ailments can run into several lakhs of rupees.

But a regular indemnity policy of Rs 3-5 lakh will not be of much use if the policyholder is diagnosed with a serious ailment. For such cases, a critical illness plan is more useful. But critical illness policies come at higher costs and cover only specific ailments. Still, they are better than some disease-specific covers.

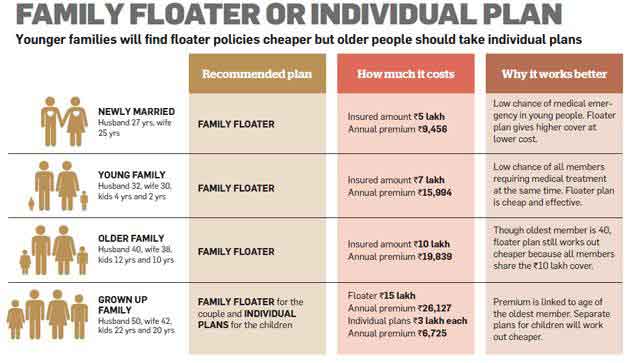

The type of policy to buy should be determined by your family’s needs. The number of family members and their age is crucial to identifying a policy. For instance, a young family can do with a basic cover of Rs 5 lakh, while a family with older members should opt for a larger floater cover. Family floater premiums are linked to the age of the oldest member. If the parents are over 50, it would be sensible to get a separate cover for them, and not include them in the floater plan.

Use a top-up policy

One way to enhance your health insurance cover at a low cost is through a top-up policy. These plans can also be used to complement the group health coverage offered by your employer. “Companies allow employees to buy top-up covers between Rs 2 lakh and Rs 5 lakh. The annual premium for employer facilitated covers is around Rs 1,000 per Rs 1 lakh,” says Arvind Laddha of Vantage Insurance Brokers. If your employer does not allow you to buy a top-up cover, you can always buy a top-up plan independent of the base plan.

Top-ups are cheaper than family floaters. According to data from MyInsuranceClub. com, a Rs 5 lakh family floater covering self, spouse, and one child will cost anywhere between Rs 10,000 and Rs 17,000 annually. A Rs 5 lakh individual health plan will cost a 35-year-old Rs 4,000-7,000 a year.

I want to change my health insurance Company. I am looking for a family Floater plan. Please advice me which is the best plan with network coverage in hospital at trivandrum, kerala