How Pension Plans Help to Save Taxes

Retirement is one of the key life events most people will ever experience. During post-retirement life, you would like to lead a comfortable life even without any impending deadlines and crushing workload. This is the time to do the things you ever wished for. However, after retirement, your regular income stops and you may find it tough to sustain yourself when you permanently take off from your work. In order to ensure you have sufficient funds to lead a similar lifestyle even after you retire, it is essential to make the post-retirement planning wisely. Here comes the role of a Pension Plan.

Table Content

- Why Buying a Pension Plan is Imperative?

- Tax Benefits under a Pension Plan

- Tax Deduction under Section 80CCC

- Tax Benefit under Section 10 (10A)

- Tax Treatment on Surrendering the Pension Plan

- Types of Pension Plans

- 1. Deferred Annuity

- 2. Immediate Annuity

- Ideal Age to Buy a Pension Plan

- Conclusion

- Related posts:

Why Buying a Pension Plan is Imperative?

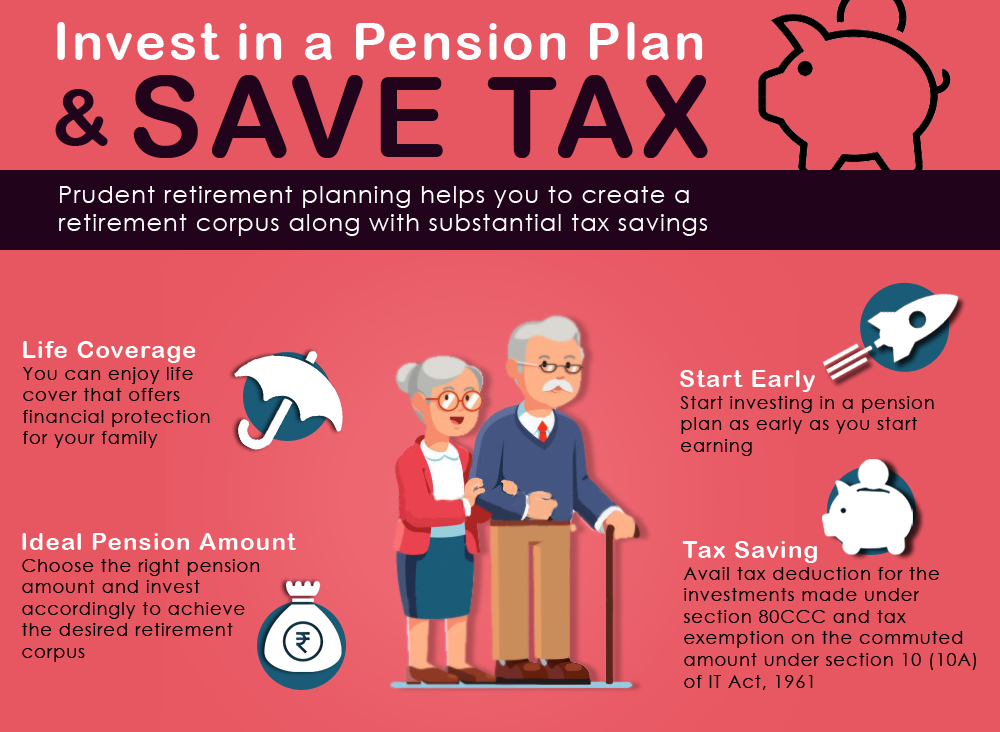

Investing in a pension plan helps you to accumulate a sizeable amount of funds to enjoy the golden post-retirement years of your life. Pension plans also come with life insurance coverage, which provides monetary reimbursement to your family when you are not around.

A pension plan provides a regular source of income after your retirement and helps you & your spouse to sustain the current lifestyle. Apart from ensuring financial stability and security for your post-retirement life, pension/retirement plans also offer significant tax benefits and help you to avail tax deductions & exemptions, as applicable under the Income Tax Act, 1961.

There are Several Benefits of Buying a Pension Plan:

Maturity/Vesting Benefit: In pension plans, you have the option to withdraw one-third of the corpus at the maturity known as “Commutation”. The remaining two-thirds of the entire amount is used to pay the annuity that you would receive as a monthly income after retirement.

Annuity Benefit: On the attainment of the vesting age, a pension plan provides you the annuity benefits with which you can get a regular pension amount monthly or as per the frequency opted by the policyholder. Death Benefits

Death Benefit: The accumulated corpus or the sum assured is paid to the nominee in the case of the death of the life insured.

Surrender Benefit: Pension plans do offer surrender value or benefits in times of exigencies after paying applicable surrender charges if any.

Apart from the above-stated benefits, a pension plan helps you to save on income tax. Let us analyze how tax deductions can be claimed with a Pension Plan.

Tax Benefits under a Pension Plan

A pension plan offers tax benefits for the investments made under section 80CCC and also allows tax exemption on the withdrawal amount at the vesting age under section 10(10A) of the Income Tax Act.

Tax Deduction under Section 80CCC

Investing in a pension plan offers a tax deduction of up to Rs 1.5 lakhs under Section 80CCC of the Income Tax Act,1961. It is important to note that Rs 1.5 Lakhs is an aggregate limit on the deductions under sections 80C, 80CCC, and 80CCD(1). You cannot claim any additional tax deduction under section 80CCC after exhausting the limit of section 80C deductions.

It is important to note that only individual tax payor allowed to avail of tax deductions under section 80 CCC. Hindu Undivided Family (HUF) is not eligible to get a tax deduction under section 80 CCC of the Income Tax Act.

| For example, if you decide to buy a pension plan with an annual premium invested is Rs 1,20,000. As the investments are made, you can avail of deductions up to Rs 1.5 lakh under section 80CCC, so you avail of tax relief for the entire premium payable during a financial year. |

Tax Benefit under Section 10 (10A)

You can withdraw 1/3rd of the entire accumulated corpus under your pension plan at the time of the maturity stage of your pension plan before your pension begins which is known as Commutation. Commuted proceeds received are exempted from the income tax under section 10 (10A) of the Income Tax Act. The remaining 2/3rd of the accumulated pension corpus is paid back to the taxpayer as a regular monthly/yearly pension at the vesting age. The pension received is considered as an income and thus taxable as per the prevailing tax laws.

IRDAI has put a limit for commutation which is up to 1/3rd of the entire pension corpus can be commuted. However, it is not mandatory to withdraw 1/3rd of the amount as commuted pension rather you have the flexibility to receive the pension from the entire pension corpus accumulated under a pension plan.

| For Example, if you have accumulated Rs 75 lakhs as pension corpus under your pension plan, you can withdraw a maximum of 1/3rd of the accumulated corpus as a lump sum payout (Rs 25 lakhs), and the remaining Rs 50 lakhs shall be used to offer you a pension income. Now, Rs 25 lakhs which is received as a lump sum shall be eligible for tax exemption under section 10 (10A) of the Income Tax Act. |

Tax Treatment on Surrendering the Pension Plan

If you surrender the pension plan before maturity, the surrender value will be added to your income for the year and taxed at the marginal income tax rate. The surrender value payable by the insurer will be considered as an income in the year of receipt and it is taxable as per your current income tax bracket rate.

Types of Pension Plans

There are basically two types of pension plans, basis the need and requirement of the individual to receive the pension amount.

1. Deferred Annuity

It is a type of pension scheme that defers pension payouts until the investor chooses to receive them. Under this annuity plan, the investor pays the premiums during the accumulation phase and during the distribution phase, he/she will start receiving regular annuities for the entire life.

2. Immediate Annuity

Under an immediate annuity plan, the investor makes a one-time lump sum investment and he/she immediately starts receiving a regular pension payout for the rest of his life. This type of annuity plan is ideal for those who don’t want to wait till the retirement age to start receiving the regular pension payout.

Ideal Age to Buy a Pension Plan

When it comes to investing in a pension plan, people always ignore investing during their younger age and when they approach the mid-’40s or 50s, they actually start thinking about retirement planning, which is a serious blunder. According to an estimate, over 90% of professionals don’t start planning for their retirement during the first five years they start earning. By the 10th year of their career, less than 20% have started investing in a retirement plan.

Let us analyze with an example to know about an ideal age for investing in a pension plan:

| Suppose, you start investing in a pension plan at an age of 30 years, considering the retirement age is 60 years and your current annual income is Rs 5 lakhs. By investing Rs 4,167 per month for 30 years, you can accumulate a retirement corpus of Rs 44.32 lakhs. In case, you started investing at an age of 45 years. By investing the same amount till the retirement age of 60 years, you will be able to accumulate just Rs 12.01 lakhs. There is a mammoth amount of Rs 32.31 lakh, which you will not be able to accumulate only because you have started investing at a later age. |

It is evident that by starting investing for your retirement at a later age, you have to face a huge financial setback at the time of your retirement. At an age of 45 years, even if you start investing a higher amount, you will not be able to accumulate the desired corpus amount, as the investment is quite less and it is not possible to attain desired returns in short-term investment. The earlier you start investing, the better it would be for your old age. Investment experts also have the opinion that retirement planning should start from the day you start earning.

Conclusion

Retirement planning is one of the key aspects of your financial planning. You will take retirement from your professional life one day and thereafter, the accumulated retirement corpus will only help you to take care of your financial expenses in the post-retirement phase. It is thus required to have systematic retirement planning and start investing in a pension plan as early as possible that will make your golden years more enjoyable. Apart from receiving a regular pension payout, buying a pension plan also provides you tax benefits for investments made under section 80CCC and tax exemption for the lump sum commuted amount up to 1/3rd of retirement corpus at the vesting age under section 10(10A) of the Income Tax Act, 1961.