Your Guide to Income Tax Return Filing

With an income tax return, you can declare your income, investments made and deductions applicable during a financial year, and if you think that you paid the excess tax then your income. In such a situation, ITR filing is a way to get money back, but first, you have to know “How to file ITR Online”?

This is our custom, every year the central government releases the General budget in February month for the common people of the country, Finance minister elaborates the budget in parliament for the whole year with some inclusions and some exclusions. But, during the budget, most of the eyes of the public are on the tax slab because tax is a matter of concern to all of us, and to be honest in the last few years tax slab is almost the same.

Table Content

- Demonetization

- ITR filing is important

- Types Of Income Tax Return forms

- How to file ITR-1 (Sahaj)?

- How to file ITR-2?

- How to file ITR-3?

- How to file ITR-4?

- How to file ITR-5?

- How to file ITR-6?

- How to file ITR-7?

- Documents required for filing ITR

- For income from salary

- For income from House Property

- For Capital Gains

- For Reporting other income

- For Investment Documents

- How to file ITR?

- Steps to “How to file ITR Online”

- Step-1: Enter log in details

- Step-2: Enter salary/income details

- Step-3: Enter Deduction Details

- Step-4: Details of Taxes Paid

- Step-5: File your Return

- Step-6: Verify the return

- What happens if you don’t file your ITR

- Final word

- Related posts:

Demonetization

Filing Income Tax Return (ITR) on time is a must for all individuals and it is also considered legitimate proof of your income. Look, we all know that tax is one of the ways by which government fills their account and tax works for multiple purposes like the development of the country, salary to their employee, and handling situations like Covid-19. Filing ITR is mandatory if your total income exceeds Rs 2.5 lakh and even if, your income is equal to or less than Rs 2.5 lakh, it’s a good habit to file your income tax return.

Let’s go back in time, in the year 2016 Indian government did demonetization and it was a surprising night for all of us. But, no one could see what the government had seen, if the government believed, three reasons were given for demonetization.

- Terrorism funding will be affected

- Increase in the number of taxpayers &

- Black money will come out

As we told you that the government saw what the common man could not see, with demonetization, the government increased the number of taxpayers in a unique way, which was the first requirement of both the government and the country.

The last date to file an income tax return (ITR) for assessment year (AY) 2020-21 has been extended till 30 November. If you have not filed the ITR, it is prudent to do it at the earliest to avoid the last-minute rush. It is crucial to link your Aadhaar Card with your PAN for e-filing your Income Tax Returns before you begin to file your ITR.

This can be done in some minutes through the income tax department’s website via the link https://incometaxindiaefiling.gov.in/e-Filing/Services/LinkAadhaarHome.html .

Also, this time you need to furnish details of cash deposited above Rs 2 Lakh during the government’s demonetization drive from November 9th, 2016 to December 30th, 2016, last year.

Now through this blog, let us decode some facts and knowledge regarding Income Tax Return filing. This blog discusses aspects of ITR forms, their types, applicability, different ways to file ITR & procedures to file the return online, which ensures you ease in filing your income tax return.

ITR filing is important

- Filing returns are considered genuine proof of your income.

- It is required for immediate registration of immovable properties.

- Filing returns are also important for VISA processing.

Types Of Income Tax Return forms

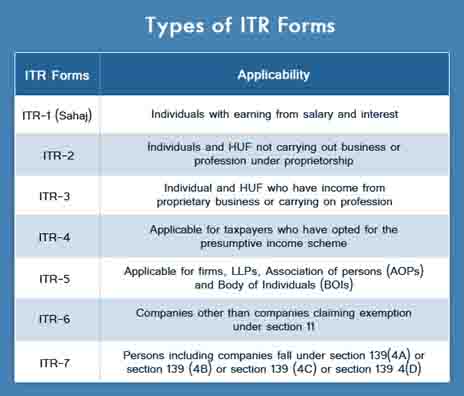

As per the Central Board of Direct Taxes (CBDT), there are 7 kinds of forms that are available to file for Income Tax Returns. But only ITR-1, ITR-2, and ITR-3 are significant to an Individual or HUF (proprietary) for filing Income Tax Returns. Let us know about these 7 different types of forms for filing Income Tax Returns:

How to file ITR-1 (Sahaj)?

It is applicable to individuals and can be used by the individuals having following sources of income:

- Income coming from salary

- Income by way of pension or other investments such as Fixed Deposits, shares, etc.

- Income from one house property, agriculture (less than Rs 5,000)

- Earn income/own assets only in India

- Does not own assets in any other country except for India

- Earn no income from lotteries, horse racing, or unforeseen inheritance

In case of clubbing of Income Tax Returns of the entire family, including a spouse or a minor child, all incomes must have been earned, as per the above-mentioned means.

Income earned by the above-specified means up to Rs 50 lakh is only catered in the ITR-1.

How to file ITR-2?

This form is applicable to individuals and HUF not carrying out business or profession under the proprietorship.

People with the following sources of income-earning income above 50 lakhs are eligible to file the ITR-2 form. The form is applicable to the following sources of income.

- Earn income by salary/pension exceeding Rs 50 lakh

- Income from more than one house property

- Earning from the sale of assets/property within India or those who earn income or have assets in any country other than India

- Income from Partnership Firm in the form of Salary, Bonus, Commission, etc.

- Highlight the loss from House Property/or under the head – Income from other sources

- Earning from agriculture exceeding Rs 5000,

- Income from wild fall gains such as lotteries, horse racing, etc.

- Want to claim relief under Section 90 – 91

How to file ITR-3?

This form is applicable to individuals and HUF who have been earning from a proprietary business or carrying on a profession. Persons with the following sources of income are eligible to file the ITR-3 form.

- Carrying on a business or profession

- Earning from House property, Salary/Pension, and Income from other sources

It includes all means of income, as specified under ITR-1 and ITR-2 forms.

How to file ITR-4?

ITR-4 form is applicable for taxpayers who have opted for a presumptive income scheme under section 44AD, Sec 44ADA, and Section 44AE of the Income Tax Act. In case, the turnover of the business exceeds Rs 2 crores, the taxpayer then needs to file ITR-3.

How to file ITR-5?

ITR-5 form is applicable for a person being a firm, LLPs, AOP, BOI, an artificial juridical person under section 2 (31)(vii), cooperative society, and local authority. A person who needs to file ITR under section 139(4A) or 139(4B) or 139(4C) or 139(4D) shall not use this form.

How to file ITR-6?

Companies other than those claiming exemption under section 11 are required to file a return in the ITR-6 form. Companies claiming exemption under section 11 include those whose income from the property is held for charitable or religious purposes.

How to file ITR-7?

Persons, including companies, who fall under section 139(4A) or section 139 (4B) or section 139 (4C) or section 139 4(D) are required to file a return with the ITR-7 form.

Documents required for filing ITR

Following is the list of documents that you need to keep ready before filing the tax returns.

For income from salary

- PAN Card

- Aadhaar Card

- House rent receipts to claim HRA

- Form 16

For income from House Property

- Address of the property

- Details of the co-owners along with their PAN details

- Home loan details and loan certificate

- Name of the tenant and the rental income, in case the property is rented

- Date when the construction was completed, if an under-construction property was purchased

For Capital Gains

- A stock trading statement, in case of trading of shares

- Sale price, purchase price, details of registration, and capital gain details, if a house or property is sold

- Sale and purchase of equity funds, debt funds, mutual fund statements, ELSS, and SIPs

For Reporting other income

- Provide bank account statements, in case the interest accumulated in a savings account

- Interest income statement for fixed deposits.

- TDS certificates are issued by banks and others.

- Details of interest income from tax saving bonds and corporate bonds

- Details of income earned from post office deposit

For Investment Documents

Documents related to investments made under PPF, NSC, LIC, ULIPS, etc. qualify for deductions under Section 80C and investments done under section 80D like a health insurance policy, etc.

How to file ITR?

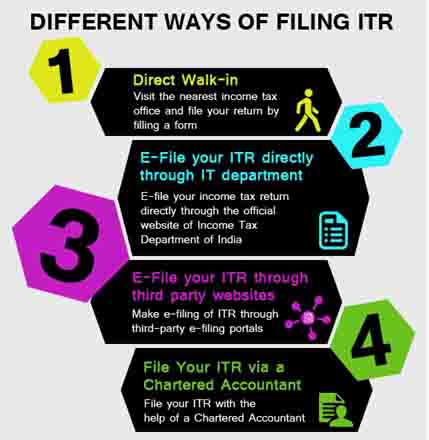

There are four ways that can help you file an income tax return.

- Direct Walk-in: In case, your income is less than Rs 5 lakh for FY’2016-17, you can directly visit the nearest income tax office and file your return. You can click on the link http://www.incometaxindia.gov.in/pages/income-tax-offices-in-india.aspx to know the nearest office to your location. However, by filing ITR with a direct walk-in, you cannot claim a refund.

- Online: You are allowed to e-file your income tax return on the official website of the Income Tax Department of India. You just need to register by providing details such as a PAN Card and date of birth. It is also mandatory to link your PAN Card with your Aadhaar Card before filing ITR. You need to choose an ITR form as applicable to you, fill up details such as salary/income details, investments made, etc., and then submit it. After e-filing ITR on the official website of the Income Tax Department, you need to e-verify it or there is another option to generate an ITR – V form and manually sign it and send it back via courier to the income tax department’s address.

- E-File your ITR through third-party websites: There are various e-filing websites with whom you can e-file ITR at the comfort of your home or office, charging a nominal price. These third-party websites also provide Chat/Phone Support to assist you in filing income tax returns.

- File your ITR through a chartered Accountant: Another way to file ITR is with the help of your chartered accountant. A chartered accountant will charge you a nominal fee, but he will ensure that your ITR is filed in the best way possible.

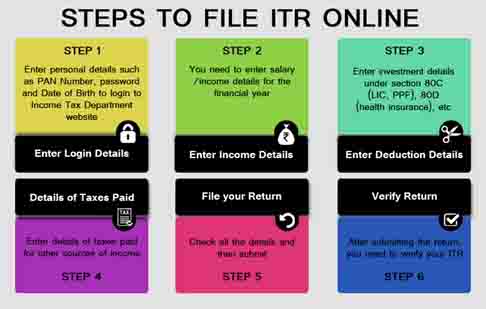

Steps to “How to file ITR Online”

Following are the steps for e-filing ITR via the official website of the Income Tax Department.

Step-1: Enter log in details

The first step towards filling your ITR is to log in to http://incometaxindiaefiling.gov.in/ and furnish details such as PAN number, password, date of birth, and captcha code. If not done yet, you also need to link your Aadhaar number with your PAN Card, before filing your return.

If you are a first-time user, you need to click on the ‘Register Yourself’ tab to register yourself by providing details such as PAN Number and other details as required. While creating your user ID, you need to have an active and correct mobile number & e-mail id. You will receive a one-time password on the mobile and an activation link on your e-mail ID.

In case of any assistance, you can get the helpline number to contact the customer care executive by just clicking on the ‘Customer care tab’.

Step-2: Enter salary/income details

After login, your account dashboard will be displayed wherein you need to click on the ‘file tab and then choose the ‘Prepare and submit online ITR’ option. In the next window, you will need to choose the relevant assessment year and applicable ITR form and choose an option to digitally sign as ‘Yes’ or ‘No’. If you choose ‘Yes, you need to upload your signature which requires you to be pre-registered at the income tax website.

Clicking on the ‘Submit’ button will bring you to a page for filing the ITR. Prior to you start filing the ITR form, it is advisable to go through the ‘General Instructions’ given. It helps you to know the do’s & don’ts while filling the form. Now, it’s time to provide your salary or income details. You also need to pick the source/s of income and enter the earnings from the respective source for the financial year 2016-17.

Step-3: Enter Deduction Details

In this step, you need to specify the investments made during the financial year.

- Under section 80C, you can claim deductions for investments made for LIC, PPF, tuition fees for children, etc.

- Repayment of the principal amount of a home loan can avail tax deduction under section 80C and income tax benefit on interest on a home loan is available under section 24 of the Income Tax Act.

- Under section 80D, you can claim a tax deduction for the premium amount payable under a health insurance plan.

Don’t forget to mention all the investment details, so you can get the maximum deduction on the taxable income.

Step-4: Details of Taxes Paid

If you are a salaried individual, your employer will pay tax on your behalf to the income tax department and will issue form 16 to you. For income from a source other than salaries, such as interest income or freelance income, you need to add details for the tax payments already made. You can also add the details of taxes paid by uploading Form 26AS.

Step-5: File your Return

After providing all your income & deduction details, the income tax department will compute the tax you need to pay. If you have paid more tax, then you need to provide bank details for receiving the fund back directly into your bank account. In case you have taxes due, you need to visit the tax information network of the Income Tax Department and select Challan 280 for e-payment of taxes.

Before submitting the details, you need to save the data entered and check the data twice to avoid any mistakes. By clicking on the ‘Preview and Submit’ button, you can take a preview of your ITR form before submitting it.

Click on ‘Submit’ to file your ITR return.

Step-6: Verify the return

After submitting the ITR form, your income tax return will be uploaded and then you will be asked to verify the return by using one of the following options.

- If you have your digital signature with the income tax department, you will be required to upload it while submitting the ITR. Once you upload your digital signature and submit the ITR, the process of ITR filing is completed.

- You can e-verify your return with the help of an electronic verification code which is sent to the registered mobile number. You also have the option to verify the returns online via Aadhaar OTP which is sent to a mobile number registered with Aadhaar.

- The last option to verify a return is to send a one-page verification document ITR-V to the address given within 120 days from the date of e-filing.

After successful uploading of ITR, an acknowledgment is sent to your registered email ID. This acknowledgment will also be displayed in your account from where you can download it whenever required.

The Income Tax department will process your ITR after you complete its verification. After the ITR is processed, you will receive the mail on your registered e-mail ID and SMS on your registered mobile number, regarding the successful processing of your income tax return.

What happens if you don’t file your ITR

August 5, 2017, is the last date for filing your ITR for the financial year 2016-17 or assessment year 2017-18. It is recommended to file your income tax within this deadline. If you are not able to file ITR by August 5, you may have to face penalties and/or financial losses as specified below:

- You can’t claim refunds payable to you by the Income Tax Department on the tax already paid by you.

- If you have paid the taxes but did not file the returns, you will not be able to carry forward your losses except losses from house property.

- You will have to pay 1% interest per month as a penalty. This penalty starts from the last date of filing ITR till the date when you file it. You may also have to face a legal suit if you file ITR after the respective assessment year for an amount exceeding Rs 3000.

- If you file your ITR by the end of the assessment year 2017-18, the income tax department will impose a penalty of Rs 5,000 unless the delay is due to unavoidable circumstances.

Final word

Filing income tax returns is a must for all individuals, irrespective of the taxable income. It also serves as legitimate proof of your income. The income tax department of India also imposes penalties, if you don’t file ITR within the specified deadline. It is always advisable to file your income tax return within the due time frame.

Good Information.

I actually added your blog to my favourite and will look forward for more updates. Great Job, Keep it up. First of all let me tell you, you have got a great blog .I am interested in looking for more of such topics and would like to have further information. Hope to see the next blog soon.

Filneg is onestop that provides financial services like Tax Filling, Business registration & Compliances etc.