Growing Travel Insurance Market in India

As individuals are becoming more mobile, travel has become a part of academic, business, and personal life, exposing people to travel-related contingencies. To mitigate the risks associated, it’s always a better option to buy a travel insurance plan. Purchasing a travel insurance policy provides cover against medical and non-medical travel-related contingencies such as emergency medical conditions, loss of tickets & passports, trip cancellation, curtailment & interruption, loss/delay of baggage, etc. that’s the reason for the growth in the Travel Insurance Market in India.

A travel insurance policy ensures complete peace of mind, and you can have fun and excitement throughout the trip. It covers the financial loss that may incur while traveling domestically or internationally.

We all like to travel and in the year 2021, a lot of people make a lot of records by traveling around the globe. Last year was tough for people and tough for business too, if we talking about tour and travel service then last year was quite hard for them but now people are ready to trek mountains and ready to make some best memories. Traveling is the best thing ever people do but protecting yourself is also a big deal for people, trekking mountains and skiing is good but it’s way risky and this is where we all need protection.

Considering the benefits offered under a travel insurance policy, people are looking forward to getting their trip insured, before leaving for vacation.

Table Content

- About India

- Analysis of the Travel Insurance Market in India

- Perspective towards Travel Insurance

- Comparative Analysis of Travel Insurance Market

- Overseas Travel Insurance

- Domestic Travel Insurance

- Expansion of Inclusions under Travel Insurance

- Prospects of Travel Insurance in India

- Final Word

- Related posts:

About India

India has many sites to trek and travel to, the four sides have a different places and almost every side has a hill station. The future of travel insurance services in India is quite bright and every year the number of visitors and the number of travelers is increasing rapidly. Last few years’ Indian people and Indian society also tend towards traveling and they accept the fact that you need sometimes change to start afresh. Well, the way travelers are increasing, it’s gives a wide view about the bright future of travel insurance in India but people should start noticing the travel insurance.

Analysis of the Travel Insurance Market in India

Travel insurance aims at providing hassle-free travel to tourists, and these policies provide assurance that the risks are reduced to the minimum.

Growth in tourism is the key factor that propels the travel insurance market. As per UNWTO records, arrivals of international tourists witnessed a growth rate of 3.9% to reach a total of 1,235 million in the year 2016. Around 46 million more tourists (overnight visitors) traveled internationally in 2016 compared to the year 2015. As per UNWTO’s Panel of Experts and economic prospects, international visitors worldwide are expected to grow at a rate of 4% in 2017.

According to research by Finaccord, the global market for travel insurance and assistance was stood at around the US $ 13.8 billion in 2013, and this figure is expected to touch the US $18.1 billion by 2017.

When it comes to the Indian perspective, the size of the travel insurance market in India is more than US $70 Million in 2016. This market in India is even an emerging state, and it constitutes less than 1% of the total travel insurance industry worldwide. The travel insurance market in India is expected to rise with a healthy growth rate of 10-15% annually.

Perspective towards Travel Insurance

Travel insurance is a way to protect ourselves during travel and travel insurance can make things easy for us and having protection like travel insurance is best. Travel insurance makes your journey easy and smooth and gives you a stress-free ride and an enjoyable journey. Look if something has to happen, it will happen and if there is a need for anything then it protects yourself.

According to research by Thomas Cook India, most travelers seek overseas travel insurance in India when traveling to a foreign land, which implies that there is an enormous potential for travel insurance in India. Not just international travelers, but there has been an exceptional rise in the domestic travel industry as well. As per recent estimates, 30 million Indians indulge in domestic travel every year, and they also seek domestic travel insurance in India.

Earlier, less than 20% of international travelers from India bought travel insurance, but recently, there has been a significant transformation in people’s attitude toward buying travel insurance. In the year 2015, the travel insurance market in India has witnessed double-digit growth in both international and domestic travel insurance.

Comparative Analysis of Travel Insurance Market

In this blog, we are discussing the scenario of travel insurance policies being offered by various insurance companies.

Overseas Travel Insurance

During the year 2015-16, overall 22.39 lakh policies have been issued covering 39.29 lakh persons, however, in the year 2014-15, 22.62 lakh overseas travel insurance policies have been issued from the non-life insurance sector in India.

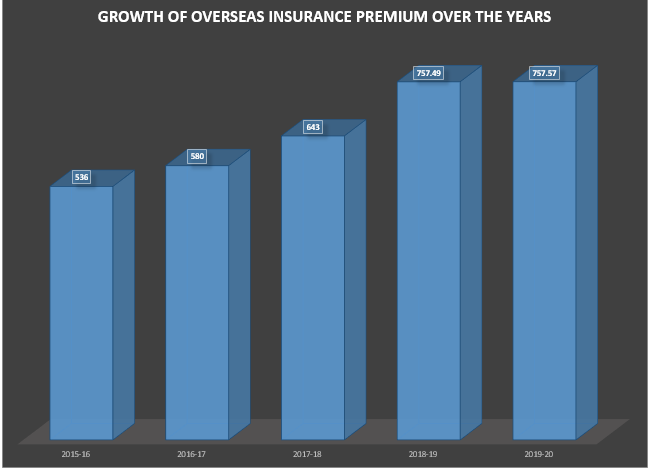

For FY 2015-16, the Gross Premium income from Overseas Travel Insurance business was Rs 536 crores, however, during the year FY 2019-20, it stood at Rs 757.57 crores registered a growth rate of 15.26% compared to the previous year. During the year 2011-12, Gross Premium income was stood at Rs 342 crores, so in the time span of 4 years during FY 2015-16, the premium income registered a growth rate of 56.72% and if we calculate the growth rate till FY 2019-2020 then it’s far away then 2011 and better.

In FY 2015-16, Private general insurers hold 87% of the market share in gross premium. Public sector general insurers and stand-alone health insurers hold 6% and 7% of the market share respectively in total gross premium. The Incurred Claims Ratio for Overseas Travel Insurance was 54.1% for the FY 2015-16.

Domestic Travel Insurance

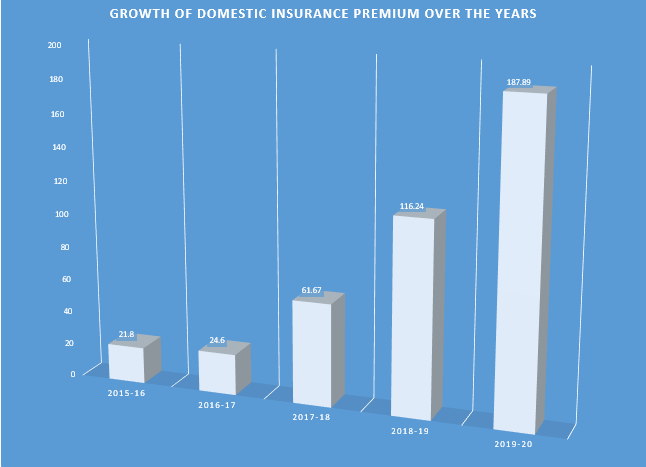

Under Domestic Travel Insurance Business, the total gross premium received was Rs 187.89 crores for FY 2019-20, registered a growth of 62% when compared to FY 2018-19. Domestic Travel Insurance policies have been issued by private general insurers and public sector insurers. ICICI Lombard holds the majority market share of 64% and Tata AIG holds 32% of the market share.

During the year 2015-16, the non-life insurance industry has issued 21.08 lakh policies providing cover for 22.57 lakh individuals. The Incurred Claims Ratio for Domestic Travel Insurance was 2.14% for the FY 2015-16.

(Note: Facts & Figures mentioned above are, as per IRDAI annual report for FY 2015-16 & 2019-20)

Expansion of Inclusions under Travel Insurance

Considering the local problems and mishaps that may occur during the travel, Insurance Companies have started offering 24×7 worldwide medical assistance, emergency evacuation, protection against natural calamities and terrorist activities, emergency evacuation, and travel inconvenience benefits that are designed to keep a guard to their customers from unforeseen emergencies.

Not only this, but one can also take advantage of covers such as political risk and catastrophe evacuation, emergency hotel extension, loss of baggage & personal effects, compassionate visit, the return of minor children, and other value-added services. Some of the recent additions to the company’s products include medical concierge services, automotive assistance, and lifestyle services for dependents at home.

Prospects of Travel Insurance in India

As far as the current scenario is concerned, the penetration of travel insurance in the country is 3.9% which is quite small, but considering the growing segment of travelers, there is a tremendous opportunity knocking on the doors of insurance companies and travel agencies to tap the growth. With the increasing level of awareness regarding the significance of travel insurance amongst people, India has excellent prospects to become one of the major travel insurance markets worldwide in the next decade.

As per estimates from UNWTO, at present, 20 million Indians travel abroad every year, and within three years by 2020, this figure will multiply more than double to 50 million travelers. This upward surge of outbound tourists ensures makes the travel insurance industry buoyant.

With the growing tourism industry in the country, there is a tough task ahead for the travel insurance industry to ensure the safety of its travelers in any way possible. The success of this industry, primarily depends on the awareness levels of customers for travel insurance, so a combined effort from all companies can accomplish the task of increasing the travel insurance penetration among travelers.

Now, with online buying of insurance policies, getting protection against travel-related contingencies is just a click away. Online platforms have made things feasible concerning the way people understand travel insurance and its significance.

Final Word

The travel industry in India has become one of the key drivers of economic growth. The travel insurance market in India is gaining momentum each year as insurance companies are now offering customized travel insurance plans, considering the convenience of travelers. A travel insurance plan provides cover against unforeseen travel contingencies such as any adverse medical condition, loss/delay of baggage, loss of tickets & passport, etc.

When looking to buy domestic or overseas travel insurance, it is advisable to look for an insurance company that can provide you with a travel insurance policy that accommodates all your travel insurance needs.