Future Generali Life Insurance Claim Settlement Ratio

As per IRDAI annual report, the latest claim settlement ratio of Future Generali India Life Insurance Company is 95.28% for the Financial Year 2019-20. The latest IRDA report gives a perfect view to look at the performance of insurance companies last year and with the help of IRDA report, you can choose the best insurance company for insuring.

Future Generali India Life Insurance Company is still in the same place in comparison to FY 2018-19, this tells us that Future Generali may not have done so much last year, but it’s also a big deal to be in the same position in between 24 different insurance companies.

| Life Insurer | Claims Rejection (FY 2019-20) | Claims Intimated (FY 2018-19) | Total Claims (Claims Pending + Claims Intimated) | CSR% (FY 2018-19) | CSR% (FY 2019-20) |

|---|---|---|---|---|---|

| Future Generali Life | 4.46% | 1143 | NA | 95.16% | 95.28% |

- The claim settlement ratio of 95.28% is the indicator of the number of death claims settled by Future Generali Life Insurance against the total claims 1143 reported for FY 2019-20.

- Rs 49.83 crores has been paid as the claim amount against 1143 claims reported in FY 2019-20 by Future Generali Life Insurance Company.

- The claims have been rejected, resulting in a Claim Repudiation of 4.46% for the FY 2019-20.

Table Content

Past 5 years CSR Trends for Future Generali Life Insurance Co.

Consistency to maintain a higher claim settlement ratio is considered to be good. Past claims settlement ratio trends will reveal the consistency and inclination of the Future Generali Life Insurance Co. towards the settlement of death claims.

If we look at the performance of last five years, it shows the ups and downs in performance but the struggle is still on to be best and last 3 years performance make Future Generali India Life Insurance most trustable and valuable insurance company.

Let’s go through the past 5 years’ CSR trend of Future Generali Life Insurance Company.

| Financial Year | Claim Settlement Ratio (%) |

|---|---|

| 2015-16 | 90.26% |

| 2016-17 | 89.53% |

| 2017-18 | 93.11% |

| 2018-19 | 95.16% |

| 2019-20 | 95.28% |

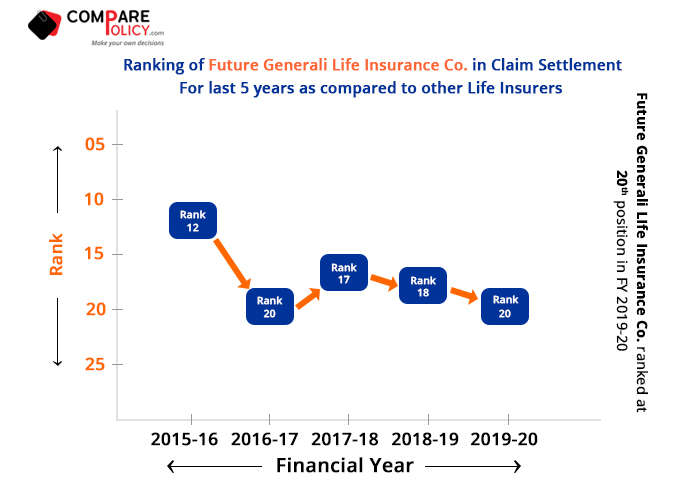

Future Generali Life Rank in Claim Settlement among other Life Insurers

The Claim Settlement Ratio (CSR) rank signifies the position where Future Generali Life Insurance Company lies, with respect to other life insurers in the industry from the financial year 2015-16 to 2019-20. The claim settlement percentage attained by Future Generali Life Insurance Co. is the basis of the rank identified in the respective financial years.

Last year was tough for everyone, Covid-19 almost ruined everything. And at that time people don’t how to survive, as far as can be seen people seem just hopeless. Covid-19 ruined only life it has a special effect on financially, but still, insurance companies trying to settle every claim and they are committed to their purpose.

How Claim Settlement Ratio (CSR) is measured?

The Claim Settlement Ratio is expressed as the number of claims settled divided by the total number of claims reported in a given financial year, including the claims outstanding at the beginning of the financial year. The claim settlement ratio is expressed in percentage which is helpful for comparing the claim settlement data by the customer across insurers. The claim settlement ratio is calculated for every financial year.

| Claim Settlement Ratio = Total claims settled / Total claims received where, Total Claims received = (Claims reported in the financial year + claims pending at the start of the year) |