The Festival of Vijaya Dashami can teach You Important Financial Planning Lessons

Table Content

Festivals in India

Festivals are one of those moments that give us a time of fun, a day of spending time with loved ones, and a day of celebration of ethics and win over negativity. Festivals have a special place in our ethics, in Indian history, and in this society. We all waited for festivals for a long time and the longer we wait, the more fun we have and in India list of festivals is quite long but every festival belongs to a proper community. Vijaya Dashami festival is almost arrived in between us.

It is one of the important festivals in the Hindu calendar, also known as Vijaya Dashami in north India specifically. It signifies the triumph of good over evil. It is also celebrated as the day when the Goddess Durga defeated Mahisasura. This festival is celebrated with extreme fervor across the country with different traditional customs and rituals being followed by different states. Vijaya Dashami has an extreme effect on the people of West Bengal and its state festival.

Keep eye on your expenditure

Well, Ashvin month arrived and we are close to Dussehra festival and festival comes with happiness and as well as a fine on the pocket, but this Dussehra you need to learn some financial lesson to make your Dussehra more excited and budgeted. We cannot deny that money is spent on festivals and it will but we have to decide by which way we have to pay for making things in favor of us. Look every festival has cashback offers with certain debit cards or credit cards, apart from this fin-tech companies are also providing you cashback and coupons as per your payment.

This occasion also teaches some important financial lessons which could help us in achieving a stable and planned Financial Planning. Robust financial planning ensures a brighter future for your family. Proper financial planning facilitates you to accomplish your financial goals and further helps you & your family to achieve their aspirations.

Importance of Financial Planning

Financial Planning is an ongoing process, which helps you to make prudent financial decisions, so you can achieve your goals in life. It also involves taking some key decisions to ensure the protection of your family, even in the worst of times, when you fall ill or die prematurely.

When it comes to putting financial planning in place, you need to set your life’s goals, assess the assets and liabilities you have, evaluate your current financial position, develop and implement a plan for achieving the goals. Proper financial planning helps you to gain control of your finances and enjoy peace of mind.

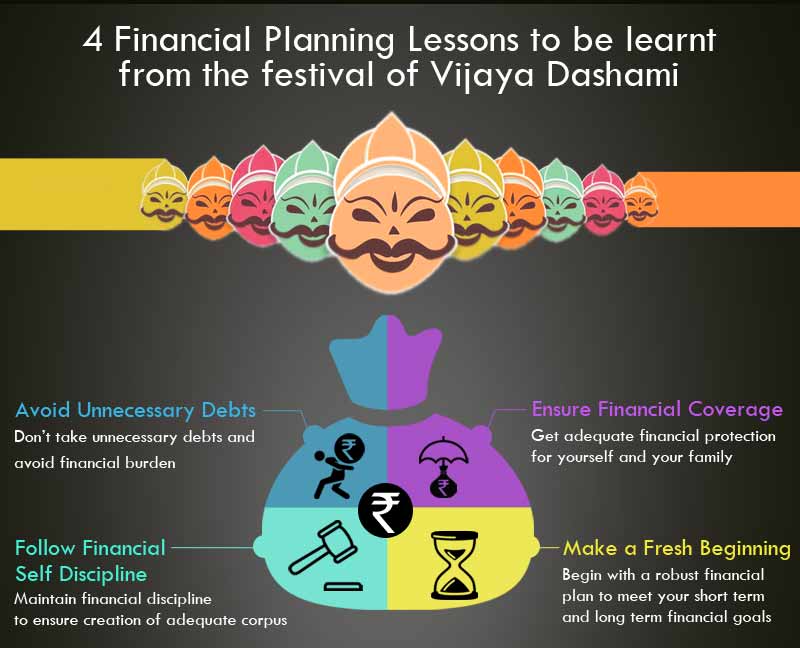

Let us imbibe these 4 Financial Planning lessons, this Dushehra for a secured Future

1. Stay Away From Unnecessary Debt

Dushehra is celebrated by burning the effigy of Ravana which signifies the victory of good over evil. It directs you to stay away from evils and when it comes to finances, you must stay away from taking unnecessary debt or loans which may act as devils if not managed properly.

Most people don’t think about the expenses while shopping, however, it is advisable to make a budget for your festival. It will help you to easily manage your expenses during festival days and you can also get rid of making any futile financial expenses.

Making expenses beyond your budget, massive shopping bills payment through your credit card, or taking a personal loan is quite usual during festivals, but it may make a drastic impact on your financial health. Repayment of credit card bills attracts a high rate of interest which not only makes it a high-cost debt, but can also have an ill impact on the credit score. Taking an unnecessary personal loan also makes an adverse impact on your finances. If you have taken debt, then you should try hard to re-pay as soon as possible. You also need to review your investment portfolio and in case, you have made some wrong investment decisions, you should stop investing in it to avoid further losses.

2. Ensure Financial Protection

When immorality or evil prevails on Earth, a savior will protect humanity! This faith is renewed at Dushehra. You should take learning from this message and make a way to protect your finances.

People sometimes choose to invest money in investment instruments that assure them to offer high returns, but they actually ignore to ensure financial protection as such, which is a key aspect of financial planning. Having comprehensive financial protection is quite helpful for your family, in the event of a mishap.

It is advisable to first assess the insurance needs of your family including life, health, motor, and home insurance.

- Life insurance pays a lump sum amount to the family or beneficiary, in the event of your unfortunate demise. A life insurance policy backs your family on the financial front when you are not around.

- Having a health policy provides you financial protection against hospitalization expenses, in the event of hospitalization of any one or all of the insured members.

- An insurance policy that covers your assets such as a home or motor insurance policy provides financial cover for your asset against perils.

A 3600 financial protection helps you to attain financial planning in all respects and you need not worry about the financial future of your family or loved ones. When you have got enough financial coverage for your family, you may go for investing the surplus savings for realizing the returns.

3. Follow Financial Self-Discipline during Vijaya Dashami

Lord Rama is also celebrated as ‘Maryada Purushottam’, as he stuck to the propriety of conduct throughout his entire life. He sets a good example of morality and always worked to be upright and responsible in life. The same needs to be applicable to your finances and one needs to be responsible and financially self-disciplined.

Financial self-discipline helps you to achieve financial goals. It provides you a way to create wealth for your future that will help you to meet financial obligations for you & your family. It enables you to grow your savings that will help meet financial expenses such as children’s education & their marriage, health care expenses, retirement planning, etc.

In order to meet your financial goals, it is imperative to invest your money with investment vehicles that can provide you the healthy returns that can facilitate your efforts to multiply the savings. As investment returns also bring associated risks, so prior to investing money, you also need to assess your risk-return profile.

You have the option to invest with Unit Linked Insurance Plans (ULIPs) which offer higher returns. These plans provide market-linked returns and investment risk is to be borne by the policyholder. Investing in an endowment plan also helps you to accumulate savings along with life cover. You may also go for investment in Fixed Deposit and Recurring Deposit schemes, as it ensures risk-free guaranteed returns.

4. Make a New Fresh Beginning, with Vijaya Dashami

Dussehra signifies to get away from what happened in the past and make a new start with a fresh perspective. Dushehra festival is considered one of the most celebrated occasions in the country and on this occasion, you may make a new start towards achieving your financial goals.

If a proper financial plan is not put in place, it’s the right time to begin with it that can enable you to meet both the short-term and long-term financial goals. You need to begin with, financial planning as soon as you start earning that will help you to get the incremental value of your savings.

Concluding Words

The joyous occasion of auspicious Dussehra signifies the triumph of truth over evil and it’s time to give your finances a fresh outlook. You may now go ahead towards implementing lessons that include, achieving financial protection, attaining financial self-discipline, and staying away from unnecessary debt. These financial planning lessons will not only help you to avoid bad expenditure, but it also gives a helping hand towards achieving your life’s financial goals.

Happy Dussehra! Hope this festival brings joy, success, and happiness to all of you.