Death is a Harsh Reality! Have you Secured your Loved Ones?

A Few Years Back

Myself Aryan! I had fond memories of childhood with my best friend Rahul and always cherished some good times spent at school and college days with him. As the saying goes “Opposites Attract”, we both are just opposites to one another in many ways but still are best of friends. Rahul is a carefree person who likes delaying things, not meeting deadlines, and postponing important decisions. I can still remember (laughing out loud) Rahul used to delay his homework as well in the school for which you can always find him standing out of the class most of the time. But thankfully, in college Rahul had the privilege to sit in the canteen at least, even if he has not submitted his assignments in timely.

Table Content

A Few Months Back

Life was and is good for both of us. Our lives were heading at the same pace we graduated together, started our career together, married in the same year. I am working as a Project Manager with an IT Company and Rahul, the PROCRASTINATOR (as I call him) is working as a Manager with FMCG Company doing well in his job. Both of us were happily married and still take life as cheerful as we used to take it in our old school days.

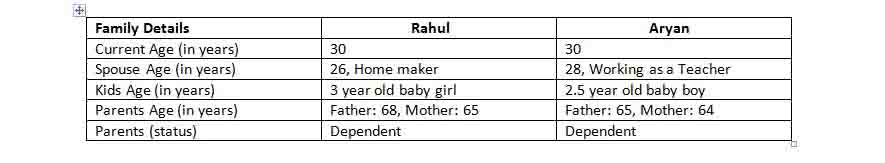

Table A:- Family Specifications

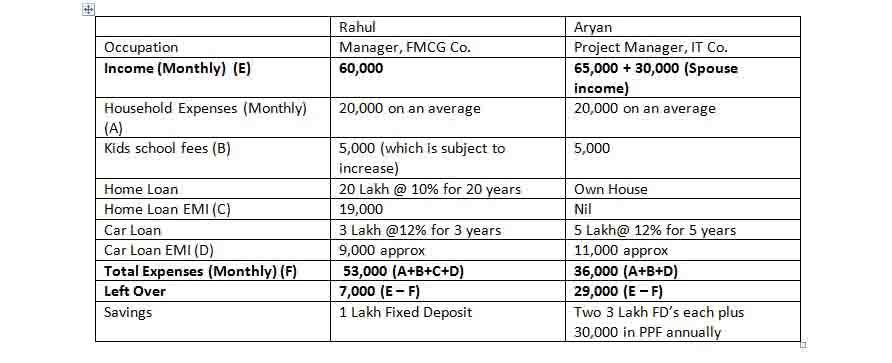

Current Financial Standing

Rahul and I still hold that friendship bond and discuss our financial landscape with one another often and exchange financial advice, worries, and gains as well.

TABLE B:- Financial Landscape

One Day

We had a school reunion and one of our friends Sidharth, who is now working as a financial consultant was also part of the reunion meeting. The first round of conversation began with old school days to discussing mischiefs done on school trips, in-class, and the conversation revolved over remembering and making fun of Mr. Jose (our English teacher). The second round of conversation was more serious and revolved around the latest news, political judgments, insurance, and financial planning. The third round of conversation was more insurance-specific and Sidharth talked about the multiple life insurance plans taken by him to ensure the financial security of his family and we both were gazing at him as if he was speaking french.

Sidharth was amazed to know that both of us (Rahul and me) did not have any Life Insurance Policy. Rahul jokingly told Sidharth that we are just 30 years of age and we are not going to die soon. So we don’t need life insurance at this stage buddy. Moreover, we will take it when we will grow older just like Mr.Jose (their English teacher), and started giggling.

Sidharth got serious and discouraged Rahul’s opinion and as our well-wisher and friend suggested to both of us the NEED and BENEFITS of LIFE INSURANCE.

Need of Life Insurance

- To secure your loves ones financially in your absence

- To make arrangements for your family to lead the same lifestyle in your absence

- To ensure that the education of your kid is not hampered in your absence

- To ensure that you leave adequate funds to take care of your kid’s marriage expenses in your absence

- To ensure your Debts/loans are taken care of in your absence

- To ensure your mental peace of mind that your family is protected financially in your absence

- To ensure that in the event of disability or illness, your family is compensated financially through additional coverage in your policy

- To ensure you have an adequate corpus to survive your post-retirement life

Benefits of Life Insurance

- Your family is financially compensated in the event of your death by a lumpsum amount taken as life cover

- Your family can get lumpsum and guaranteed monthly income to take care of the household and other regular expenses

- You get tax benefits as per the prevailing income tax laws under sections 80C and 10(10D)

- You can avail Loan out of your Life insurance policy

- Life insurance policy can serve as collateral in case of loans

- You may take add on coverage known as Riders which offer Accidental death benefit, waiver of premium benefit, Disability benefit, critical illness coverage benefit, etc. at a nominal cost to enhance protection

- If you outlive the tenure of the policy, you are entitled to the maturity benefits (except for Term Plan without return of premium) which is your basic life cover plus an additional guaranteed amount from your insurer.

- Last but not least if you buy at an early age, you have to pay lower premiums for the entire tenure.

Rahul without delaying his sense of humor stopped Sidharth and asked him to take a chill pill saying don’t worry buddy, I have a long age, nothing will happen to me. But I understood the IMPORTANCE OF LIFE INSURANCE and thanked Sidharth for the eye-opener session. Sidharth emphasized again to take a pure protection plan which is a Term Insurance Plan for our family that comes at a lower premium and offers huge life cover due to zero element of saving in it and is very cost-effective. Moreover, he suggested we compare insurance plans online and buy the best one as per our financial needs.

Reality Check

I made Rahul understand the financial implications (with reference to TABLE B *) to our families in case something happens to us. I suggested to Rahul that your family’s monthly expenses are 53,000 INR and monthly income is 60,000 INR. If god forbid! Something happens to you or me than the monthly income which is 60,000 in your case Rahul and 65,000 in my case will stop from that very moment. Being in private jobs, we don’t have the provision of getting a pension as well.

How will our family be able to bear the enormous monthly expenses? On top of it, we both have loans, especially Rahul, you have a Home Loan and Car loan. Also, the rate of inflation will increase the expenses to higher limits in the future. Thinking about such a scenario only gives me goosebumps. But Rahul continuing his carefree attitude and being a procrastinator delayed the very thought of buying a Life Insurance Policy of any kind and joked to me about being so much influenced by Sidharth and nothing is going to happen to us, we both will retire together.

Prudent Decision by Aryan

My mind was full of apprehensions and I was cursing myself for my delayed decision. But it is never too late. On reaching home and without wasting an iota of time I sat on the laptop and started researching for a term insurance plan. I did a comparative analysis and comparison of all Term Insurance plans in India offered by multiple insurers by logging on to www.ComparePolicy.com to get unbiased details on Term insurance plans. I found out that all the benefits, key features, inclusions, and exclusions of multiple plans are evident on one screen which helped me compare the plans and decide on the final one.

Post comparing, I decided to take a term insurance plan to begin with, which is cost-effective, within my budget, and which offered me assured lump sum benefit and guaranteed monthly income benefit.

I finalized one of the online Term Plan with a Sum Assured of 1 crore and guaranteed monthly income of Rs 40000 and took the plan online at just a few clicks from the comforts of my house which saved me more money on premium by buying online. I made the premium payment online which came out to be 9,500 INR annually. I was still upset with Rahul’s decision of delaying the thought of buying insurance. I called him up and told him. that I have got the policy online and urged him to buy one for himself as well. But he showed me his carefree attitude again and did not agree.

The Unfortunate Day

A few days later, Aryan was accompanying Rahul in his car to attend their common school friend’s wedding. But suddenly, a big and heavy good carrying truck hit their car and they both met with an accident. The impact was so gigantic that they both died on the spot, leaving only memories behind.

Life Insurance came as the Biggest Saviour

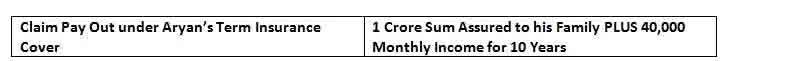

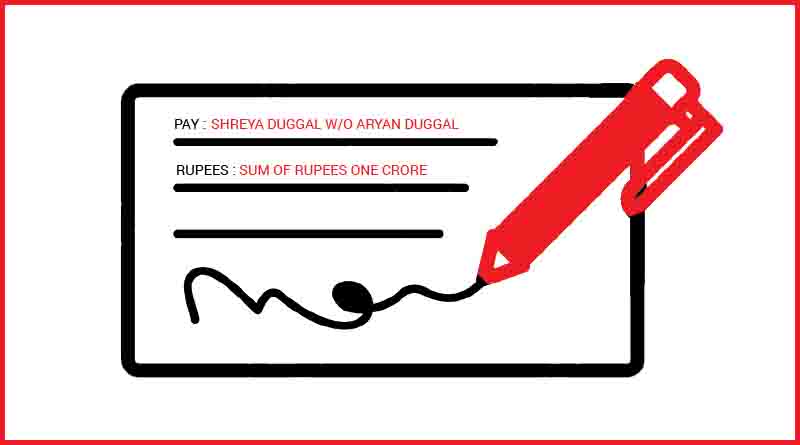

Life took a 360-degree turn for both the families of Rahul and Aryan, but Aryan’s prudent decision saved his family from the financial calamity. His wife filed a claim with the insurer being the nominee and the claim was accepted on genuine grounds.

Which is a huge financial support and arrangement Aryan had made by taking the prudent decision of buying a Term Insurance Policy.

With this financial indemnification from the Life Insurance Policy Aryan’s family will be able to:

- Pay off all debts,

- Will be financially independent,

- Kid’s education and higher education can be taken care of,

- Aryan’s old parents can be taken care of,

- His wife may start up a business with the amount in her hand,

- Monthly expenses are taken care of.

Rahul’s family is in complete shock as they lost Rahul and also huge debts, old parents, kids education, monthly expenses all were haunting Rahul’s family as monsters. Relatives also showed them back (which is the hard reality in today’s world). Had Rahul acted prudently and bought a term insurance plan without delay situation for Rahul’s family would have all been different.

Conclusion

The entire story of Aryan and Rahul can be concluded as “ It is better to be Safe than Sorry! Life is unpredictable for all of us and it is very important to make adequate arrangements for our loved ones. Life Insurance will act as your prudent financial decision on rainy days for your family in your absence. Think of life insurance and buy it at the earliest for your loved ones without delay. Life Insurance is a Necessity Not an Expense!