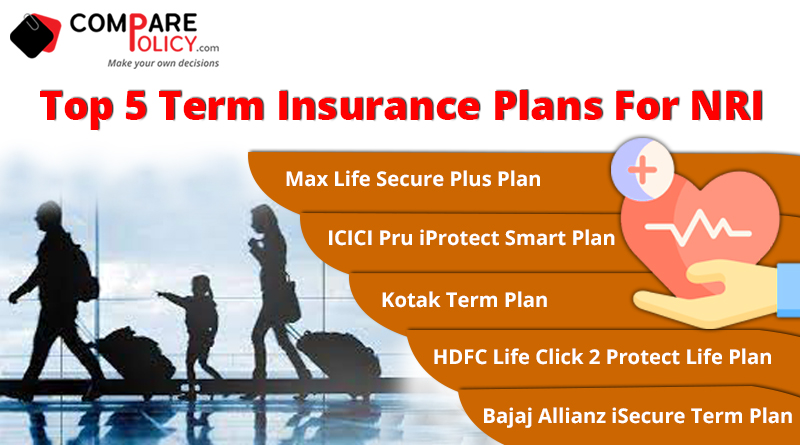

Top 5 Term Insurance Plans for NRI

Every individual hopes to secure their family’s finances as long as they are alive. But sooner or later, as one passes away, their family’s financial security needs to be taken care of and a term insurance plan aims to provide financial protection for the family. This form of life insurance offers financial help to the insured’s family in case of his death. You can pick the Term Insurance Plans for NRI in India to get life cover outside the country.

Term insurance is a type of insurance that provides coverage for a specific period of time or for a certain predetermined duration. If the insured individual dies during the specific period, then the benefits will be paid to the nominee.

When the policyholder chooses the plan and its premium, he should take into consideration the expenditure of his family and the amount they will require every month. In addition to the expenses, the liabilities should also be taken into consideration since they need to be paid off on time. The insurance benefits should cover all the expenses in order to be useful to the family of the policyholder. It makes no sense to purchase a term insurance plan that does not provide enough cover for the family.

The Term Insurance Plans for NRI has a tenure between 6 months to 25 years and the minimum age for the same is 18 years, which goes up to 65 years that may differ depending on the terms of your Insurance Company. The premium for the plan is determined in the same manner for all insurance policies. It is based on the terms of the policy, the sum assured, riders opted, and the frequency of the premium payment. For a term insurance plan, the sum assured is then paid to the family of the policyholder in case of the demise of the life assured. Various Insurance companies offer a grace period of 15 days to 30 days if you have missed your premium payment by any chance. Certain policies enable you to increase the amount of sum assured after a few years of policy purchase.

Table Content

Best 5 Term Insurance Plans for NRI

1. Max Life Smart Secure Plus Plan

“Max Life Smart Secure Plus Plan” provides comprehensive financial protection to your family, in the event of your untimely demise offered by Max Life Insurance. With this term plan, your family will be able to sustain the same lifestyle, even when you are not around. An NRI can buy this term plan, subject to fulfillment of terms specified. This plan comes with two different death benefit options that will help you to customize the protection for your family. With the rider option, you will ensure enhanced protection under this term plan. You can buy this plan between 18 years to 65 years of age with a policy term of 10 to 67 years.

2. ICICI Pru iProtect Smart Plan

“ICICI Pru iProtect Smart” is a term plan that offers life cover that ensures financial protection to your family offered by ICICI Prudential Life Insurance. This term plan secures the future of your family, even after your demise. With this plan, you can choose enhanced coverage against accidental death and 34 critical illnesses, as specified under the policy. It has an age bracket of 20 years to 65 years and it is offered with a minimum annual premium of Rs 2,400. This plan comes with an additional death benefit which is Rs 50 lakh or the base amount, whichever is lower, will be paid in case of death due to an accident.

3. Kotak e-Term Plan

“Kotak e-term plan” offers a pure risk cover and it thus provides comprehensive financial protection offered by Kotak Life Insurance. In this plan, the sum assured (life cover) as chosen is payable to the beneficiary in the event of the death of the life insured. Kotak term plan can be bought in the age group of 18 years to 65 years. The policy term ranges from 5 years to 40 years and the sum assured can be chosen in the range of minimum Rs 25 lakh and maximum have no limit. Tax benefits can be availed for the premium paid as well as for the death benefits received. You can also opt for additional protection with riders to ensure enhanced protection for yourself & your family.

4. HDFC Life Click 2 Protect Life Plan

“HDFC Life Click 2 Protect Life” is a pure term plan, which offers financial protection against death, disability & disease offered by HDFC Life Insurance. It has 9 different plan options to make this term plan suitable, as per your requirement. This term plan can be bought in the age group of 18 to 65 years with the policy term of 5 years to 50 years. You can also choose additional covers through the rider option and enhance the coverage under this term plan.

5. Bajaj Allianz iSecure Term Plan

“Bajaj Allianz iSecure Term Plan” provides financial security for the family, in case of your demise during the policy term offered by Bajaj Allianz Life Insurance. The age group for buying the plan is 18 years to 65 years with the policy term of 10 years. The minimum sum assured is Rs.25 lakh and the maximum amount limit is Rs.50 lakh for choosing the sum assured. The premiums paid for the same are eligible for a tax benefit under Section 80C. The nominee may take the death benefit in monthly installments. It is also possible to include your spouse in the policy at a later stage. The tenure, as well as the installments, can be altered and set as per your requirements.

How NRI’s can Buy Term Insurance?

A variety of Term Insurance Plans for NRI is available. It is extremely easy for an NRI to purchase a term insurance plan.

- He can purchase one when visiting India, with complete documentation and completion of formalities, the policy will be considered as any other policy held by an Indian citizen.

- If the NRI is unable to visit India, he can purchase the policy from the country he is residing in, this can be done using a Mail Order Business. The policy will be verified by the official of the Indian embassy, a notary, and by an Indian diplomat. Complete documentation will be required and they need to be verified as well.

Document Requirements

For NRIs, it is easy to apply for a policy, the payment of premium is also quick and convenient. They can easily pay the premium using internet banking. The amount can be simply transferred to the account of the Insurance Company through an NRO/NRE bank account. There are various companies offering Term Insurance Plans for NRI, one can simply approach the chosen company and learn about the terms and conditions.

The documents required for buying a term plan by an NRI.

- Duly filled proposal form

- Proof of age

- Proof of income

- Report on the health condition

- Attested copy of passport

- An amount equal to the first premium.

Different insurance companies might ask for additional documents. The premium amount will vary, depending on the health condition of the policyholder and the terms & conditions of the insurance. The sum assured depends on the country of residence, the income of the policyholder, and the nature of the job.

Pl call me

What’s your phone number.