Best Single Premium Policies in India

The evolution in the insurance sector has widened the area of benefit for the buyers. From comparing, buying and managing a policy to surrender and claim settlement, everything has become very easy and efficient. More and more flexibility in the insurance sector has provided various options for the buyers and has allowed maximum customization to fit the insurance policy according to your need. With time, the type and number of products have also increased to suit your needs. One such product of the insurance sector is the single premium policy.

A single premium policy allows you to pay the whole amount of the premium for your policy at one go instead of paying the premium at periodic intervals. Most of the insurers provide single premium policies for the benefit of their customers and that’s why, you have a wide range of products to choose from.

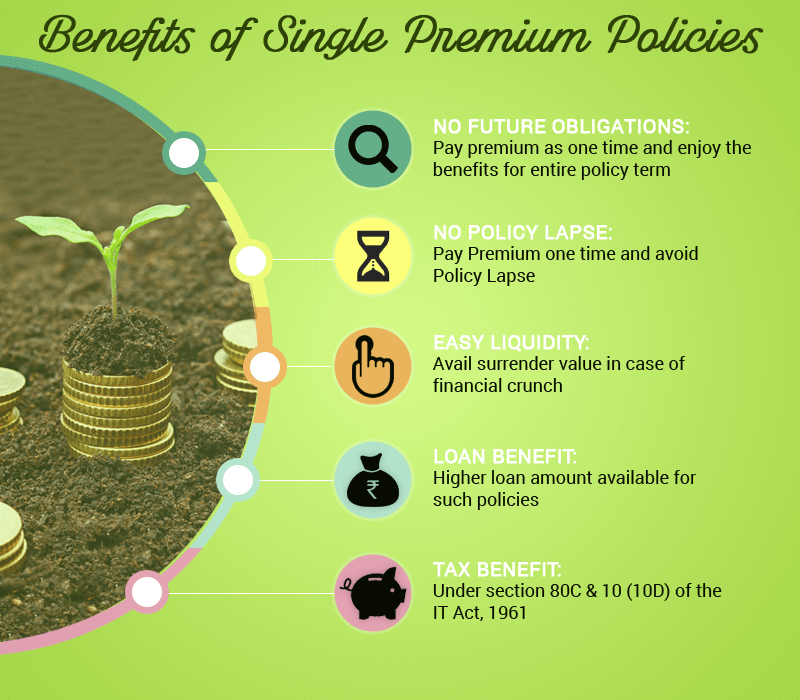

Following are the benefits that you can enjoy by opting a single premium policy:

No Future Obligations: It’s only the one time when you have to strain your finances for paying the premium once as a lump sum. After paying the premium at the commencement of the policy, you don’t need to pay any other premium amount under the policy. So, no worries after paying the one time premium.

No Policy Lapse: A single premium policy comes with the one time premium option, which helps you to avoid the policy lapse and you don’t have to lose the policy benefits. As you have to pay the premium once, you don’t have to track the due date of premium payment. After paying the premium, you can enjoy the policy benefits through the entire policy tenure.

Easy Liquidity: Most of the single premium policies offer an option to acquire the surrender value at any time during the term of the policy.

Loan Benefit: These types of policies provide an approximate 90% loan of insurance value, which you can use in fulfilling the financial obligations. Also, you don’t have to pay taxes on the loan amount.

Tax Benefit: Under a single premium policy, the sum assured chosen should be at least 10 times the premium amount to avail tax-free maturity proceeds. The death benefit applicable is fully exempt from tax. In order to avail income tax deduction on premium amount, the single premium paid should not exceed 10% of the sum assured and the maximum exemption available up to Rs 1.5 Lacs during the year, you made the premium payment.

In this blog, we are discussing 5 best single premium plans.

Table Content

- Snapshot of Single Premium Plans

- Single Premium Policies in India

- 1. Future Generali Pramukh Nivesh ULIP Plan

- Benefits Available

- Charges Applicable

- 2. Aegon Life iMaximize Single Premium Insurance Plan

- Benefits Available

- Charges Applicable

- 3. HDFC Life Single Premium Pension Super Plan

- Benefits Available

- Charges Applicable

- 4. LIC’s Single Premium Endowment Plan

- Benefits Available

- 5. Aegon Life Jeevan Riddhi Insurance Plan

- Benefits Available

- Conclusion

- Related posts:

Snapshot of Single Premium Plans

| Policy Name | Entry Age | Maturity Age | Sum Assured | Premium Amount | Policy Term |

|---|---|---|---|---|---|

| Future Generali Pramukh Nivesh ULIP plan | Min:7 years Max:70 years | Min:18 years Max: 75 years | Min:1.25 times the single premium Max:5 times the single premium | Min:Rs 50,000 Max: No Limit | Min: 5 years Max: 20 years |

| Aegon Life iMaximize Single Premium Insurance Plan | Min:8 years Max:60 years | Min:18 years Max:65 years | Min:1.10 times the single premium Max:10 times the single premium | Min:Rs 1,00,000 Max: N/A | Min: 5 years Max: 10 years |

| HDFC Life Single Premium Pension Super | Min:40 years Max:75 years | Min:50 years Max:85 years | N/A | Min:Rs 25,000 Max: No Limit | 10 years (fixed) |

| LIC’s Single Premium Endowment Plan | Min:90 days Max:65 years | Min:18 years Max:75 years | Min:Rs 50,000 Max:No Limit | N/A | Min:10 years Max:25 years |

| Aegon Life Jeevan Riddhi Insurance Plan | Min:18 years Max:60 years | Max:70 years | Depend on the age of the Life Assured, Premium Payment Term opted and the Annualized Premium amount | Min:Rs 1,00,000 Max: No Limit | 10 years (single pay) |

Single Premium Policies in India

followings are the list of single premium policies offered by Indian insurance companies.

1. Future Generali Pramukh Nivesh ULIP Plan

Future Generali Pramukh Nivesh ULIP Plan is a single premium Unit Linked Insurance Plan that provides you the flexibility to invest in 6 varied fund options that will help you receive higher returns on your investment. This plan also provides insurance protection that provides financial security for your family/loved ones, in the event of your untimely demise.

This plan offers the flexibility to receive maturity benefit as a lump sum or installments (during 5 years after maturity). You can enjoy switching benefit & partial withdrawal facility. This policy does not levy Premium Allocation Charge. This policy offers tax benefits under section 80C, 80CCC(1), 80D, & 10(10D) under the Income Tax Act.

Benefits Available

Death Benefit: In the event of death of the life insured during the policy term, Sum Assured plus Fund Value is payable as Death Benefit.

Maturity Benefit: In case of survival of the life insured till end of the policy term, Fund Value is payable at maturity. You can also opt to receive this benefit as a lump sum or periodic installments.

Switching: You have the option to switch among 6 available fund options to suit your investment goals. The minimum switch amount of Rs 5,000 is allowed under this policy. You can opt for 12 free switches during a policy year.

Partial Withdrawal: Partial Withdrawal facility is allowed after completion of 5th policy year (for minor lives, the life insured attains 18 years). The minimum amount of Rs 5,000 is allowed for partial withdrawals, subject to the terms specified. You can opt for 4 free withdrawals during a policy year.

Surrender Value: Surrender Value (as applicable) is payable after completion of the lock-in period of first 5 policy years.

Charges Applicable

Under this policy, you are levied for Policy Administration Charge, Mortality Charge, Fund Management Charge, Switching Charge, Partial Withdrawal Charge, Discontinuance Charge & Miscellaneous Charges.

2. Aegon Life iMaximize Single Premium Insurance Plan

Aegon Life iMaximize Single Premium Insurance Plan is a Unit Linked Plan that helps you to receive higher investment returns at optimum costs. Under this plan, you can invest in any of the six unit linked funds, which aims to maximize your investment. With single premium payment on commencement of the policy, you can get the life cover for the entire policy term.

With the help of top-ups, you can boost the fund value payable under the policy. You can also enjoy switching and the partial withdrawal facility. It is an online plan, so no commissions are payable in this policy. Under this policy, you can also avail tax benefits under section 80C & 10 (10D) under the Income Tax Act.

Benefits Available

Death Benefit: In the event of death of the life insured within the policy term, the higher of Sum Assured or Fund Value or 105% of all the premiums paid, is payable to the nominee. In case of Top-Up fund, the higher of Top-Up Sum Assured or Top-Up Fund Value is also payable.

Maturity Benefit: In case of survival of the life insured till end of the policy term, Fund Value (including top-up fund) is payable at maturity.

Top-up Premium: A top-up premium is an amount payable over & above the basic premiums under the policy. The minimum top-up premium allowed is Rs 5,000 and you can exercise this option anytime during the entire policy term except the last 5 years.

Switching: You have the option to switch among 6 available fund options to suit your investment goals. Under this plan, you can avail 4 free switches during a policy year.

Partial Withdrawal: Partial Withdrawal facility is allowed after completion of 5th policy year (for minor lives, the life insured attains 18 years). You can opt for 4 free withdrawals during a policy year. The amount of partial withdrawal allowed is at least Rs 5,000.

Surrender Value: The acquired Surrender Value is payable after completion of the lock-in period of first 5 policy years.

Charges Applicable

Under this policy, you are levied for Policy Administration Charge, Mortality Charges, Fund Management Charges, Switching Charge, Partial Withdrawal Charge and Discontinuance Charge.

3. HDFC Life Single Premium Pension Super Plan

HDFC Life Single Premium Pension Super Plan is a unit linked single premium deferred pension plan which helps you to lead a happy and comfortable life after retirement. This plan is designed to ensure security of your investments. You can invest your money with ‘Pension Super Plus 2012’ Fund.

This plan offers benefit of assured maturity value. It also provides you the opportunity to build corpus for post-retirement income. By paying the premium once, you can get cover for the entire policy term. There is an option to choose top-ups which will enhance the fund value. You can avail commutation benefit as per the current tax regulations. This policy also provides tax benefits under section 80CCC & 10 (10A) of the Income Tax Act.

Benefits Available

Death Benefit: In the event of death of the life insured within the policy term, the nominee will receive the higher of Fund Value or 105% of total premiums paid.

Vesting Benefit: At vesting/maturity, you have the option to buy a regular annuity for life. You can also commute up to 1/3rd of the benefit at vesting as tax-free lump sum as per the prevailing tax laws.

Top-up Premium: A top-up premium is an amount payable over & above the basic premiums under the policy. The minimum top-up premium allowed is Rs 10,000 and you can pay the top-up premium anytime during the entire policy term.

Surrender Value: The acquired Surrender Value is payable after completion of the lock-in period of first 5 policy years.

Charges Applicable

Under this policy, you are levied for Premium Allocation Charges, Policy Administration Charge, Mortality Charges, Fund Management Charges and Investment Guarantee Charge.

4. LIC’s Single Premium Endowment Plan

LIC’s Single Premium Endowment Plan is a participating & non-linked savings plus protection plan, where you need to pay premiums only once at the beginning of the policy. This policy provides a lump sum amount at the maturity of the policy. It also ensures financial protection for your family.

It also offers bonuses that will help enhance the maturity or death payout. This plan offers rebate on choosing sum assured of Rs 1 lac & above.

Benefits Available

Death Benefit: In the event of death of the life insured within the policy term and prior commencement of the risk, the single premium is payable. On death within the policy term and on or after commencement of risk, Sum Assured plus vested Simple Reversionary Bonuses and Final Additional Bonus is payable.

Maturity Benefit: In case of survival of the life insured till completion of the policy term, Sum Assured plus vested Simple Reversionary Bonuses and Final Additional Bonus is payable.

Bonus: Simple Reversionary Bonuses and Final Additional Bonus is payable, under the policy.

Loan Benefit: This plan provides loan amount, if the policy has been active for at least 1 year. It will help you to meet unforeseen liquidity needs.

Surrender Value: The Surrender Value is acquired at any time during the term of the policy.

Tax Benefit: This policy provides tax benefits under IT Act, subject to prevailing tax laws.

5. Aegon Life Jeevan Riddhi Insurance Plan

Aegon Life Jeevan Riddhi Insurance Plan is a non-linked & participating endowment life insurance plan that gives a boost to your savings with help of guaranteed additions. This plan also provides financial security for your family, in case you are not around.

This plan provides a lump sum amount at maturity of the policy. It also provides bonus benefit that will increase in benefit amount every year. It offers In-built accidental death benefit and premium waiver option on disability is also available.

Benefits Available

Death Benefit: In the event of death of the life insured during the policy term, the sum of Sum Assured on Death, accrued reversionary bonuses, accrued guaranteed additions, and terminal bonus is payable as death benefit.

Maturity Benefit: In case of survival of the life insured till the end of the policy term, Sum Assured plus accrued guaranteed additions plus accrued reversionary bonuses, and terminal bonus is payable.

Guaranteed Additions: 5% of Sum Assured as Guaranteed Additions is added for 5 years. It is paid on maturity or death claim, whichever occurs earlier.

Bonus: Simple Reversionary Bonuses and Terminal Bonus is payable.

Loan Benefit: The maximum loan amount that can be availed is 60% of the surrender value and the minimum loan amount is Rs 5,000.

Surrender Value: The Surrender Value payable is higher of Special Surrender Value or Guaranteed Surrender Value.

Rider Benefit: Aegon Life Premium Shield Rider can be attached to this plan.

Tax Benefit: This policy offers tax benefits under section 80C & 10(10D) of the IT Act, 1961.

Conclusion

A single premium policy wipes out the hassle of paying the premium at a periodic interval and allows you to get coverage under your policy without worrying about its lapse. But you need to know that the tax benefit under single premium policy is valid for the first year only when you pay the premium. It is fine to buy a single premium policy if you don’t have steady cash flow or want to avoid paying regularly otherwise going for a policy with regular premium payment is advisable.