Best Life Insurance Companies in India 2023-24

People work hard and plan their upcoming life, but life is full of uncertainties and unpredictable. An event like our near one’s death is harrowing and leaves the family in an emotional and financial crisis. To plan our family’s security, the necessary thing is to cover yourself with Life insurance and Life insurance companies.

In simple words, It provides a dedicated sum of money on the demise of the policyholder or after a certain amount of time. It is one of the essentials which an individual should have for the more stable future of his family in his absence. In India, 24 Life Insurance Companies are operating, approved, and Recognized by IRDAI (Insurance Regulatory and Development Authority of India), a regulatory body of the insurance and reinsurance industry.

Table Content

- Top Life Insurance companies with their Claim Settlement Ratio report.

- Best Insurance companies with their Claim Settlement Ratio report in chart

- Top 10 Life Insurance Companies, based on CSR

- 1. Max Life

- 2. HDFC Life

- 3. TATA AIA Life Insurance Company

- 4. Pramerica Life Insurance

- 5. Exide Life Insurance Company

- 6. Reliance Life Insurance Company

- 7. Bajaj Allianz Life Insurance Company

- 8. Aegon Life Insurance Company

- 9. ICICI Prudential

- 10. Aditya Birla Sun Life

- Top Insurance Company in India

- Ways to find, India’s best life insurance company

- Related posts:

Top Life Insurance companies with their Claim Settlement Ratio report.

The way we have spent our last years in fear of Covid-19, life insurance policy has become an essential service for people now. We all know about insurance policies but we all have a bad habit, we can’t take things seriously until it becomes the question of life and death. Well, there is the quote “It’s never too late to mend”, so wake up and insure yourself and your family too, until it’s late.

Look insurance companies are just trying to protect you, and when you know that you are protected by anyone you just trying to live a free life without any tension and stress. This is why life insurance is the best service that we all looking for. Here is the table of the best life insurance companies with their latest claim settlement ratio report.

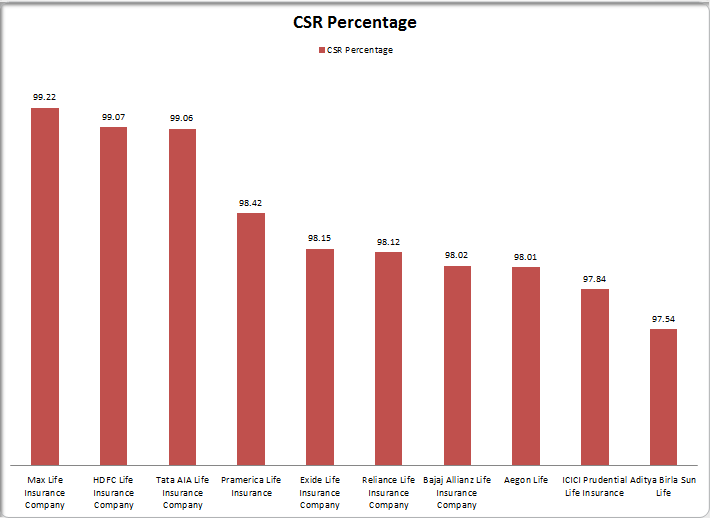

| Top Insurance Company | CSR Percentage | Claim Settled |

| Max Life Insurance Company | 99.22 | 15,463 |

| HDFC Life Insurance Company | 99.07 | 12,626 |

| Tata AIA Life Insurance Company | 99.06 | 2,982 |

| Pramerica Life Insurance | 98.42 | 569 |

| Exide Life Insurance Company | 98.15 | 3,468 |

| Reliance Life Insurance Company | 98.12 | 8,017 |

| Bajaj Allianz Life Insurance Company | 98.02 | 12,127 |

| Aegon Life Insurance Company | 98.01 | 351 |

| ICICI Prudential Life Insurance | 97.84 | 11,460 |

| Aditya Birla Sun Life | 97.54 | 5,162 |

| Aviva Life Insurance Company | 97.53 | 810 |

| Bharti AXA Life Insurance Company | 97.35 | 1320 |

| Canara HSBC OBC Life Insurance | 97.35 | 1320 |

| PNB Metlife Life Insurance | 97.18 | 4,346 |

| Star Union Dai-ichi | 96.96 | 1,248 |

| Life Insurance Corporation of India | 96.69 | 758916 |

| India first Life Insurance | 96.65 | 2241 |

| IDBI Federal | 96.47 | 1416 |

| Kotak Life Insurance | 96.38 | 3346 |

| Future Generali | 95.28 | 1143 |

| SBI Life Insurance Company | 94.52 | 22,490 |

| SHRIRAM Life Insurance | 91.61 | 3074 |

| Sahara India Life Insurance | 89.45 | 654 |

| Edelweiss Tokio Life | 83.44 | 326 |

Best Insurance companies with their Claim Settlement Ratio report in chart

Top 10 Life Insurance Companies, based on CSR

We have shortlisted the Top 10 Life Insurance Companies in India (2021-22) based on The Claim Settlement Ratio (CSR), customer satisfaction level, and after-sale services.

1. Max Life

Max Life Insurance Company acquires top of the list. The company came into existence in 2000 and is the largest non-bank private sector insurance company in India. It is a joint venture between Max Financial Services (Indian Company) and Mitsui Sumitomo Insurance Company (Japanese Insurance company), with assets under management crossing Rs. 50,000 Crores.

The Claim settlement ratio is 99.2% highest in the Life Insurance Industry that is 15,463 claims till now.

2. HDFC Life

The third place is occupied by HDFC Life Insurance Company. It is a joint venture between HDFC Ltd, India’s one of the biggest financial institutions, and Standard Life Aberdeen (a global investment company).

The company came into existence in 2000 and went on to become one of the most reputed insurance providers in the country.

The claim settlement ratio of the company is 99.07%, with 12,626 successful claims paid.

3. TATA AIA Life Insurance Company

In the second place, it is a joint venture of TATA AIG Life Insurance Company and AIA (American International Assurance) Hong Kong-based Company. The company’s strengths have been in Tata’s established position as a reliable brand in the Indian market.

AIA is the largest independent insurance group globally, crossing 18 markets in the Asia Pacific. Tata AIA asset under management in 2019 is Rs. 28,430 Crores.

The claim settlement ratio is 99.06% as per the latest data, with 3,659 claims paid.

4. Pramerica Life Insurance

The fourth place goes to Pramerica Life Insurance The company came into existence in 2008 and has maintained its status as one of the most extensively recognized insurance companies in the country.

The insurance company is a joint venture between DHFL Investments Limited and Prudential International Insurance Holdings. Its customer-centric approach and strong bancassurance and distribution channels have made it one of the best insurance companies in India.

The company has a Claim Settlement Ratio of 98.42% backed with 569 claims paid.

5. Exide Life Insurance Company

In the tenth position, Exide life insurance company came into existence in 2001. The company is owned by Exide Industries Ltd. The company serves over 15 lakh customers and manages assets of over INR 15,795 Crores.

Exide Life distributes its products through multi-channels viz. Agency, Bancassurance, Corporate Agency & Broking, Direct Channel, and Online.

The claim settlement ratio of the company is 97.03% and covers almost 3,468 claims.

6. Reliance Life Insurance Company

At the sixth position, Reliance Life Insurance is a joint venture between Reliance Capital and Nippon Life (the most extensive Japanese insurance company). The company came into existence in 2001.

The stakes of Reliance are 51%, and Nippon stands with 49% in the company. The Reliance Nippon has assets under management is Rs. 20,281 crores.

The Claim Settlement Ratio of 98.12% with 8,017 claims paid by the company.

7. Bajaj Allianz Life Insurance Company

Bajaj Allianz Life Insurance stands in seventh place. It is a joint venture between India’s Bajaj Finserv Limited, and the leading global insurance company Allianz SE incorporated in 2001. Till now, Bajaj Allianz has 509 branches across the country, and more than 1 Lakh agents. The company’s main strength lies in the trust it has among Indians due to its well-established presence for over half a century.

It is one of India’s best insurance companies, with an authorized capital of Rs. 73,773 crores. The claim settlement ratio of the company is 98.02%, with 12,127 claims settled by the company.

8. Aegon Life Insurance Company

At the eighth position, Aegon Life Insurance Company is a joint venture between Aegon and Times Group. Aegon life insurance company has been for 175 years, and actively working in 20 countries across the world. The company came into existence in 2008.

From 2008, Aegon continuously served and maintained the image of being India’s best insurance company, the claim settlement ratio of the company is 98.01%, with 351 claims settled by the company.

9. ICICI Prudential

The fourth-place goes to ICICI Prudential Life Insurance Company. The company came into existence in 2000 and has maintained its status as one of the most extensively recognized insurance companies in the country.

The insurance company is a joint venture between ICICI Bank and Prudential Corporation Holdings Limited. ICICI Bank holds a 74% stakeholding, and Prudential Plc holds a 26% stake in the venture.

Its customer-centric approach and strong bancassurance and distribution channels have made it one of the best insurance companies in India.

The Total Assets Under Management of the company are Rs. 1,604.10 crores and the company have a Claim Settlement Ratio of 98.58% backed with 11,546 claims paid.

10. Aditya Birla Sun Life

The ninth position goes to Aditya Birla Sun Life Insurance. It is a joint venture company between Aditya Birla Group and Sun Life Financial Inc. Sun Life Financial is a renowned international financial services organization in Canada.

Aditya Birla Sun is abbreviated as ABSLI and came into existence in 2000. The Claim Settlement Ratio of the Company is 97.15%, which means, 8,055 claims have been paid by the company till present.

- policies offer attractive tax benefits u/s 80C and help you save a significant amount that you would otherwise spend as taxes.

- The individual who avails of life insurance has the choice of helping a loan against their insurance policy without hampering the benefits provided by the policy they have purchased.

- Policies serve as the best possible tool for the coverage of loans and mortgages availed by the policyholder. Suppose there is ever any unforeseen situation due to which the policyholder is not able to repay his / her loan or mortgage. In that case, the bereaved family members will not have the burden of repayment, and the policy can be used to repay the loan or mortgage.

Top Insurance Company in India

Note: The Insurance companies mentioned above are based on the high claim settlement ratio, after-sale services, and customer satisfaction level.

Ways to find, India’s best life insurance company

- Do Research with the help of the internet.

- Customer Care Service.

- Numbers of Network Hospital.

- Track the CSR report of the last 5 years.

- Feedback & Reviews of Customers about Company.

To see IRDAI Annual Report for FY 2018-19 click below:

Life Insurance companies Claim Settlement Ratio for FY 2018-19

Hye i like your posts your all content is very usefull

Which should I buy between LIC and Birla Sunlife life insurance?

My monthly income 2,40,000. Which is most profitable for long term plan.

If you want to meet long-term financial goals, you may go for insurance products from Birla Sun Life Insurance Company. Birla Sun Life offers customized products such as protection plans, wealth with protection, children’s future plans, savings with protection, retirements plans and health plans, all at affordable premium.

You can also buy Tata Aia Life product best for fututre.

Thank you very much for such an amazing article. Of the above mentioned companies, my favourite is Exide Life Insurance.

i am a soldier. i want to purchase 1cr term plan ,which is best for me, my income 7 lakh ,

I bought 2term plan from different insurance company from 4years ago. Both are in force. But when I purchased second one I did not disclose the first one although at that time first policy not issued. I purchased both the plan at same time. Have any issue will face in future??

Hey,

Thanks for sharing lot of information about insurance policy.

HOW IS PNB MET LIFE

Nice

You can also buy Tata Aia Life product best for fututre.