Bajaj Allianz Life Insurance Claim Settlement Ratio

As per IRDAI annual report, the latest claim settlement ratio of Bajaj Allianz Life Insurance Company is 98.02% for the Financial Year 2019-20. Bajaj Allianz did really better in FY 2019-20, Bajaj Allianz is one of the best insurance companies in FY 2019-20 and this is claimed by IRDA.

Every year IRDA comes with a Claim Settlement Report of insurance companies and ranked different companies with their performance. It’s a good thing in terms of customers cause everyone wants the best option for themselves and this is how they can select the best option for insuring.

| Life Insurer | Claims Rejection (FY 2019-20) | Claims Intimated (FY 2018-19) | Total Claims (Claims Pending + Claims Intimated) | CSR% (FY 2018-19) | CSR% (FY 2019-20) |

|---|---|---|---|---|---|

| Bajaj Allianz Life | 1.95% | 12127 | NA | 95.01% | 98.02% |

- The claim settlement ratio of 98.02% is the indicator of the number of death claims settled by Bajaj Allianz Life Insurance against the total claims more than 12127 reported for the FY 2019-20.

- Rs 349 crores has been paid as the claim amount against 12130 claims reported in FY 2018-19 by Bajaj Allianz Life Insurance Company.

- Rs 332.15 crores has been paid as the claim amount against 12127 claims reported in FY 2019-20 by Bajaj Allianz Life Insurance Company.

- The claims have been rejected, resulting in a Claim Repudiation of 1.95% for the FY 2019-20.

Table Content

Past 5 years CSR Trends for Bajaj Allianz Life Insurance Co.

Consistency to maintain a higher claim settlement ratio is considered to be good. Past claims settlement ratio trends will reveal the consistency and inclination of the Bajaj Allianz Life Insurance Co. towards the settlement of death claims.

The last 5 years was quite progressive for Bajaj Allianz and this is how you achieve your position with the time but the most important thing is Bajaj Allianz serve people in their hard time. Well, this is why insurance company stands for and this is what people expect from an insurance company. And this is how you achieve your target, the difference between the last 2 years is quite enough and quite commendable too.

Let’s go through the past 5 years’ CSR trend of Bajaj Allianz Life Insurance Company.

| Financial Year | Claim Settlement Ratio (%) |

|---|---|

| 2015-16 | 91.30% |

| 2016-17 | 91.67% |

| 2017-18 | 92.04% |

| 2018-19 | 95.01% |

| 2019-20 | 98.02% |

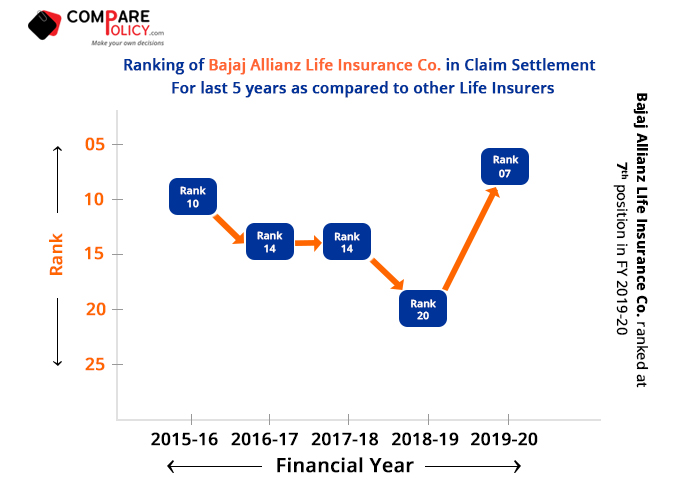

Bajaj Allianz Life Rank in Claim Settlement among other Life Insurers

The Claim Settlement Ratio (CSR) rank signifies the position where Bajaj Allianz Life Insurance Company lies, with respect to other life insurers in the industry from the financial year 2014-15 to 2018-19. The claim settlement percentage attained by Bajaj Allianz Life Insurance Co. is the basis of the rank identified in the respective financial years.

How Claim Settlement Ratio (CSR) is measured?

The Claim Settlement Ratio is the number of claims settled divided by the total number of claims reported in a given financial year, including the claims outstanding at the beginning of the financial year. The claim settlement ratio is expressed in percentage which is helpful for comparing the claim settlement data by the customer across insurers. The claim settlement ratio is calculated for every financial year.

| Claim Settlement Ratio = Total claims settled / Total claims received where, Total Claims received = (Claims reported in the financial year + claims pending at the start of the year) |

The CSR mentioned is only for Term Plans, or this is including all other plans as well?

Where can I get the data only for the claims related to Term Plans?

My two term plan had crossed grace period 3and half month later I paid the premium will it be consider it fresh contract of policies my plan has crossed 3 year will the section 45 Wii implied or not I mean whether the claim may rejected on 3 year clause or not

Dear madam bajaj allianz term plan smart protect goal is good term policy or not.how the company term plan claim settlement

Mam this is the safe company. Where i can trust

Hello mam, Recently I purchased a term plan from bajjaj allianz life insurance. They provide me policy with medical test on phone call and without any salary slip. I want to know that in future they can reject my claim with this two reason ?