Are ULIPs the Best Tax Saving Investment Options?

Tax saving is an important part of financial planning, but choosing the right tax saving instrument is much more important. There are various tax saving instruments in the market with different benefits and features. The best tax saving instrument is the one which fulfills your financial objective. Fulfilling your financial goals along with tax saving is a key component of sensible financial planning. When it comes to tax saving instruments, there are several traditional and conventional investment options available. One such ULIPs the Best Tax Saving investment options.

| A unit linked insurance plan is a type of life insurance plan which provides you the flexibility to invest in various investment options such as equity, debt or money market instruments, which offers you high returns and thereby help you to build a corpus. You can also avail life insurance coverage that ensures financial protection for your family, in case of any eventualities. |

Apart from the investment plus insurance benefit in a ULIP investment, you can also enjoy the tax benefits along with getting investment returns.

Table Content

- How ULIPs Offer you Tax Benefits?

- Tax Deduction on Premium Amount

- Tax Benefit on Maturity

- Tax Benefit on Death

- Tax Benefit on Partial Withdrawal

- Tax Benefit on Top-up Premium

- Tax Benefit under Section 80 CCC

- Minimum Policy Term to avail Tax Benefits

- Other Benefits of Investing in ULIPs

- Flexible Investment

- Transparency

- Cost Effective

- Liquidity

- Effective Planning

- Top up Premium

- Returns

- Final Word

- Related posts:

How ULIPs Offer you Tax Benefits?

Investing in a ULIP plan also attracts tax benefits, which help you to reduce the tax liability. Let us understand what all tax benefits can be availed under a Unit Linked Insurance Plan.

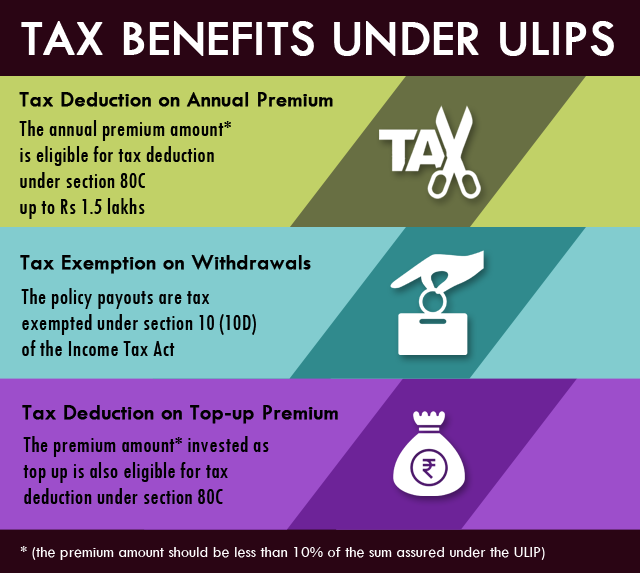

Tax Deduction on Premium Amount

The annual premium amount (including, applicable taxes, cess, and other charges) for a unit linked policy is eligible for tax deduction under section 80C of the Income Tax Act, 1961. The maximum permissible limit to avail the tax deduction under section 80C is Rs 1.5 lakhs. You are free to invest a higher amount, but the deduction applicable is capped at Rs 1.5 lakh.

There are certain conditions associated with ULIPs and related tax deductions as per the year of purchase

| ULIPs purchased after 1st April 2012 | The maximum tax deduction can be availed if premium amount is less than 10% of the sum assured (For instance, if the sum assured is Rs 10 lakhs and the annual premium is Rs 1.5 lakhs, you can avail the tax deduction for Rs 1 lakhs premium (10% of the sum assured). | In case of premium of ULIP is more than 10% of the sum assured, the maximum tax deduction availed can be up to 10% of the sum assured |

| ULIPs purchased before 1st April 2012 | The maximum tax deduction can be availed if premium amount is less than 20% of the sum assured | In case of premium of ULIP is more than 20% of the sum assured, the maximum tax deduction availed can be up to 20% of the sum assured |

Tax Benefit on Maturity

ULIP offers tax free maturity proceeds under Section 10 (10D) of the Income Tax Act,1961. where the annual premium payable is less than 10% of the sum assured amount for the policies issued after 1st April,2012. For the policies purchased before 1st April 2012, the maturity value is tax free if the annual premium payable is less than 20% of the sum assured.While filing income Tax Return you must mention this as exempt income under section 10 (10D)

If, the annual premium paid exceeds the prescribed limits which is 10% (for the policies issued after 1st April,2012) or 20% (for the policies issued before 1st April,2012)of the sum assured, the entire proceeds of the policy will be treated as income from other sources and thus taxable as per the tax slab rate applicable to you.

| If compared to the mutual funds, the ULIP offers tax free investment proceeds, whereas under Mutual Fund, the investment proceeds are taxable. |

Tax Benefit on Death

Death benefit received by the nominee in case of the death of the life insured is tax free and does not attract any tax liability.

Tax Benefit on Partial Withdrawal

The unit linked insurance plan offers liquidity in the form of “Partial Withdrawals”. Partial withdrawal allows you to withdraw some portion out of your fund value created after a specified time period. Partial withdrawal can be done after completion of 5 policy years. There is a minimum and maximum limit defined for such withdrawals which may vary from one plan to another. Partial Withdrawals are tax exempted from any tax implications.

Tax Benefit on Top-up Premium

And if the premiums paid are not exceeding 10% of the sum assured then the top ups are also eligible for tax deduction under section 80C as well as 10 (10D). As the top-up premium also allows tax benefits, it will not attract additional tax liability and does not affect your financial planning as well. The maximum tax deduction limit is 1.5 Lakhs only under section 80 C.

Tax Benefit under Section 80 CCC

For another category of ULIPs which are the pension ULIPs,the commutation amount is tax free under section 80 CCC of the Income Tax Act. The commutation amount is the one third amount which can be withdrawn by the policyholder at the time of maturity before the pension begins.

Minimum Policy Term to avail Tax Benefits

ULIPs have a lock in period of 5 years. If surrendered, before 5 years the policyholder has to pay surrender charges. Similarly, to avail the tax benefits on premium payment under section 80C, the policyholder has to pay the premiums regularly for 5 policy years. In the event of discontinuance of the plan, one cannot avail any tax benefit. The premium payable in the earlier policy years shall be added back to your income in the year in which ULIP is discontinued.

Other Benefits of Investing in ULIPs

Let’s go through the key features that you can enjoy in a ULIP investment.

Flexible Investment

ULIPs offer a variety of high, medium and low risk investment options and you have the flexibility to invest your money in any of the investment fund options available as per your risk taking capacity. A ULIP policy also allows you to switch between fund options, either free of cost or charging some nominal fee. Usually, you can make a certain number of free fund switches (as specified under the policy terms) in a year and the subsequent switches are then chargeable. Fund switching is carried out based on your risk appetite and balancing the equity-debt portfolio. Intelligent investors make use of this option to optimize their ULIP investment returns.

Transparency

A ULIP provides you details regarding the charges levied, expected rate of returns, the value of investment, etc. Daily NAV reporting along with quarterly investment portfolio and annual account statement also helps you to keep track of your investment portfolio at all times. A ULIP investment ensures a high level of transparency for your invested amount, where it is invested and its returns as well.

Cost Effective

IRDAI has put capping on the annual charges levied for a ULIP plan. For the first 10 years of investing, you have to pay a maximum of 3% of the annual invested amount towards charges. It is also mandatory to levy charges evenly during the lock in period. When investing for more than 10 years, up to 2.25% of the annual invested amount goes for ULIP charges only. With long-term investing, the charges tend to reduce and the cost involved does not make any adverse impact on returns.

Liquidity

In case of any unforeseen circumstances when you are in urgent need of funds, ULIP offers you a facility to make partial withdrawals. You have the option to withdraw funds anytime during the policy term, after the completion of first five policy years.

Effective Planning

A ULIP comes with a lock-in period of 5 years during which you can’t make any withdrawal. Even if you make partial withdrawals after 5 years, the amount cannot exceed 20% of the fund value. Long-term investing in a ULIP plan allows you to enjoy the power of compounding, which facilitate you to build a corpus and thereby helps you in achieving long term goals like building a house, higher education for your children and their marriage, retirement planning, etc.

In addition to the opportunity of building a corpus amount, a ULIP investment provides a life cover which also allows you to financially protect your family against unfortunate events of life.

Top up Premium

ULIP also allows you to top up the excess cash, in addition to your regular premium for investment enhancement. You can invest the top-up premium anytime during the tenure of existing policy. A top-up investment helps you to boost the fund value which will be payable at maturity, surrender or death under the policy.

Returns

The money you invest in a ULIP, is invested in a variety of market linked investment avenues such as debt and equity funds. A ULIP investment, thus offers the opportunity to earn market-linked returns, which will help you to fulfill your goals as well. The availability of versatile investment options allows you to diminish the negative impact of inflation and you will be able to receive high returns.

Final Word

Unit Linked Insurance Plans (ULIPs) are one of the best investment options, which help you to achieve the objective of capital appreciation and financial protection. A ULIP plan serves the purpose of goal-based planning.If you have long-term financial goals such as saving for higher education of your children & marriage, saving for your post-retirement life, and also looking for financial security for your family, ULIP investment is the best bet. Not only wealth creation, it also offers tax benefits for the premium invested under section 80C and the policy proceeds are tax exempted under section 10 (10D) of the Income Tax Act, 1961. It is important to know that investment in market-linked products carry risks, it is thus advisable to analyze your risk appetite and financial goals, before investing. So invest wisely for a long term to avail the benefits of returns.