All about – National Health Protection Scheme (NHPS) introduced in Budget 2018

India has a low health insurance penetration. As per the data available with the National Health Profile 2017, only 27% of Indians, or around 35 crore people have any form of health insurance. Out of India’s 135 crore population, 100 crore people have no health cover. Considering the lack of health insurance coverage in the country, the government has launched the National Health Protection Scheme (NHPS) recently in the Union budget 2018. It is considered a significant effort toward ensuring health coverage for all citizens.

According to the recently released National Family Health Survey (NFHS-4) conducted by the ministry of health and family welfare, only 29% of households have one member covered under health insurance. Only 20% of women and 23% of men in the age group of 15-49 are covered by health insurance. India’s per capita public spending on health is 1.4% of GDP during the year 2016-17, which is quite low compared to the world average of 5.99%.

Table Content

- National Health Protection Scheme (NHPS) – What is it?

- Its Coverage

- Who will be benefited?

- Other existing Health Schemes

- Rashtriya Swasthya Bima Yojana (RSBY)

- Employees’ State Insurance Scheme (ESIC)

- Central Government Health Scheme (CGHS)

- Aam Aadmi Bima Yojana (AABY)

- Universal Health Insurance Scheme (UHIS)

- Final Thoughts

- Related posts:

National Health Protection Scheme (NHPS) – What is it?

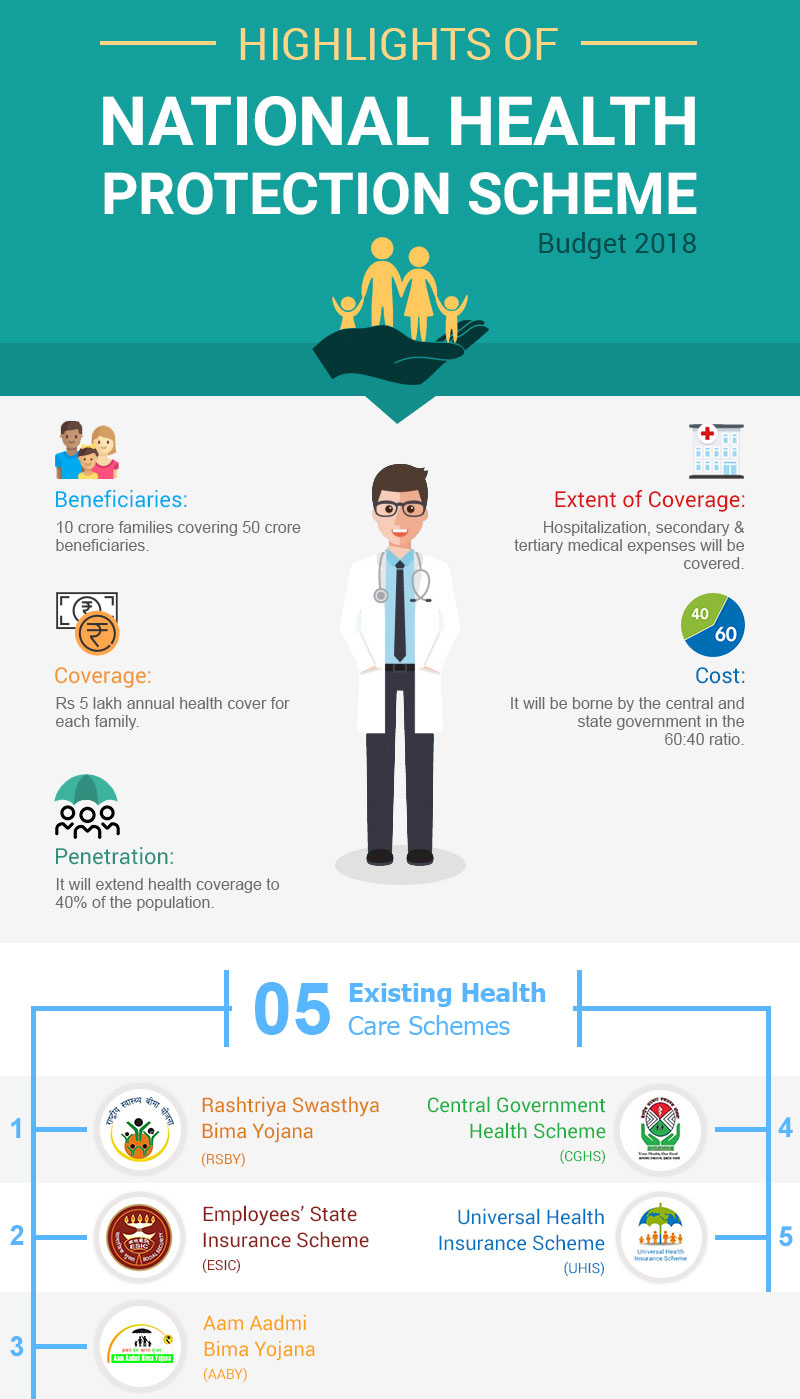

National Health Protection Scheme is completely funded by the government, with no premium payment and co-payment by beneficiaries. NHPS, if effectively executed will extend health coverage to 40% of the population and generate sizable growth in insurers’ premiums. This scheme will thus give a boost to the insurance sector as well. It is estimated to be launched either on 15th August or 2nd October.

Its Coverage

The projected cost of NHPS is around Rs 12,000 crore, and the total expenses will be borne by the central and state government in a 60:40 ratio. This health insurance scheme will provide cashless hospitalization, so the insured need not worry at all about treatment expenses. There will be state hospitals and selected private hospitals where the insured can avail of the treatment.

It takes care of expenses incurred during hospitalization, secondary (urologists, dermatologists, cardiologists, etc., for outpatient treatment and a short stay at the hospital), and tertiary medical care (plastic surgery, burn treatment, cardiac surgery, etc. usually for inpatients).

As per NSSO data, out-of-pocket expenses are on the rise among the poorer sections of the society and, 65% of those expenses account for outpatient treatment. Out-patient treatment expenses do not under the scope of RSBY, however, NHPS will cover outpatient treatment as well.

Who will be benefited?

This flagship health insurance scheme is intended to cover 10 crore poor and vulnerable families and 50 crore beneficiaries across the country. This scheme will provide Rs 5 lakh health cover to each family annually for medical treatment. This health coverage initiative will replace the Rashtriya Swasthya Bima Yojana (RSBY) and it is aimed to increase health care facilities, especially in smaller towns and villages.

Other existing Health Schemes

Rashtriya Swasthya Bima Yojana (RSBY)

Rashtriya Swasthya Bima Yojana (RSBY) is a government-run health insurance scheme for the poor sections of society. It was launched in the year 2008 and aimed to provide coverage to Below Poverty Line (BPL) households against financial expenses arising out of hospitalization. Beneficiaries can avail of health coverage of up to Rs 30,000 annually. The beneficiary will enjoy cashless hospitalization in any of the impaneled hospitals. People who get enrolled under this health program, need to pay only Rs 30 as a registration fee and the premium is payable by the central and state government.

Employees’ State Insurance Scheme (ESIC)

ESIC provides complete medical cover for self and dependants from day one of employment. The insured person is also entitled to receive cash benefits in case of physical illness, disablement, etc. resulting in loss of earning capacity. On employment injury or on the death of the insured person in the industrial accident, his/her dependents are entitled to a monthly pension. This scheme also covers domiciliary treatment and specialist consultation expenses. Medical care to retired and permanently disabled insured persons and their spouses is also provided.

Central Government Health Scheme (CGHS)

CGHS was launched in the year 1954 by the Ministry of Health and Family Welfare with an aim to ensure comprehensive medical care to central government employees and pensioners enrolled under the scheme. CGHS provides health care to beneficiaries through Allopathic, Homoeopathic & AYUSH systems of medicine.

Aam Aadmi Bima Yojana (AABY)

Aam Admi Bima yojana launched in the year 2007, is a social security scheme wherein the member should be the sole earning member or usually the head of a BPL family or marginally above the poverty line. The rural landless households between the age of 18 to 59 years are only eligible to join this scheme. The premium amount is shared equally by the central and state government. Upon natural death, the sum assured of Rs 30,000 is payable. In the event of accidental death or disability within the period of insurance cover, Rs 75,000 is payable. Scholarship benefits of Rs 100 per month are also payable to a maximum of two children of the beneficiary studying between the 9th to 12th standard.

Universal Health Insurance Scheme (UHIS)

UHIS is offered by the govt. to both the segments of society i.e ‘Below Poverty Line’ & ‘Above Poverty Line families. The 4 public sector general insurance companies (New India Assurance, United India Insurance, Oriental Insurance & National Insurance) have implemented Universal Health Insurance Scheme with an aim to enhance access to health care, especially for poor families.

The scheme provides medical expense reimbursement of up to Rs 30,000 towards hospitalization for the entire family, accidental death cover of Rs 25,000 for a sole earning member of the family, and compensation for the loss of the earning member as Rs 50 per day for up to 15 days.

Final Thoughts

National Health Protection Scheme recently proposed in Budget 2018, looks at a larger picture to ensure accessible and equitable quality health care to the marginalized and vulnerable sections if implemented effectively. This health insurance scheme will supplement efforts to improve public health infrastructure. A Rs 5 lakh annual health cover no doubt would be enough to take care of expenses incurred in hospitalization, but a proper regulation needs to be implemented, which should ensure that there is no overcharging and medical malpractices that might make the cover ineffective.