All about Individual Health Insurance Plans

Everyone wants to keep himself/herself fit and healthy. When you are healthy, you find yourself in the right frame of mind to handle any obstacles that you face. You make healthy choices, indulge in a regular workout session, and follow a good diet, but may still find yourself falling sick which needs medical attention.

Medical exigencies can hit anyone and at any time. Due to its unpredictability, you need to stay prepared on the financial front to treat them. The costly medical treatment is always a reason for worry for most people. When it comes to medical care, its ever-rising cost will burn a hole in one’s pocket. The medical inflation in India is estimated at a rate of around 15% and it may increase further, which would make medical treatment unaffordable for most people. Having Individual Health Insurance is an ideal way out.

Table Content

- What is an Individual Health Insurance Plan?

- Individual Health Insurance Plans in India

- Exclusions under Individual Health Insurance Plans

- Coverage under Individual Health Insurance Plans

- Tax Benefits under Individual Health Insurance Plan

- Key things to consider before buying an Individual Health Insurance Plan

- Health Insurance Plans Online

- Steps to buying an online Health Insurance Plan

- What are Different Types of Single Health Insurance Plans?

- Let’s know about Inclusion and Exclusion in an Individual Health Insurance Policy

- Final Words

- Related posts:

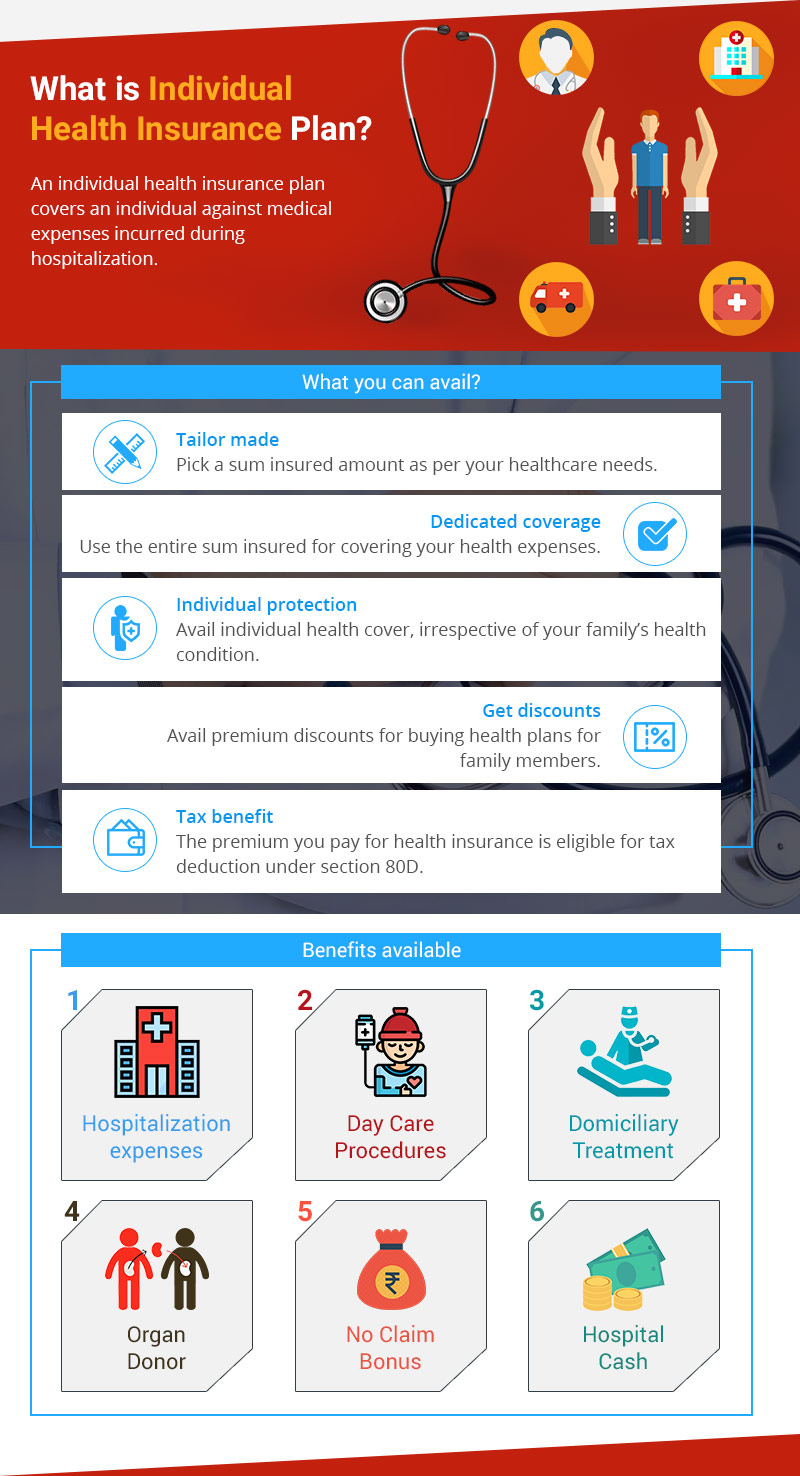

What is an Individual Health Insurance Plan?

An individual health plan provides comprehensive health coverage for an individual against medical exigencies. It covers the medical expenses incurred for injuries, illnesses, or other medical conditions and thus served as a financial guard against medical expenses pertaining to the hospitalization. An individual health insurance plan is designed to cover the policyholder against expenses incurred while receiving the medical treatment. You can avail the of cashless hospitalization when hospitalized in a network hospital (as listed by the insurer). You have the option to get the reimbursement of medical expenses from the insurer after discharge from the hospital, in case you are hospitalized in a non-network hospital.

An individual health plan can be bought by an individual aged 18 years or above. When you buy a plan, you need to pay the premium amount as determined by the insurance company and the insurance company is obliged to pay the permissible medical expenses up to an amount equal to the sum insured available during a policy year.

| Suppose, you bought an individual health plan with a sum insured of Rs 2 lakhs. In case, you become hospitalized due to a medical condition and if the cost of the medical treatment/ procedures is Rs 1.8 lakhs, the insurance company will pay the entire bill amount. In other scenarios, if the medical treatment cost is Rs 2.15 lakhs, the insurance company will pay for an amount up to the sum insured (Rs 2 lakhs) and the rest of the amount Rs 15,000 will have to be paid from your pocket. |

Individual Health Insurance Plans in India

| Plan Name | Minimum Entry Age | Sum Insured | Pre Existing Diseases | Co- Payment | No Claim Bonus | Pre & Post Hospitalization |

|---|---|---|---|---|---|---|

| Care Policy | Child: 91 days, Adult: 18 years | 3 Lakh to 75 Lakh | Covered after 4 years | Applicable | Up to 150% of SI | 30 & 60 days |

| Future Health Suraksha-Individual Policy | Child: 90 days, Adult: 18 years | Rs 50,000 to 10 lakh | Covered after 4 years | Applicable | Up to 50% of SI | 60 & 90 days |

| ICICI Lombard Complete Health Insurance Plan | Child: 6 years, Adult: 18 years | 3 Lakh to 50 Lakh | Covered after 4 or 2 years, depending on SI opted | Not applicable | Up to 50% of SI | 30 & 60 days |

| HDFC ERGO Health Optima Restore Individual | Child: 91 days, Adult: 18 years | 3 Lakh to 50 Lakh | Covered after 3 years | Not Applicable | Up to 100% of SI | 60 & 180 days |

| ManipalCigna ProHealth Protect Plan | Child: 91 days, Adult: 18 years | 2.5 Lakh to 10 Lakh | Covered after 4 years | Applicable | Up to 100% of SI | 60 & 90 days |

Exclusions under Individual Health Insurance Plans

There are some conditions that are not included under Individual health plans:

- Pre-existing conditions within 4 years of commencement of the first policy.

- No claims are admissible during the first 30 days from the commencement of the health policy.

- Intentional self-injury

- Cost of contact lenses, hearing aids, and spectacles

- Consumption of intoxicating drugs/alcohol

- Pregnancy/ childbirth related treatments

- Naturopathy treatment

- Dental treatment/surgery, etc.

(Exclusions may differ from one plan to another.)

Coverage under Individual Health Insurance Plans

In-patient hospitalization: All the medical expenses incurred upon hospitalization for more than 24 hours are covered. Hospitalization expenses such as room rent, nursing, ICU charges, doctor’s/surgeon’s fee, medicines, drugs, operation theater charges, etc. are covered.

Pre-hospitalization: The medical expenses incurred prior to the hospitalization are covered. Expenses such as various diagnostic tests, doctor’s visits, etc., are covered before the hospitalization for a specific number of days ranging from 30 days to 90 days.

Post hospitalization: The medical expenses incurred post-discharge from the hospital is reimbursed. Any medical expenses incurred towards medicines or any medical tests done after discharge from the hospital are covered for a specific number of days ranging from 60 days to 180 days.

Daycare procedures: Some medical treatments/procedures that do not require a minimum of 24 hours of hospitalization due to technological innovation are covered. The number of daycare procedures covered may differ from one plan to another, as mentioned under the policy wordings.

Domiciliary treatment: Medical expenses incurred when taking the treatment at home and under medical advice are also covered, as specified under the policy wordings.

Hospital cash: A hospital cash allowance is payable on a daily basis. A specified minimum stay in the hospital is required to get the hospital daily cash and this benefit is payable, depending on the policy terms.

Restoration benefit: Several individual health plans offer restoration benefit, which helps to reinstate the sum insured in case of its exhaustion during a policy year. This restoration benefit will be applicable, as per the policy terms specified.

Organ donor: The medical expenses incurred towards the donation of an organ are covered, as specified in the policy wordings.

No claim bonus: An individual health insurance plan offers a No Claim Bonus (NCB) when you make no claim during a policy year. The NCB benefit is usually available as a discount on the future premiums for renewing the health plan.

Free health check-up: An individual health plan offers you the benefit of free health check-up. Some insurance companies offer health check-ups on policy renewal, and some others provide this benefit upon completion of claim-free policy years, as specified under the policy terms

Emergency ambulance cover: Several insurance companies cover the ambulance charges for transferring the insured from home to hospital. The amount covered as an ambulance charge depends on the policy terms specified.

Tax Benefits under Individual Health Insurance Plan

Upon paying the premium amount towards getting individual health insurance, you can avail of tax deduction under section 80D of the Income Tax Act, 1961.

For the health insurance premium you pay for self, spouse & children, the available tax deduction is Rs 25,000. For senior citizens, the tax deduction limit has been raised to Rs 50,000 (from the financial year 2018-19). An individual health plan serves as a tool to cater to you & your family’s health care needs and helps you attain tax savings as well.

Key things to consider before buying an Individual Health Insurance Plan

Here are some key aspects that you need to ponder before buying an individual health plan

Sum insured: When buying an individual health plan, you need to assess your health condition, check whether there is any adverse family history of an illness, and then pick a sum insured that can easily cover your health-related expenses upon hospitalization.

Daycare treatments: Insurers also offer coverage for daycare procedures or treatments. You need to check the number of daycare procedures covered and it is advisable to choose a health plan that provides comprehensive coverage for daycare treatments.

Auto restoration: The auto restoration facility available under a health plan ensures automatic refill of the sum insured, upon its exhaustion due to claims during a policy year. You should choose a plan that offers an auto restoration facility.

Co-payment: The co-payment defines a percentage of the claim amount, which has to be borne by the insured. Choosing co-payment under the health plan will help to reduce the premium amount, but you should choose a co-payment percentage that you can easily afford.

Sub limit: Each insurer sets a monetary cap for the coverage available against specific illnesses or treatments. If your hospitalization cost goes beyond the sub-limit specified, you will have to pay the additional amount from your pocket. You are thus advised to choose a sub-limit after assessing your health condition, to ensure you don’t end up paying hefty bills from your pocket.

Checklist of network hospitals: You need to check the list of network hospitals available under the plan chosen. You should also make sure that the listed hospitals are equipped with specialty services that can cater to your health care needs.

Choose riders prudently: An individual health plan offers several riders/add-ons. You need to pick a rider/s, based on your health condition. Adding a rider under the plan will increase the premium, you are thus advised to choose the requisite riders.

Check No claim bonus (NCB) benefit: NCB benefit can be availed, in case of a claim-free policy year. This benefit is available as a discount in premium or an increment in the sum insured. You should choose an individual health plan that offers NCB benefits.

Read policy wordings: Before you buy a health plan, it is essential to read the policy terms and check the benefits applicable and their exclusions. It helps you know all about the policy benefits, so you can make a prudent decision about buying a health plan.

Health Insurance Plans Online

By buying a health insurance plan online, you can avail several amazing benefits.

Access to correct information: Every insurance company offers updated information on each and every insurance product. When it comes to buying health insurance, you can get access to all health plans offered by the insurance company. You can also check the benefits and the coverage available. Now, you don’t need to rely on the information provided by the agent. By going online, you can easily access the correct and detailed information, which helps you choose the right health insurance plan.

Compare premium: Before buying a health plan online, through an insurance web aggregator’s website, you have the option to compare plans. You only need to enter the details like age, gender, annual income, sum insured, etc. and it instantly calculates the premium amount of a particular plan. You will also get a range of plans with the benefits available. It helps you to easily narrow down the list of health plans you may opt to buy.

Convenient: With the online facility of buying health plans online, you are not required to contact the agent or insurance company. You can simply buy the plan from the comfort of your home or from anywhere with internet connectivity. You are advised to do your research about various health plans and choose the one that fits your health care needs. You can also pay the premium for the chosen plan with just a few clicks.

Saves money: There is no involvement of agents while buying health plans online and the insurer does not require to pay the agent’s commission. This saving is transferred to the online buyers by offering discounts on premiums.

Pre and post-sales service: After buying the health policy online, the insurer also offers you the premium calculation option which helps you to determine the premiums before buying. Some insurers also offer live chat services where you can ask and resolve all your queries. After the purchase of the policy, the insurer also sends you a soft copy of your policy, premium receipts, and premium renewal reminders.

Instant coverage: You get covered from the moment, you buy a health policy online. You don’t have to wait for a physical policy to arrive. Buy policy online and enjoy instant coverage.

You have checked all the benefits and coverage available under an individual health insurance plan and now looking to buy it online. However, you don’t know exactly about the process of buying health insurance plans online.

Steps to buying an online Health Insurance Plan

Step 1- Whom to cover: Firstly, you need to decide for whom you want to buy a health plan, such as for yourself, your spouse, children, or your parents. You also need to fill in any other personal details like age, gender, annual income, mailing address, and mobile number.

Step 2- Type of cover: Here, you have to choose from the individual or family floater health plan. An individual health plan provides a separate sum insured for each family member and a family floater health plan offers a common sum insured amount for the entire family.

Step 3- Coverage amount: It is one of the crucial steps in buying a health plan. You need to choose the right coverage amount (sum insured) that can fulfill the insured’s health care needs without any financial worry.

Step 4- Medical History: In this step, you are required to furnish details regarding your medical history, such as pre-existing illness, and you/ your family’s adverse medical condition. You are advised to provide all and correct details of the to-be insured’s medical history.

Step 5- Make payment: It’s the final step for buying a policy. You have the flexibility to pay the premium through different payment options such as credit card, debit card, or internet banking.

What are Different Types of Single Health Insurance Plans?

Well, it’s more than types, it’s part of health insurance for individuals and these kinds of parts are making it one of the best options for people.

Critical Illness Insurance – We all have our family history and some of us are facing genetic disease problems, which are absolutely common in people. Genetic diseases always create problems in terms of insurance, in such a situation you can protect yourself with critical illness insurance, and with this, you will get the best coverage along with your problems.

Senior Citizen Health Insurance – Senior Citizen health insurance policy is mostly for those who are at 55, everyone needs health insurance and we all know the importance of these kinds of insurance policies and most people suffer disease problems in their old-age period. The good thing about this plan is anyone can purchase this plan between the age of 55 years to 80 years.

Personal Accident Insurance – As per the name, it’s a pure individual plan who’ll protect you from an accident and make your life precious. Personal accident insurance is the third and last part of individual health insurance and we all know that road accident are common in India. With the time it’s increased and As per the Road Accident Report for 2019, a total number of 449,002 accidents took place in the country. For individuals, it’s the way good insurance policy and we never know when we have to face unfortunate things.

Let’s know about Inclusion and Exclusion in an Individual Health Insurance Policy

Insurance policies are made something just like you want, and they never give you everything with a single insurance plan or policy. That’s why they have plans for everything, like Critical illness, Cancer insurance plans, etc. So, whenever you choose an insurance plan for yourself and your family, you need to know about the inclusion and exclusion in easy words what you get with the plan and what you don’t.

| Inclusion | Exclusion |

| Hospitalization | Pre-Existing Conditions |

| Pre and Post-Hospitalization | Dental, Hearing, and Vision-related Expenses |

| Day Care Procedures | Cosmetic Surgery |

| Ambulance Costs | Pregnancy and Related Conditions |

| Domiciliary Treatment | Alternative Therapies |

Final Words

An individual health plan offers the benefit of the individual sum insured. Which helps you to pay off the medical bills with ease. There are numerous individual health plans available from different insurers. However, you need to assess benefits & exclusions and pick one that offers you coverage to cater to your health care needs. Moreover, opting for an online health insurance plan will enable you quick comparisons regarding cost. And benefits and facilitate quick policy issuance in minutes at your convenience.