What is a Family Floater Health Insurance Policy?

Health is an essential asset of our lives. Everyone is seeking better health care for their family members. However, with the constant rise in medical treatment costs, health care has become an expensive affair. Having health insurance will act as a cushion against expenses that incur during medical emergencies or treatments.

Table Content

- Family Floater Health Insurance Policy- What is it?

- Who can be insured under a Family Floater Health Plan?

- Reasons to opt for a Family Floater Health Plan

- Key benefits available under the Family Floater Health Plan

- Tax Benefits under a Family Floater Health Insurance Plan

- Key aspects to consider while opting for a Family Floater Health Insurance Plan

- Best Family Floater Plans in India 2021

- Drawbacks of Family Floater Health Plan

- Conclusion

- Related posts:

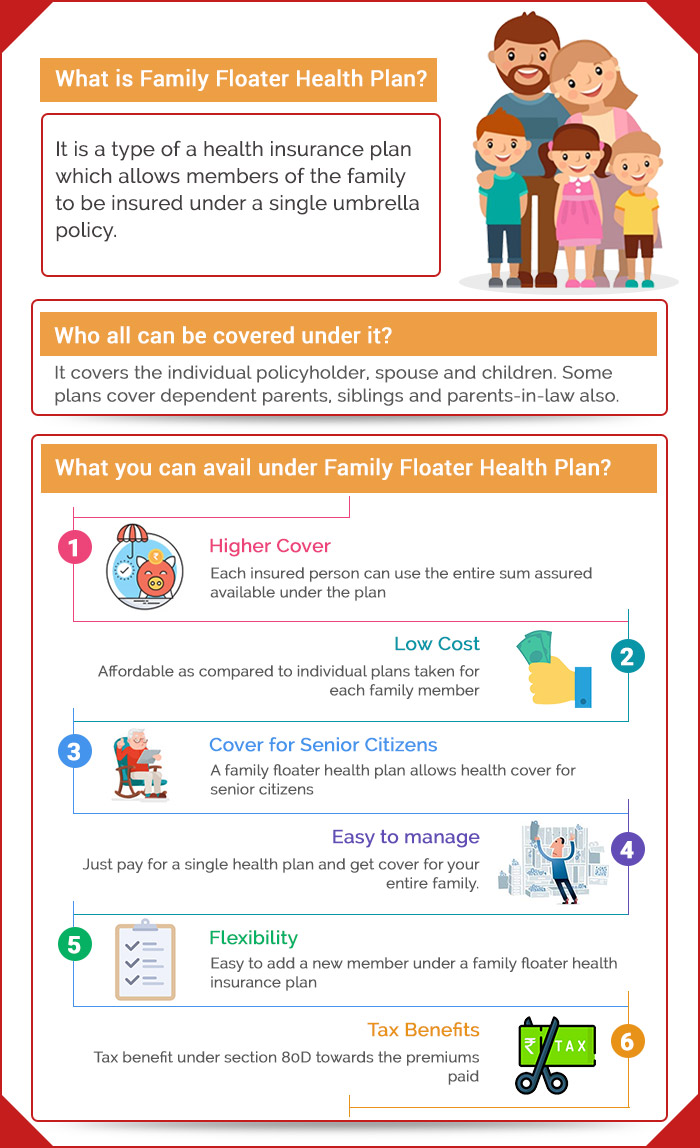

Family Floater Health Insurance Policy- What is it?

It is a type of health insurance plan which allows members of the family to be insured under a single umbrella policy. Getting a health cover for the entire family is always a wise move. You have two options to cover your family members.

Individual cover: You can opt for individual coverage, wherein an individual sum insured is available separately for each family member covered under the policy. The insured person can use the assigned sum assured to meet hospitalization expenses.

| For instance, you bought the individual health insurance policy for all family members with a sum insured of Rs 1 lakh. If the hospital bill for treatment of your spouse is Rs 1.25 lakhs during a policy year, you need to pay Rs 25,000 from your pocket. Under this scenario, the insurance company will pay up to Rs 1 lakh for an insured person. |

Family floater cover: Buying a family floater health plan provides health coverage for your entire family against any sickness, illness, or disease. A family floater health insurance policy offers a sum insured on a shared or floater basis. It means the available health cover or sum insured under the policy can be utilized by any of the insured members of the family to meet medical expenses incurred during a policy year.

| For instance, you buy a family floater health plan with a sum insured of Rs 5 lakhs. So, the health cover of Rs 5 lakhs can be used by any insured members under the policy to take care of health expenses arising during a year. If your spouse has used Rs 2 lakhs of the sum insured, then the remaining sum insured of Rs 3 lakhs is left to be used by other insured members to consume within a policy year, in case of a claim. |

Who can be insured under a Family Floater Health Plan?

A family floater health plan usually covers a family (self, spouse, and children). Some insurers also cover your dependent parents, siblings, and parents-in-law, only at the cost of an additional premium of the existing health insurance policy.

Reasons to opt for a Family Floater Health Plan

- Higher cover for individuals: Each member of the family can use the entire sum assured available for the family. Each insured person gets a higher health cover that will help an insured member get the treatment done without any financial hiccups.

- Cost-effective: The premium amount payable under a family floater health insurance plan is quite more affordable than the premiums paid for individual health plans for each family member. A family floater health plan thus ensures an adequate health cover at a relatively lower cost.

- Coverage for senior citizens: Usually, insurers tend to deny the renewal of individual health policies for senior citizens after a certain age. A family floater health policy, however, offers cover for senior citizens in your family.

- Hassle-free: A family floater health plan is a single plan to get health coverage for your entire family. You don’t need to maintain separate health policies, just pay for a single-family floater health policy and keep your family insured against ever-rising medical expenses.

- Flexibility: When a new member such as a spouse or a newborn child joins the family, a family floater plan provides you the flexibility to add members. It gives you the ease to extend health coverage for the new entrants also.

- Tax Benefits: The premium amount paid for the health policy during a financial year is eligible for tax benefit under section 80D of the Income Tax Act 1961. The applicable tax benefits are subject to changes in tax laws.

Key benefits available under the Family Floater Health Plan

Apart from providing your family an umbrella cover, a family health policy offers several key policy benefits.

- In-patient Hospitalization: All the medical expenses incurred due to hospitalization for more than 24 hours are covered. Hospitalization expenses such as room rent, ICU charges, nursing, doctor’s/surgeon’s fee, blood, oxygen, operation theater charges, etc., are covered.

- Pre-Hospitalization: The medical expenses incurred before the hospitalization are covered under the pre-hospitalization expenses such as various diagnostic tests, doctor’s visits, etc., before the hospitalization. Usually, it ranges from 30 days to 90 days.

- Post-Hospitalization: The medical expenses incurred after discharge from the hospital are reimbursed, as specified under the plan. Any medical expenses such as medicines or any medical tests are done post-discharge from the hospital are covered. Usually, it ranges from 60 days to 180 days.

- Day Care Procedures: Specific medical treatments/procedures that do not require a minimum of 24 hours of hospitalization are covered. The daycare procedures covered may vary from one plan to another, as specified under the plan details.

- Domiciliary Treatment: Medical expenses incurred when the treatment is done at home and under medical advice are also covered, as specified under the policy.

- Restoration Benefits: Several family health plans offer restoration benefits, which help reinstate the coverage amount or sum insured if it gets exhausted during a policy year. This restoration benefit will usually trigger unrelated illnesses.

- Organ Donor: The medical expenses incurred in the donation of an organ are covered, as specified in the family floater health plan. The organ donation covered under a health policy includes the heart, liver, lungs, kidneys, intestine, pancreas, skin, and bone marrow, and it may differ depending on the plan chosen.

- No claim bonus: A family floater health insurance policy offers a No Claim Bonus (NCB) in case of a claim-free policy year. The NCB benefit is usually available as a discount on the future premiums for the health plan.

- Hospital cash: The insurance company offers a daily cash allowance, as specified under the policy terms. The hospital cash can be utilized to meet some expenses that your health policy does not cover.

Tax Benefits under a Family Floater Health Insurance Plan

A family floater health insurance policy offers the tax benefit under section 80D of the Income Tax Act towards the premium amount paid in a set financial year.

Premium paid by you for medical insurance for your family, the available tax deduction is Rs 25,000 when the eldest member’s age is below 60 years. When the age of the most senior member (you or your parent) exceeds 60 years, you can avail of a tax deduction of Rs 30,000 until the financial year 2017-18, which has been enhanced to Rs 50,000 from the financial year 2018 19.

Key aspects to consider while opting for a Family Floater Health Insurance Plan

Each family has unique health insurance needs, and no one plan fits all. It is thus advisable to do thorough research before you pick the right health insurance plan for your family. There are some key factors that you should consider while opting for a Family Floater Health Insurance Plan.

- Adequate Sum Insured: When buying a family floater plan, it is essential to choose the sum insured or health cover wisely. You need to pick a sum insured that will fulfill your family’s treatment expenses. Considering the medical inflation, the number of members insured, the number of senior citizens covered, family history of a disease, etc., one should pick the health cover amount.

- Day Care Procedures: Insurance companies offer coverage for daycare procedures and it is advisable to check the list of daycare procedures covered under the plan chosen.

- Co-payment: It refers to a specific percentage of the claim amount, which has to be borne by the insured person. Choosing a co-payment under the plan will help you reduce the premium amount, but while picking a co-payment you need to check whether you can easily pay the claim amount from your pocket.

- Sub-limits: The insurance company sets a monetary limit for the coverage available for certain illnesses or treatments. If your medical bill is Rs 1.10 lakhs and the sub-limit for the specific treatment is Rs 40,000, you need to pay the remaining amount of Rs 70,000 from your pocket. It is thus advisable to pick a sub-limit after assessing the health condition of the insureds.

- Waiting Period: It is a time period during which the insurer is not bound to pay for your claims. The insurance company will cover the illnesses/diseases after completion of the waiting period. You should check the conditions specified under the waiting period section of the policy.

- Check Auto Restoration: The auto restoration facility will help to restore your health cover, in case it gets exhausted due to claims during a policy year. It is an important benefit in the case of a family floater health plan. It is usually available without any additional cost. Under the family health plan, the sum insured is utilized by every family member, and there are higher chances of its exhaustion. Thus, you should opt for a health plan that offers an auto restoration facility.

- Look for NCB Benefit: No claim bonus (NCB) benefit is available in case of a claim-free policy year. In case you are young and healthy and have your spouse and or your child insured under the policy, the probability of hospitalization reduces. This benefit helps you to lower future premiums, so you should choose a family health policy that offers NCB benefits.

- Choose Additional Covers with Prudence: There are several add-ons available under a family floater health plan, but you need to choose the required add-ons/ riders based on certain factors. The additional cover is available at an extra cost, so be wise in picking the one.

- Read Policy Terms and Conditions: When you are looking to buy a health plan, you are advised to go through the policy terms & conditions thoroughly and check the inclusions & exclusions applicable under the policy. So, you will be known all about the policy benefits before buying.

Best Family Floater Plans in India 2021

| Plan Name | Insurer Name | Min. Entry Age | Sum Insured | Pre-Existing Diseases | CSR % FY 2019-20 |

| Aditya Birla Activ Health Platinum Plan | Aditya Birla Health Insurance | 91 Days | 2 Lakh – 2 Crore | After 4 Years | 94 |

| Bajaj Allianz Family Floater Health Guard Plan | Bajaj Allianz Health Insurance | Child -3 Months Adult -18 Years | 2 -10 Lakh | After 4 Years | 98 |

| Bharti AXA Smart Super Health Insurance Policy | Bharti AXA Health Insurance | 5 Years | 5 Lakh – 1 Crore | After 4 Years | NA |

| Care Health Insurance | Care Health Insurance | Child -3 Months Adult -18 Years | 3-60 Lakh | After 4 Years | 95 |

| Cholamandalam Health Insurance | Cholamandalam MS Health Insurance | Child -3 Months Adult -18 Years | 2-15 Lakh | After 4 Years | 95 |

Drawbacks of Family Floater Health Plan

Sharing: As a family floater health plan offers a sum insured which is shared by all family members. In case a family member has utilized a part of the sum insured, others will have a lower cover remaining for that year. If multiple family members are hospitalized during a policy year, you may fall short of the sum insured available.

Cost: In family floater plans, the premium amount is calculated based on the age of the eldest member. As the eldest member gets older, the premium will shoot up. It’s always beneficial to opt for a family health plan with young members that will help you to save on premiums and buy a separate policy for older members, say parents.

Renewal: This health policy will only be renewed till the eldest member reaches the maximum age of renewability, as applicable under the policy terms. At this stage, you need to take a fresh policy without the benefit of the earlier continuous coverage. In this scenario, it would be better to take individual policies for the family members.

Conclusion

As far as family health cover is concerned, having a family floater health insurance policy is the most obvious choice. There are a number of health policies available with insurers, but you need to choose the right one that will fulfill your family’s healthcare needs. Before buying a family health plan, you should compare the benefits & features available and then choose the best one.

Hi, Sonia,Greetings!! Thanks for your fantastic tips.I am 64+ yrs old and my wife is 57 yrs. I have been having a NIC policy and the agents seem to be very confused. First I was told that I will get the benefit of a Floater type and now I am told the benefit of the summ assured would be only for individuals. Now my policy has expired on the 10th July 2020 and I stills ahve a months grace period. I have been with NIC for the last 6 years and with no hospitalization issues, ie have been enjoying no claim bonus. Now I would like to switch to a better option for me and my wife and we can go for 10lacs of sum assured and it should also cover covid . Kindly advise on the best option and the company yousuggest on reliability.

Thanks