5 Reasons to Invest in ULIPs

Economic protection along with adequate investment in one’s future are the things which every investor tries to achieve. Both these needs can be met separately but there are financial products like unit linked insurance plan (ULIP) that fulfills both financial and economic protection along with offering returns on investments. In short offering insurance plus investment under one umbrella plan. ULIP is a market-linked insurance product which is an appropriate wealth creating product for meeting one’s long-term goals. There are various reasons to invest in ULIPs for attainment of financial objectives.

Table Content

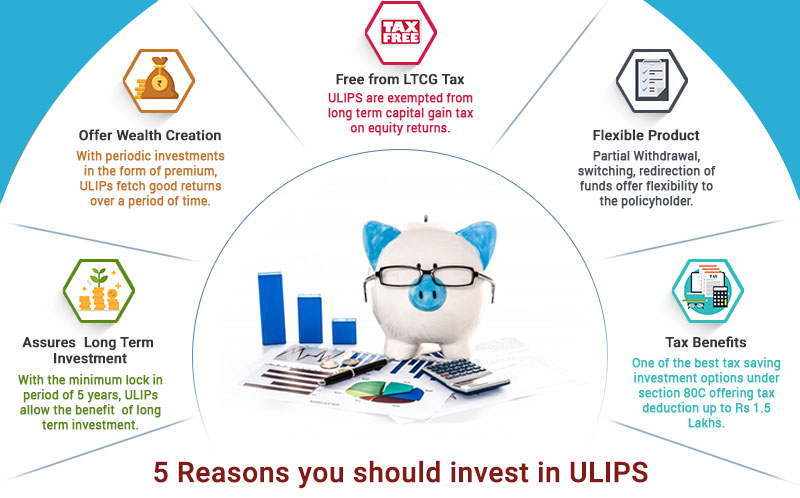

1. ULIPs are free from LTCG Tax

With the introduction of long term capital gain (LTCG) tax in the budget 2018, investors have to pay 10% tax on the long-term capital gains on the profit reaped exceeding Rs 1 lakh from the sale of shares or equity mutual fund schemes retained for more than a year from the date of acquisition. ULIPs on the other hand, are free from long term capital gain tax as per the current regime. ULIPs stand as an alternative arrangement to get potential returns from investing in equity through equity based funds which is exempted from the LTCG tax. Long term capital gain on mutual funds for profit over and above 1 lakh is taxable.In such a scenario, investors looking for equity based returns can invest in the funds with higher exposure to equities and reap tax free returns.

2. ULIPs offer wealth creation

Building of wealth is a thought through financial process and cannot be done fortnightly.It could be managed when you save today religiously in the investment which could offer returns surpassing inflation. You can achieve financial freedom in the future when wealth management goes hand in hand with income generation. With a regular flow of income you need to invest in investment vehicles to offer you potential returns to fulfill.

Invest in ULIPs can be one such investment vehicles which are market linked product that aggregates the best of insurance and investment. ULIPs are associated to the capital market and offers flexibility to choose the funds out of equity, debt or balanced funds as per your risk appetite. To suit various policyholders a unit linked insurance plan offers varying multiple fund options are available to offer different risk apetite. Based on the risk bearing capabilities, financial goals and the term of the policy, the policyholder can invest in one or more funds as per his suitability. So, if you want to raise your wealth and won’t hesitate taking risk on your investment, you can invest in equity funds. Similarly, if you want to gain steady returns on your investment, you can invest in debt funds.You can assess the past returns of the fund before investing. Also one could use the top-up option to invest any additional investible surplus available. Top-ups shrinks the overall cost of Ulip for the policyholder along with increasing the life cover also. Top-ups are usually charged at 1- 2 per cent, which is less than the base plan charges. Top us could be looked at buying more units at a lower cost resulting in lowering the total average cost.

3. ULIPs assures long term investment

With the power of compounding, ULIP offers better returns if invested for a longer tenure. With changes in the lock in period from 3 years to 5 years, ULIP allows the invested funds to be kept invested for a minimum tenure of 5 years, which is a longer lock in period as compared to other related schemes like ELSS. Invest in ULIPs fetch the best of returns when the amount is invested for a longer tenure. It is an investment vehicle which will prosper funds from a long term atleast for a minimum term of 10 years.

4. ULIPs are Flexible

Financial needs are different at different life stages of an individual. Features of Ulip such as partial withdrawals, multiple fund options, different premium payment options and mode may be used to customize one’s savings schedule. The unit linked insurance plan or invest in ULIPs offers flexibility by offering the benefit of switching and redirection. Switching allows you to change your existing proportion of investment from one fund to another due to the market fluctuations, your changed risk apetite, etc. Redirection on the other hand, allows you to define the investment proportion into different funds for your future investments, keeping your existing investment set up intact. This feature makes ULIP different from other investment instruments as this feature is not available in mutual funds or any other kind of financial instruments. This facility is usually free of charge for most of the unit linked plans or attract nominal charges, if applicable. The unit linked insurance plan offers liquidity in the form of “Partial Withdrawals”. Partial withdrawal allows you to withdraw some portion out of your fund value created after a specified time period. There is a minimum and maximum limits defined for such withdrawals which may vary from one plan to another.

5. ULIPs offer Tax Benefits

The annual premium amount (including, applicable taxes, cess, and other charges) for a unit linked policy or invest in ULIPs is eligible for tax deduction under section 80C of the Income Tax Act, 1961. The maximum permissible limit to avail the tax deduction under section 80C is Rs 1.5 lakhs.

ULIPs purchased after 1st April 2012 – The maximum tax deduction can be availed if premium amount is less than 10% of the sum assured. In case of premium of ULIP is more than 10% of the sum assured, the maximum tax deduction availed can be up to 10% of the sum assured.

ULIPs purchased before 1st April 2012- The maximum tax deduction can be availed if premium amount is less than 20% of the sum assured. In case of premium of ULIP is more than 20% of the sum assured, the maximum tax deduction availed can be up to 20% of the sum assured.

ULIP offers tax free maturity value under Section 10 (10D) of the Income Tax Act,1961 in case of the annual premium payable is less than 10% of the sum assured amount for the policies issued after 1st April,2012. For the policies purchased before 1st April 2012, the maturity proceeds are tax free if the annual premium payable is less than 20% of the sum assured.But in case the annual premium paid exceeds the prescribed limits which is 10% (for the policies issued after 1stApril,2012) or 20% (for the policies issued before 1st April,2012)of the sum assured, then th entire proceeds of the policy will be treated as income from other sources and thus taxable as per the tax slab rate applicable to you.

Some online ULIPs in the market:

Age of the Investor: 30 years, Policy Term: 20 years

| Unit Link Insurance Plan | Investment (per annum) | Maturity Value (@ Growth Rate 8%) | Maturity Value (based on 3 year performance of funds offering higher returns) |

|---|---|---|---|

| Bajaj Allianz Future Gain | INR 50,000 p.a | Rs 19.66 Lakh | Rs 1.02 Crore (@ Growth Rate 21.22%) |

| INR 1,00,000 p.a | Rs 39.74 Lakh | Rs 2.07 Crore (@ Growth Rate 21.22%) | |

| HDFC Click2Invest | INR 50,000 p.a | Rs 20.1 L | Rs 20.66 L (@ Growth Rate 8.23%) |

| INR 1,00,000 p.a | Rs 40.2 Lakh | Rs 41.33 Lakh (@ Growth Rate 8.23%) | |

| PNB Mera Wealth Plan | INR 50,000 p.a | Rs 20.84 L | Rs 27.55 L (@ Growth Rate 10.33%) |

| INR 1,00,000 p.a | Rs 41.68 Lakh | Rs 55.1 Lakh (@ Growth Rate 10.33%) | |

| Aegon Life I Maximize Plan | INR 50,000 p.a | Rs 20.61 L | Rs 17.43 L (@ Growth Rate 6.56%) |

| INR 1,00,000 p.a | Rs 41.79 Lakh | Rs 35.33 Lakh (@ Growth Rate 6.56%) | |

| Future Generali Easy Invest online | INR 50,000 p.a | Rs 20.48 L | Rs 24.05 L (@ Growth Rate 9.35%) |

| INR 1,00,000 p.a | Rs 40.97 L | Rs 48.1 L (@ Growth Rate 9.35%) |

shall i invest in ulip and in which scheme? pls help i need good returns after 10yrs

If you are looking to grow your invested money along with insurance cover, then you should go for investing in a ULIP plan. In case, you are seeking good returns from your invested value, opting HDFC Click2Invest plan is the right choice. This ULIP plan comes with varying fund options that will help you to fulfill the goals, depending on your appetite for risk. If you keep investing in this plan for a long-term say for 10 years, you will receive higher returns.

In 10 years investment in ULIP plans, you will get the decent returns. For more assistance regarding plans, you may call on our Toll free No.- 1800-200-1770